Policies for addressing smokeless tobacco (ST) use in Bangladesh

This presentation on “Policies for addressing smokeless tobacco (ST) use in Bangladesh”. Prepared by Kamran Siddiqi, Professor of Global Public Health University of York, UK. KEY FINDINGS In Bangladesh and India, almost all ST products are illegal. 84% of ST packs in Bangladesh and 93% in India have no pictorial health warning or the size is […]

Kamran Siddiqi, Professor of Global Public Health University of York, UK

Why is Tobacco Price Manipulation a Problem? Point-of-Sale Marketing and Cigarette Smoking

The presentation given at the Summit to Identify Policy Strategies to Address Retail Tobacco Price Manipulation in San Francisco, CA, briefly reviews the recent trends in cigarette company marketing expenditures and impact on price, the impact of cigarette marketing on youth and adult cigarette smoking, and the effects of point-of-sale cigarette marketing on youth smoking […]

Frank J. Chaloupka

Tobacco Taxation

The Tobacco Taxation presentation given at the Johns Hopkins School of Public Health, International Tobacco Control Leadership Program in Baltimore, MD, provides an overview for the need and impact of tobacco taxes, the types of tobacco taxes, and the myths and facts about the economic impact of tobacco tax increases. To Read the full presentation […]

The Science Behind Tobacco Taxation

The presentation given in Kansas City, MO, provides an overview of tobacco taxation, industry price-marketing, and the impact of tobacco taxes and prices on usage. To Read the full presentation please click the download button.

Frank J. Chaloupka

The Economics of Tobacco and Tobacco Taxation in the Philippines

The Economics of Tobacco and Tobacco Taxation in the Philippines presentation given at International Experts’ Forum on Sin Tax Reforms in Manila, Philippines, provides an overview of tobacco use and its consequences in the Philippines. The presentation also reviews the taxes, prices, and demand for cigarettes in a country that is noted as one of […]

Frank J. Chaloupka

50 State Law Approaches to Reducing Cigarette Tax Avoidance and Taxing OTPs, 2005–2014

This presentation at the Society for Research on Nicotine and Tobacco meeting in February 2015 highlights research on how states have minimized cigarette tax avoidance through encrypted cigarette stamps, distinctive tribal stamps, and border tax rates. Also covered is research on what tax rates and federal law changes regarding other tobacco products (OTPs) have occurred between 2005–2014. […]

Camille K. Gourdet, J.D., M.A.*, Hillary R. DeLong, J.D., Colin Goodman, Jamie F. Chriqui, Ph.D., M.H.S., Frank J. Chaloupka

Companion Slides for Tobacco Product Taxation: An Analysis of State Tax Schemes Nationwide, Selected Years, 2005-2014

This slide deck presents background information on the chartbook, Tobacco Product Taxation: An Analysis of State Tax Schemes Nationwide, Selected Years, 2005-2014, and includes a summary of the key findings including all of the graphics and tables included in the national overview section of the chartbook. To Read the full presentation please click the download button.

E-Cigarette Taxation: Potential Impact & Options

This presentation, given at the Society for Research on Nicotine and Tobacco (SRNT) Annual Meeting by Frank J. Chaloupka on March 5, 2016, in Chicago, Illinois, addresses the demand for e-cigarettes, the effects of prices on e-cigarette demand, options for ENDS Taxation, and potential e-cigarette tax revenues. To Read the full presentation please click the download […]

Frank J. Chaloupka

Smokeless Tobacco Pricing Strategies and Policies

This presentation was given by Frank J. Chaloupka at the 8th National Summit on Smokeless and Spit Tobacco in Albuquerque, New Mexico, on April 20, 2016. It reviews state taxation of other tobacco products, the impact of tax structure on price, and the impact of taxes and prices on smokeless tobacco product use. To […]

Frank J. Chaloupka

The Economics of Smoking: Dispelling the Myths

This presentation was given by Frank Chaloupka at the Summit on Creation of a Tobacco Endgame for Canada in Kingston, Ontario, on September 30, 2016. The presentation covers tax, price, and tobacco use; the economic impact of tobacco use; and the economic impact of tobacco control. It dispels myths related to tobacco control, including oppositional arguments […]

