Regional Report on Tobacco Industry Interference in South Asia

The tobacco epidemic continues today, claiming the lives of about 8 million people worldwide every year. Increasingly, interference by the tobacco industry has been known to hinder progress in tobacco control. Given the growing concerns with respect to tobacco industry interference (TII) in South Asia, the Institute of Public Health Bengaluru in collaboration with the […]

The Union

Md. Masum Billah and others

Increasing Taxes on Tobacco in Low and Middle-Income Countries : Hurting or Saving the Poor?

Policy makers hesitate to increase tobacco taxes over concerns about taxes being regressive and potentially increasing poverty and inequality. This note summarizes a set of studies of the effects of raising tobacco taxes in 11 low and middle-income countries using an extended cost-benefit analysis (ECBA) and harmonized national household budget survey data and introduces the […]

Increasing Taxes on Tobacco in Low and Middle-Income Countries : Hurting or Saving the Poor?

Fuchs Tarlovsky, Alan; Gonzalez Icaza, María Fernanda

Regressive or Progressive? : The Effect of Tobacco Taxes in Ukraine

Tobacco taxes are usually considered regressive as the poorest individuals allocate larger shares of their budget towards the purchase of tobacco related products. However, because these taxes also discourage tobacco use, some of the most adverse effects and their economic costs are reduced, including lower life expectancy at birth, higher medical expenses, increased years of […]

Regressive or Progressive? : The Effect of Tobacco Taxes in Ukraine

Fuchs, Alan; Meneses, Francisco.

Long-Run Impacts of Increasing Tobacco Taxes : Evidence from South Africa

Tobacco taxes are considered an effective policy tool to reduce tobacco consumption and produce long-run benefits that outweigh the costs associated with a price increase. Through this policy, some of the most adverse effects and economic costs of smoking can be reduced, including shorter life expectancy, higher medical expenses, added years of disability among smokers, […]

Long-Run Impacts of Increasing Tobacco Taxes : Evidence from South Africa

Fuchs, Alan; Del Carmen, Giselle; Mukon, Alfred Kechia

Healthcare utilisation and expenditures attributable to current e-cigarette use among US adults

ABSTRACT Aims This study estimated annual healthcare expenditures attributable to current e-cigarette use among US adults, including current exclusive and dual/poly e-cigarette use. Methods Analysing the 2015–2018 National Health Interview Survey data, we estimated the impacts of e-cigarette use on healthcare utilisation among adults aged 18+ years. Healthcare utilisation outcomes were hospital nights, emergency room […]

tobacco control

Yingning Wang, Hai-Yen Sung, James Lightwood,Tingting Yao and Wendy B Max

How to Design and Enforce Tobacco Excises?

Tobacco is for several good reasons more heavily taxed than other goods in many countries. From the early days of industrial production of cigarettes in the late nineteenth century until a clear link was established between tobacco and various health conditions in the middle of the twentieth century, tobacco was fairly lightly taxed. All this […]

INTERNATIONAL MONETARY FUND

Rapid evidence review: Strengths and limitations of tobacco taxation and pricing strategies

Background Tobacco use represents the leading preventable cause of morbidity and mortality in Scotland, with around 20% of all deaths attributable to smoking. Smoking-related morbidity and mortality are strongly patterned by socioeconomic group in Scotland, with 35% of adults in the most deprived quintile of the Scottish Index of Multiple Deprivation (SIMD) being current smokers, […]

Ross Whitehead, Lynda Brown, Emma Riches, Louise Rennick, Gillian Armour, John McAteer, Yvonne Laird and Garth Reid

The Economic Cost of Tobacco-Induced Diseases in Pakistan (Report)

This report was written by the Pakistan Institute of Development Economics (PIDE) in Pakistan. The report uses a nationally representative survey to estimate the economic burden of three major smoking-attributable diseases: cancer, cardiovascular, and respiratory; and to estimate the total economic costs of all smoking-attributable diseases. The researchers found that the total costs of all […]

