Influence of Tobacco Industry Undermines Public Health in Bangladesh

Keywords Tobacco industry, Public health, Bangladesh, Policy interference, Tobacco control, Revenue collection Introduction This report investigates the pervasive influence of the tobacco industry in Bangladesh, with a specific focus on how it undermines public health and interferes with policy implementation. Tobacco use remains a significant public health concern, with millions of Bangladeshis consuming smoking and […]

STOP

Md. Masum Billah

The Environmental Harm of the Tobacco Factory in Residential Areas of Bangladesh

Mahrukh Mohiuddin[1] and Nayeem Muhammad Abdullah[2] Abstract Reports submitted to regulatory authorities have highlighted that the country’s leading tobacco company—despite its public claims of adhering to environmental regulations—has been found in violation of key environmental standards. Moreover, there are concerns that the company wields significant influence over environmental policies, potentially stalling efforts to protect both […]

Mahrukh Mohiuddin and Nayeem Muhammad Abdullah

An Investigation of Bangladesh’s Industry-Friendly Cigarette Pricing and Way Forward

Sushanta Kumar Singha[1] Executive Summary In Bangladesh, cigarette taxes were first imposed in 1992-93, and while the tax structure has fluctuated over time, a four-tier system has been in place since 2004-05. However, there are no clear guidelines for determining cigarette prices, which are set annually in the national budget, often influenced by cigarette companies. […]

Sushanta Kumar Singha

Analyzing Tax Evasion Strategies in the Tobacco Industry: Market Surveillance Study of Cigarette Pricing in Bangladesh

Introduction Tobacco use in Bangladesh remains a pressing public health concern, facilitated by low product prices and inadequate tax measures. Despite ongoing policy efforts, including budgetary adjustments and regulatory frameworks, the country’s tobacco-related mortality and morbidity rates persist at alarming levels. According to the World Health Organization (WHO), tobacco products contain over 7,000 harmful chemicals, […]

BNTTP

BER, DU

Impact Of Price And Tax Changes In The National Budget On The Retail Prices Of Tobacco Products (Cigarette): A Cross Sectional Survey

Introduction Bangladesh is one of the countries in the world where tobacco products are available at low prices. As a result, the rate of smoking among young people is increasing alarmingly. At the same time, the death toll from tobacco-related diseases is on the rise. According to the World Health Organization, tobacco products, including bidi-cigarette […]

BNTTP

BER, DU

A Policy Outline to Introduce Specific Taxation System in Bangladesh- Based on the Practical Evidence

Background Bangladesh has a complex multi-tiered ad-valorem excise tax system for tobacco products.[1] Though we have high rates of taxes imposed on tobacco products, the prices of these products are still very low and quite affordable to the general public. One benefit of using an ad valorem excise tax structure from a revenue perspective is […]

BNTTP

Rumana Huque and Ishrat Zahan Aishi

Impact of price and tax changes in the national budget on the retail prices of tobacco products (cigarette): A cross sectional survey

Introduction Bangladesh is one of the countries in the world where tobacco products are available at low prices. As a result, the rate of smoking among young people is increasing alarmingly. At the same time, the death toll from tobacco-related diseases is on the rise. According to the World Health Organization, tobacco products, including bidi-cigarette […]

BER, DU

বাংলাদেশে তামাক ব্যবস্থার নিয়ন্ত্রণ : একটি পর্যালোচনা

বিশ্বব্যাপী অকাল মৃত্যু এবং রোগের অন্যতম প্রধান কারণ হলো তামাক ও তামাকজাত পণ্যের ব্যবহার। “তামাক সম্পর্কিত রোগের কারণে বিশ্বব্যাপী প্রতিবছর প্রায় ৫৪ লাখ মানুষ মারা যাচ্ছে। আশক্ষা করা হচ্ছে যে, ২০০০ সাল নাগাদ বিশ্বব্যাপী তামাক সম্পর্কিত রোগের কারণে বার্ষিক মৃত্যু সংখ্যা বেড়ে গিয়ে প্রায় ৮০ লাখে পৌঁছবে। যদি তামাকপণ্য ব্যবহারে কোনো নিয়ন্ত্রণ ব্যবস্থা আরোপ না […]

মারুফ আহমেদ

Analysis of BATB’s 10-year Annual Report: A Review of Financial Anomalies, Corporate Social Responsibility and Interference in Policy in Bangladesh

Abstract: Bangladesh is the world’s eighth largest cigarette market, with annual volumes exceeding 86 billion units and a growth rate of 2%.1 One of the most effective ways to increase government revenues while also decreasing tobacco consumption is through strong tax policy.2 In Bangladesh, a value added tax (VAT) on cigarettes was first introduced in […]

BNTTP

Sushanta kumar singha

Existing Tobacco Tax Policy and Tax Administration in Bangladesh: A Qualitative Study

Executive Summary This report has been developed as part of a research conducted by the Bureau of Economic Research (BER), University of Dhaka with the aim to generate evidence to identify the gaps in Bangladesh’s current tobacco tax policy and tax administration. A qualitative study was undertaken where a series of Key Informant Interviews (KII) […]

Bureau of Economic Research (BER), University of Dhaka

Regional Report on Tobacco Industry Interference in South Asia

The tobacco epidemic continues today, claiming the lives of about 8 million people worldwide every year. Increasingly, interference by the tobacco industry has been known to hinder progress in tobacco control. Given the growing concerns with respect to tobacco industry interference (TII) in South Asia, the Institute of Public Health Bengaluru in collaboration with the […]