Frank Chaloupka

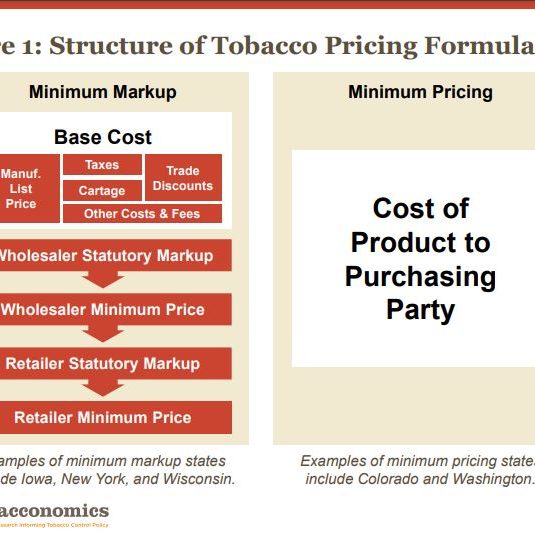

Companion Slides for Tobacco Product Pricing Laws: A State-by-State Analysis, 2015

This slide deck presents background information on the chartbook, Tobacco Product Pricing Laws: A State-by-State Analysis, 2015, and includes a summary of the key findings including all of the graphics and tables included in the national overview section of the chartbook. To Read the full presentation please click the download button.

The Economics of Tobacco and Tobacco Control Beyond Taxation

This presentation was given by Frank J. Chaloupka at the World Bank on February 27, 2017. The presentation provides an overview of the major conclusions of the NCI/WHO monograph on the Economics of Tobacco and Tobacco Control. To Read the full presentation please click the download button.

Frank J. Chaloupka

Best Practices in Tobacco Taxation

Best Practices in Tobacco Taxation presentation was given at the Tobacco Free Nebraska State Conference in Lincoln, NE, and it provides an overview of tobacco taxation. The presentation covers the impact of taxes/prices on tobacco use, earmarking revenues for tobacco control, industry price marketing, myths and facts, and a summary and impact of a tax […]

Frank J. Chaloupka

The Economics of Tobacco Taxation in Oklahoma

This presentation was given by Frank J. Chaloupka at the Oklahoma Hospital Association in Oklahoma City, Oklahoma, on March 1, 2017. The presentation provides an overview of tobacco taxation, the impact of taxes/prices on tobacco use, industry price marketing, and counterarguments. To Read the full presentation please click the download button.

Frank J. Chaloupka

Making the Case for Higher Tobacco Taxes in Europe

This presentation was given by Hana Ross at the Society for Research on Nicotine and Tobacco (SRNT) Annual Meeting in Florence, Italy, on March 9, 2017. The presentation reviews the evidence on smoking prevalence, tax and price, and illicit cigarette trade in Europe. To Read the full presentation please click the download button.

Hana Ross

The Economics of Tobacco and Tobacco Control: Global Evidence and Implications for the Republic of Korea

This presentation was given by Dr. Frank J. Chaloupka at the International Symposium on Tobacco Control: An Evaluation and the Way Forward on March 28, 2017, in Seoul, Republic of Korea. The presentation covers the economic costs of tobacco use, the impact of tobacco taxes on tobacco use, myths & facts on the economic “costs” […]

Dr. Frank J. Chaloupka

The Economics of Tobacco and Tobacco Taxation: Global Evidence and Implications for Indonesia

This presentation was given by Dr. Frank J. Chaloupka at the Customs and Excise Directorate General, Ministry of Finance, in Jakarta, Indonesia, on April 5, 2017. The presentation covers the economic costs of tobacco use, the impact of tobacco taxes on tobacco use, myths & facts on the economic “costs” of tobacco taxation and tobacco control, […]

Frank J. Chaloupka

Tobacco Taxes are Good for Health and Good for Public Finance: Global and Regional Evidence

This presentation was given by Frank J. Chaloupka at the Latin American Network on Tobacco Tax Policy for Tobacco Control in Washington, DC on February 5, 2018. The economic impact of higher tobacco taxes on tobacco use, cessation for youths and adults, and tax revenues was discussed. In addition, the positive impact of tax increases, […]