The Huge Economic Cost of Tobacco-Induced Diseases in Pakistan (Policy Brief)

This Policy Brief was written by the Pakistan Institute of Development Economics (PIDE) in Pakistan. The policy brief uses a nationally representative survey to estimate the economic burden of three major smoking-attributable diseases: cancer, cardiovascular, and respiratory; and to estimate the total economic costs of all smoking-attributable diseases. The researchers find that the total costs […]

The Crowding Out Effect of Tobacco Spending in Pakistan

This Report was written by Social Policy and Development Centre (SPDC) in Pakistan. The report discusses the impact of tobacco consumption on overall household spending in the country after the cigarette excise tax rate reduction in 2017-18. The tax rate on low-price brands decreased 48%, leading to an over 27% decline in price. As a […]

Household Tobacco Spending and Consumption: Implications for Tax Policy

This Policy Brief was written by Social Policy and Development Centre (SPDC) in Pakistan. The policy brief discusses the impact of tobacco consumption on overall household spending in the country after the cigarette excise tax rate reduction in 2017-18. The tax rate on low-price brands decreased 48%, leading to an over 27% decline in price. […]

Switch, Reduce, or Quit: How do Smokers Respond To Tobacco Tax Increases in Pakistan?

This Report was written by the Pakistan Institute of Development Economics (PIDE) in Pakistan. The report discusses the impact of tax increases on the behavior of smokers. The authors find that a 50% increase in the price of cigarettes results in almost half of the smokers surveyed quitting. In contrast, only 2.6% respond that they […]

Higher Tobacco Tax, Fewer Cigarettes Consumed

This Policy Brief was written by the Pakistan Institute of Development Economics (PIDE) in Pakistan. The policy brief discusses the impact of tax increases on the behavior of smokers. The authors find that a 50% increase in the price of cigarettes results in almost half of the smokers surveyed quitting. In contrast, only 2.6% respond […]

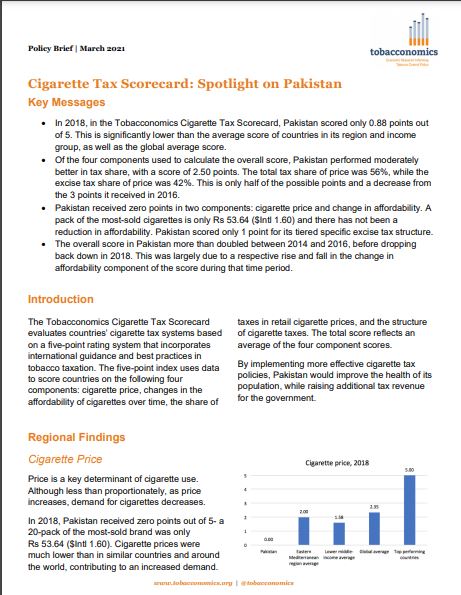

Cigarette Tax Scorecard: Pakistan

This Policy Brief was written based on the findings of the Cigarette Tax Scorecard. The policy brief evaluates the cigarette tax policies in Pakistan. In 2018, Pakistan scored only 0.88 points out of 5, demonstrating that there is significant need for improvements. The overall score is an average of the following components: the absolute price […]

Tobacco Oversupply in Paraguay and Its Cross-Border Impacts (Policy Brief)

This Policy Brief was written by the Centro de Análisis y Difusión de la Economía Paraguaya (CADEP) in Paraguay. The policy brief discusses the trends in supply of tobacco compared to trends in consumption. Tobacco consumption in Paraguay has decreased over the last 20 years. Further, the researchers find that a 10% increase in the […]

