13 years of tobacco tax rates

Bangladesh ranks 14th for area under tobacco, 12th for production in quantity, and has a share of 1.3% of global tobacco production (FAO-2018). Mainly 4 types of tobacco products available and under the taxation in Bangladesh (Cigarette, Biri, Zarda and Gul).

The current tax system is ad valorem, which has a low tax base and yields low revenue. When VAT was first introduced on cigarettes in FY 1992- 93, there were four price bands. However, in FY 1994-1995 and FY 1995-96, this number was increased to 5 under pressure of the cigarette industry. Increasing the number of price bands led to massive switching to lower bands when tax rates were increased.

To prevent this, the number of bands was reduced to 4 in FY 1996-97. This continued up to the middle of FY 1998- 99. In January 1999, the number of price bands was increased to 6 as a result of collective bargaining of the cigarette industry. This continued up to June 2000.

Again the number of price bands was reduced to 4 in FY 2000-01 through FY 2001-02. In FY 2002-03, the government took the initiative to reduce the number of price slabs to 3 to augment revenue. This continued through FY 2003-04. Finally, the number of bands was raised to 4 in FY 2004-05 and since then the number of price bands remained at 4.

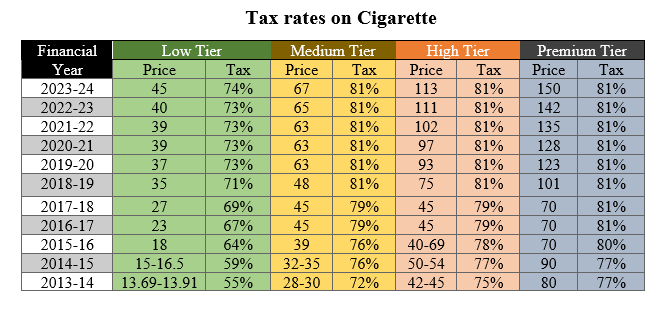

Tobacco taxes are governed by the Value Added Tax and Supplementary Duty Act, 2012. The prices of cigarettes by tiers are determined by the National Board of Revenue (NBR) of the Government of Bangladesh and are used as the tax base for calculating tax liability of cigarette manufacturers.

Based on these administered prices by tiers, cigarettes are categorized into four tiers – premium, high, medium and low. Biris are divided into filtered biri and non filtered biri. The government introduced the MRP replacing tariff value since FY 2017-18.

On the other hand, SLT products were historically not taxed in Bangladesh, Because they were treated as cottage industries. In June 2003, the government took SLT out of the purview of cottage industries, and SLT was taxed for the first time beginning in FY 2003-04.

13 years of tobacco tax rates given bellow :