Frank J. Chaloupka

The Economics of Tobacco Control in Latin America: Highlights and Gaps

This presentation was given by Frank Chaloupka at the session “Building the Case for Increasing Taxes in Latin America and the Caribbean” at the World Conference on Tobacco or Health on March 8, 2018, in Cape Town, South Africa. During this session, the economic costs of tobacco use, tobacco taxes and tobacco use, and evidence […]

Frank Chaloupka

Generating Revenue & Cutting Costs- The Health & Economic Benefits of “Sin” Taxes

This presentation was given by Frank Chaloupka at the Harvard Ministerial Leadership Program on April 24, 2018, in Cambridge, Massachusetts. During this presentation, the health and economic impact of non-communicable diseases, and the impact of tobacco, alcohol, and sugary drink taxes on use and consequences of use were discusses. In addition, tax revenues, structure and […]

Frank Chaloupka

Research on Tobacco Taxation

This presentation was given by Frank Chaloupka at the South Eastern Europe Tobacco Tax Workshop in Warsaw, Poland, on May 10, 2018. The presentation discusses tobacco taxes, prices, and their effect on tobacco use globally. In addition, the findings from various projects, such as the ITC Project and Tobacconomics, discuss the potential impact of tax […]

Frank Chaloupka

The Importance of Economic Data for Tobacco Control

This presentation was given by Frank Chaloupka at the Workshop on Tobacco Economics for Central and Eastern Europe at the Marie Curie Institute in Warsaw, Poland, on May 8, 2018. The economic costs of tobacco use, impact of tobacco taxes on tobacco use, cost-effectiveness of tobacco control, and the myths and facts on the economics […]

Frank J. Chaloupka, Ph.D.

Tobacco Taxation: The Global Evidence

This presentation was given by Frank Chaloupka at the Workshop on Tobacco Economics in Southeastern Europe in Belgrade, Serbia, on December 11th, 2018. During the presentation, the economic costs of tobacco use (direct and indirect), impact of tobacco taxes on tobacco use, best practices in tobacco taxation, myths and facts on the economic costs of […]

Frank J. Chaloupka

The Economics of Tobacco Taxation In Massachusetts

The Economics of Tobacco Taxation presentation given at Harvard University School of Public Health, provides an overview of the history of cigarette and other tobacco taxes in the US, the evidence on the impact of taxes on prices and tobacco use, the myths and facts about the economic costs of tobacco taxation and tobacco control, […]

Frank J. Chaloupka

The Economic Impact of Tobacco Control

This presentation was given by Frank J. Chaloupka at the Society for Research on Nicotine and Tobacco (SRNT) Annual Meeting in Florence, Italy, on March 9, 2017. The presentation provides an overview of the main conclusions of the NCI & WHO monograph on the Economics of Tobacco and Tobacco Control, of which Dr. Chaloupka was the lead […]

Frank J. Chaloupka

The Economics of Tobacco Control: Increasing Taxes on Tobacco Products

This presentation was given by Frank Chaloupka at the Asia-Pacific Sub-Regional Tobacco Control Leadership Program on November 6, 2018, in Bali, Indonesia. During the presentation, the economic costs of tobacco use, impact of tobacco taxes on tobacco use, cost-effectiveness of tobacco control, and the myths and facts on economic “costs” of tobacco control were discussed. […]

Frank J. Chaloupka

Accelerating Progress on Effective Tobacco Tax Policies in Low- and Middle-Income Countries

This presentation was given by Frank Chaloupka on September 13th, 2018, at 12th Asia Pacific Conference on Tobacco or Health in Bali, Indonesia. During this presentation, the impact of tobacco tax increases, economic impact of tobacco control, tax avoidance and evasion and how to combat illicit trade were discussed. Lastly, Chaloupka presented an overview of […]

Frank J. Chaloupka

Tax, Price, and Tobacco Use

The presentation given was given at the Economics of Tobacco and Tobacco Control Session in Singapore at the World Conference of Tobacco or Health. The presentation provides an overview of the reasons to increase tobacco taxes in order to decrease the prevalence of tobacco use. This presentation prepared by Frank J. Chaloupka, Chair, WHO Collaborating Centre on […]