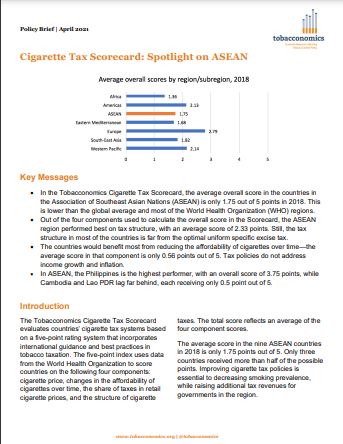

Cigarette Tax Scorecard: ASEAN

This Policy Brief was written based on the findings of the Cigarette Tax Scorecard. The policy brief evaluates the cigarette tax policies in the Association of Southeast Asian Nations (ASEAN). In 2018, the average score in the region was 1.75 points out of 5, demonstrating that there is significant room for improvements. The overall score […]

Cigarette Brand-Switching Behavior and Tobacco Taxation in Vietnam

This Report was written by the Development and Policies Research Center (DEPOCEN) in Vietnam. The report analyzes the effect that the proposed tax structure would have on cigarette brand substitution, as well as on illicit trade. The researchers find that smokers are more likely to substitute a domestic brand with a different domestic brand, largely because foreign […]

Potential Effects of a Ban on the Sale of Flavored Tobacco Products in Washington, DC

This Fact Sheet was written by Frank J. Chaloupka. The fact sheet discusses the potential effects of ending the sale of flavored tobacco products in Washington, DC. Ending the sale of flavored tobacco products would reduce tobacco use initiation, lead current tobacco users to quit, improve health, and save lives. In addition to the public […]

Cigarette Tax Scorecard: Cigarette Price

This Policy Note was written based on the Cigarette Tax Scorecard. The policy note elaborates on one of the four scoring components used in the Scorecard: cigarette price. This component of the score measures the price of the most-sold brand in international dollars (Intl$), adjusted for purchasing power parity (PPP). The highest score of 5 […]

Cigarette Tax Scorecard: Tax Structure

This Policy Note was written based on the Cigarette Tax Scorecard. The policy note elaborates on one of the four scoring components used in the Scorecard: tax structure. This component of the score quantifies the effectiveness of the excise tax structure used for cigarettes. The highest score of 5 points is awarded to countries that […]

Cigarette Tax Scorecard: Affordability Change

This Policy Note was written based on the Cigarette Tax Scorecard. The policy note elaborates on one of the four scoring components used in the Scorecard: affordability change. This component of the score measures the the trend in cigarette affordability, using the average annual percentage change (AAPC) in the affordability index over a six year […]

Cigarette Tax Scorecard: Tax Share

This Policy Note was written based on the Cigarette Tax Scorecard. The policy note elaborates on one of the four scoring components used in the Scorecard: tax share. This component of the score measures the total tax share and the excise tax share of the price of the most-sold brand of cigarettes. The highest score […]

Macroeconomic Impacts of Higher Tobacco Taxes in Argentina

This Policy Brief was written by Centro de Estudios, Distributivos, Laborales y Sociales (CEDLAS) in Argentina. The Policy Brief discusses the macroeconomic impacts of increasing tobacco taxes. The authors find that even a significant tax increase in the country does not impact the overall number of jobs, as employment in tobacco-related sectors shifts to other […]

Incidence of Tobacco Taxation in Argentina: Employment and Economy-Wide Effects

This Report was written by Centro de Estudios, Distributivos, Laborales y Sociales (CEDLAS) in Argentina. The Report discusses the macroeconomic impacts of increasing tobacco taxes. The authors find that even a significant tax increase in the country does not impact the overall number of jobs, as employment in tobacco-related sectors shifts to other fields. Additional tax revenue from tobacco […]

The 2019 Health Care Cost of Smoking in Indonesia

This Report was written by the Center for Indonesia’s Strategic Development Initiatives (CISDI) in Indonesia. The Report estimated the health care costs of tobacco use in Indonesia to be between Rp 17.9 trillion and Rp 27.7 trillion in 2019, or between 0.1% and 0.2% of the GDP, respectively. These figures are much higher than the […]

The Source of Waste in Indonesia’s Health Care Expenditure: Smoking Attributable Disease