Frank J. Chaloupka

Toolkit on Using Household Expenditure Surveys for Research in Economics of Tobacco Control

This presentation was given by Rijo John, PhD, during the Tobacconomics webinar about our new toolkit, “A Toolkit on Using Household Expenditure Surveys for Research in the Economics of Tobacco Control”, on March 20th, 2019. During the presentation, Rijo discussed the purpose of the toolkit, how to use it for research in the economics of tobacco control, […]

Rijo M. John, PhD

The Economics of Tobacco Taxation

This presentation on The Economics of Tobacco Taxation, prepared by Frank J. Chaloupka, Director, ImpacTeen Project and, International Tobacco Evidence Network and Director, Health Policy Center, University of Illinois at Chicago. To Read the full presentation please click the download button.

Frank J. Chaloupka

Illicit trade in tobacco: a summary of the evidence and country responses

This presentation summaries the evidence on illicit trade in tobacco products and measures that countries and the international community are introducing to address the problem. To Read the full presentation please click the download button.

WHO

Increasing compliance: electronic monitoring system for production and trade

This presentation on Increasing compliance: electronic monitoring system for production and trade, prepared by WHO. To Read the full presentation please click the download button.

WHO

Compliance and tax authority

This presentation on Compliance and tax authority, prepared by WHO. To Read the full presentation please click the download button.

WHO

Administrative issues on tobacco tax implementation

This presentation on Administrative issues on tobacco tax implementation, prepared by WHO. To Read the full presentation please click the download button.

WHO

Tobacco tax increases and the consumer price index

The UN Statistics define the Consumer Price Index (CPI) as follows: “The CPI is an index that measures the rate at which the prices of consumption goods and services are changing from month to month (or from quarter to quarter). The prices are collected from shops or other retail outlets. CPIs are official statistics that are […]

WHO

Evidence on excise tax systems and their challenges

There is a wide range of excise systems that countries have adopted for tobacco products. These systems vary from the simplest to the most complex ones offering scope for relating outcomes in terms of price, consumption and revenue to the tax systems. This presentation deals with the empirical evidence on the types of tobacco excise […]

WHO

Impact of excise tax on price, consumption and revenue

Increase in tobacco tax that leads to price increase is expected to reduce tobacco consumption and improve public health. This section reviews existing empirical evidence on the effects of excise tax on price, consumption, government revenue and public health. Tobacco taxes account for a fraction of tobacco product prices and the percentage reduction in tobacco […]

WHO

Relationship between tobacco tax and price and global evidence

Taxes on tobacco products are often a significant component of the prices paid by consumers of these products, adding over and above the production and distribution costs and the profits made by those engaged in tobacco product manufacturing and distribution. The relationship between tax and price is complex. Even though tax increase is meant to […]

WHO

Estimating price and income elasticity of demand

The responsiveness of tobacco consumption to price and income increases is measured by the price and income elasticity of demand respectively. Policy makers are interested in learning about the price sensitivity of tobacco consumption with a view to predicting the possible impact of tobacco tax increase that causes tobacco price to increase leading to decrease […]

WHO

Factors affecting consumer behavior of purchasing tobacco products

This presentation discusses the major determinants of tobacco demand, in particular the relationship between tobacco demand and the price of tobacco products and consumer income. To Read the full presentation please click the download button.

WHO

Global and regional overview of cigarette prices and taxation

This presentation prepared by WHO which briefly reviews the differences in tobacco taxes across countries, both regionally and by income level, and highlights the impact of these taxes on cigarette prices. By the end of the chapter, users will: understand the differences in the types and amounts of taxes applied by governments in various regions; […]

WHO

Tobacco Tax Structure and Tobacco Use by Frank J. Chaloupka

This presentation on Tobacco Tax Structure and Tobacco Use prepared by Frank J. Chaloupka, Chair, WHO Collaborating Centre on the Economics of Tobacco & Tobacco Control, Distinguished Professor, UIC. To Read the full presentation please click the download button.