This Policy Brief was written by the Center for Indonesia’s Strategic Development Initiatives (CISDI) in Indonesia. The Policy Brief estimates the health care costs of tobacco use in Indonesia to be between Rp 17.9 trillion and Rp 27.7 trillion in 2019, or between 0.1% and 0.2% of the GDP, respectively. These figures are much higher […]

Public Health Benefits of a Ban on the Sale of Flavored Tobacco Products in Maine

This Fact Sheet was written by Frank Chaloupka. The fact sheet discusses the potential public health benefits of ending the sale of flavored tobacco products in Maine. Ending the sale of flavored tobacco products would reduce tobacco use initiation, lead current tobacco users to quit, reduce tobacco-attributable deaths, and significantly decrease health care costs. The […]

Tobacco Tax Avoidance and Evasion in Serbia

This Policy Brief was written by the Institute of Economic Sciences (IES) in Serbia. The policy brief describes the illicit tobacco market in Serbia using a representative survey of smokers. Both tax evasion and tax avoidance are low overall, at 2.6% and 1.1%, respectively. The researchers find that the illicit market of hand-rolled tobacco (90.7%) […]

Illicit Trade in Manufactured Cigarettes and Hand-Rolled Tobacco in North Macedonia

This Policy Brief was written by Analytica in North Macedonia. The policy brief estimates the size and characteristics of the illicit tobacco market in North Macedonia. The study finds that tax evasion is higher in North Macedonia, compared to EU countries. The share of tax evasion 14.6% of the market, with the majority occurring in […]

Tobacco Tax Evasion in Albania

This Policy Brief is written by Development Solutions Associates (DSA) in Albania. The policy brief estimates the size and characteristics of the illicit tobacco market in Albania. The study shows that 29.3% of tobacco consumption in the country is illicit, the majority stemming from hand-rolled tobacco products. The majority of hand-rolled tobacco is purchased from […]

Cigarette Smoking Prevalence and Policies in the 50 States: An Era of Change

The report bore a simple, understated title: “Smoking and Health”. But when it was issued in 1964 by the United States Surgeon General, it signaled the beginning of a massive public health campaign to curtail tobacco consumption (Figure 1). Now, more than 40 years later, we recognize that smoking harms nearly every organ in the […]

Case Studies in Illicit Tobacco Trade: United Kingdom

This Case Study was written by Evan Blecher, PhD, Senior Economist, Health Policy Center, University of Illinois at Chicago, Chicago, Illinois. The Case Study presents the successful efforts of the UK government in the past two decades to reduce illicit trade in tobacco while at the same time repeatedly raising taxes on tobacco products. Drawing […]

Case Studies in Illicit Tobacco Trade: South Africa

An often-heard argument from the tobacco industry is that an increase in the tobacco excise tax will stimulate illicit trade in cigarettes. The experience of South Africa, presented in this case study, does not support this argument. South Africa was one of the first middle-income countries to use excise tax increases as a tobacco control […]

Case Studies in Illicit Tobacco Trade: Colombia

Large price differentials that result from high taxation in one jurisdiction relative to others create economic incentives for illicit trade. However, illicit trade depends on other factors, such as the availability of illicit products, which is a function of the strength of the customs and tax administrations and the industry’s motivation to supply the market […]

Case Studies in Illicit Tobacco Trade: The Philippines

Beginning in 2013, the Philippines began imposing steep price increases on tobacco. This Fact Sheet describes the series of increases and the measures put in place by the government during this time to combat illicit trade. The Fact Sheet concludes by offering recommendations to further address illicit trade of tobacco products. In the Philippines, the […]

Progress in Tobacco Taxation: The Case of Argentina

Abstract In May 2016, the executive branch of the Government of Argentina ratified Decree 626, which raised domestic taxes on cigarettes from 60% to 75%, amounting to a 50% increase in their average retail price. This measure was promoted by Argentina’s InterAmerican Heart Foundation (FIC Argentina) through a strategy that included conducting local research to […]

Germán Rodriguez-Iglesias, MSc

Tobacco causes 20% of deaths from coronary heart disease: Report

Every year, 1.9 million people die from tobacco-induced heart disease, according to a new brief released on Tuesday by the World Health Organization (WHO), World Heart Federation and the University of Newcastle Australia. The organisations came up with the data ahead of World Heart Day that falls on September 29. This equates to one in […]

Cigarette demand, taxation, and the poor : a case study of Bulgaria

This paper uses data from the Living Standards Measurement Study (LSMS) Household Survey conducted in 1995, to analyze demand for manufactured cigarettes in Bulgaria and the effects on the poor of a hypothetical revenue-maximizing specific excise tax increase on cigarettes. A cigarette tax increase is the single most effective and cost-efficient measure to reduce smoking. […]

Cigarette demand, taxation, and the poor : a case study of Bulgaria

Sayginsoy, Ozgen Yurekli, Ayda A. Beyer, Joy de

Tobacco Taxation Incidence : Evidence from the Russian Federation

Despite the well-known positive effects of tobacco taxes on health outcomes, policy makers avoid relying on such taxes because of their possible regressive impact. Using an extended cost-benefit analysis to estimate the distributional effect of cigarettes in the Russian Federation, this paper finds that the long-run impact may in fact be progressive. The methodology applied […]

Policy Research Working Paper

Fuchs, Alan; Matytsin, Mikhail; Obukhova, Olga

Distributional Effects of Tobacco Taxation: A Comparative Analysis

Tobacco taxes have positive impacts on health outcomes. However, policy makers often hesitate to use them because of the perception that poorer households are affected disproportionally more than richer households. This study compares the simulated distributional effects of tobacco tax increases in eight low- and middle-income countries. It applies a standardized extended cost-benefit analysis methodology […]

Policy Research Working Paper

Fuchs, Alan; González Icaza, Fernanda; Paz, Daniela

Long-Run Impacts of Increasing Tobacco Taxes

Tobacco taxes are considered an effective policy tool to reduce tobacco consumption and produce long-run benefits that outweigh the costs associated with a price increase. Through this policy, some of the most adverse effects and economic costs of smoking can be reduced, including shorter life expectancy, higher medical expenses, added years of disability among smokers, […]

Long-Run Impacts of Increasing Tobacco Taxes

Alan Fuchs, Giselle Del Carmen and Alfred Kechia Mukong

Tobacco Taxation and Impact of Policy Reforms : Trinidad and Tobago

Evidence from across the world shows that raising taxes sharply on tobacco products, and then adjusting for inflation and increased affordability due to growing incomes, is the single most cost-effective measure to reduce tobacco consumption. A scaled-up and stronger tobacco control effort is required in Trinidad and Tobago to achieve the WHO-recommended target of at […]

World Bank

Global Youth Tobacco Survey (GYTS), Bhutan 2019

Overview The Global Youth Tobacco Survey (GYTS) was developed by the Tobacco-Free Initiative (TFI), World Health Organization (WHO) and the Office on Smoking and Health of the United States Centers for Disease Control and Prevention (CDC), in collaboration with other countries representing the six WHO regions. Its aim was to generate a comprehensive information on […]

Living with a smoker raises your risk of developing mouth cancer by 51%, study warns

Researchers looked at five studies focusing on almost 7,000 people globally Found people who live with smokers are 51% more likely to get mouth cancer Is first study to find a causal link between second-hand smoke and oral cancer A non-smoker who lives with someone who does smoke is at 51 per cent higher risk of […]

Trend in the affordability of tobacco products in Bangladesh: findings from the ITC Bangladesh Surveys

Background: The price of tobacco products in relation to the income of tobacco users—affordability—is recognised as a key determinant of tobacco use behaviour. The effectiveness of a price increase as a deterrent to tobacco use depends on how much price increases in relation to the income of the potential users. The aim of this paper […]

Trend in the affordability of tobacco products in Bangladesh

Nigar Nargis, Michal Stoklosa, Jeffrey Drope, Geoffrey T Fong, Anne C K Quah, Pete Driezen, Ce Shang, Frank J Chaloupka & A K M Ghulam Hussain