The Union

Md. Masum Billah and others

Effect of Introducing a New Low-Tier Cigarette Brand on Cigarette Tax Revenue in Bangladesh: Evidence from Cigarette Sales by British American Tobacco (BAT) in Bangladesh, 2019–2020

Background A substantial body of evidence demonstrates that significantly increasing cigarette prices via cigarette tax increases is the most effective way to reduce cigarette smoking in addition to producing higher tax revenue. In Bangladesh, the complicated tiered ad valorem cigarette tax system, with a low base price for each tier, has made tobacco tax a […]

Effect of Introducing a New Low-Tier Cigarette Brand on Cigarette Tax Revenue in Bangladesh

Md. Nazmul Hossain, S M Abdullah, Dr. Rumana Huque

The Impact of Income and Taxation in a Price-Tiered Cigarette Market: Findings from the ITC Bangladesh Surveys

Background Taxing tobacco is among the most effective measures of tobacco control. However, in a tiered market structure where multiple tiers of taxes coexist, the anticipated impact of tobacco taxes on consumption is complex. This paper investigates changing smoking behaviour in lieu of changing prices and changing income. The objective of the paper is to evaluate […]

The Impact of Income and Taxation in a Price-Tiered Cigarette Market: findings from the ITC Bangladesh Surveys

Iftekharul Huq, Nigar Nargis, Damba Lkhagvasuren, AKM Ghulam Hussain, and Geoffrey T Fong

Preliminary Recommendations for Effective Tobacco Tax Design in Bangladesh

Tobacco control poses a major public policy concern and challenge in Bangladesh, which has one of the world highest rates of tobacco use. Over 46 million adults (43% of all adults) consume some form of tobacco, whether smoked or smokeless. Alarmingly, youth tobacco use has also been on the rise in Bangladesh with an estimated […]

World Bank

World Bank

Appetite for Nicotine : An Economic Analysis of Tobacco Control in Bangladesh

Abstract: The study estimates the economic issues related to tobacco. Cigarette and bidi production in Bangladesh have been increasing since 1980. Imports and exports have fluctuated, but there is a persistent negative trade balance in tobacco and tobacco products. Recent prevalence trends are not clear, but remain over 40% among men. National statistics put smoking […]

Appetite for Nicotine

Ali, Zulfiqar; Rahman, Atiur; Rahman, Taifur

Bangladesh Budget 2022-23: Modest Cigarette Price Increases Will Not Achieve Significant Revenue and Health Benefits

This Policy Brief was written by the Institute of Health Economics at the University of Dhaka in Bangladesh. The policy brief assesses the impact of the recently approved National Budget for fiscal year 2022-23, compared to the alternative proposal developed by tobacco control experts (learn more here). The reform slightly increases cigarette prices while maintaining the […]

Institute of Health Economics, University of Dhaka

বাংলাদেশে তামাকজাত দ্রব্য থেকে অতিরিক্ত রাজস্ব আয়ে হৃদরোগ চিকিৎসার ব্যয় সংকুলান

বিশ্ব স্বাস্থ্য সংস্থার তথ্য অনুযায়ী, বাংলাদেশে সবচেয়ে বেশি সংখ্যক মানুষ মারা যায় হৃদরোগ ও স্ট্রোকের কারণে। বর্তমানে দেশে সাধারণত শহুরে জীবনে যথেষ্ট পরিমাণ শারীরিক পরিশ্রম না করার ফলে ডায়বেটিস, হার্টের রোগ, স্ট্রোক, প্যারালাইসিসের ঝুঁকি বাড়ছে। পাশাপাশি শরীরে কোলস্টোরেলের মাত্রাও বাড়ছে। একইসঙ্গে ধূমপানের কারণে খাদ্যনালী, জিহ্বা, ফুসফুস, বৃহদান্ত্রে ক্যান্সারের ঝুঁকিসহ মস্তিষ্কের রক্তনালী ব্লক হয়ে স্ট্রোক হওয়ার […]

বাংলাদেশে তামাকজাত দ্রব্য থেকে অতিরিক্ত রাজস্ব আয়ে হৃদরোগ চিকিৎসার ব্যয় সংকুলান

BER and BNTTP

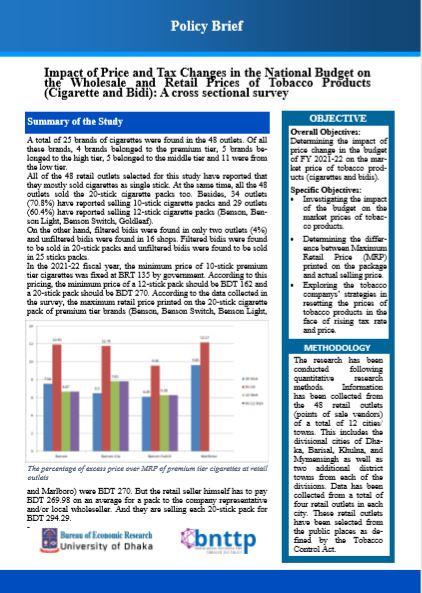

Impact of Price and Tax Changes in the National Budget on the Wholesale and Retail Prices of Tobacco Products (Cigarette and Bidi): A cross sectional survey

Introduction Bangladesh is one of the countries in the world where tobacco products are available at low prices. As a result, the rate of smoking among young people is increasing alarmingly. At the same time, the death toll from tobacco-related diseases is on the rise. According to the World Health Organization, tobacco products, including bidi-cigarette […]

Ibrahim Khalil

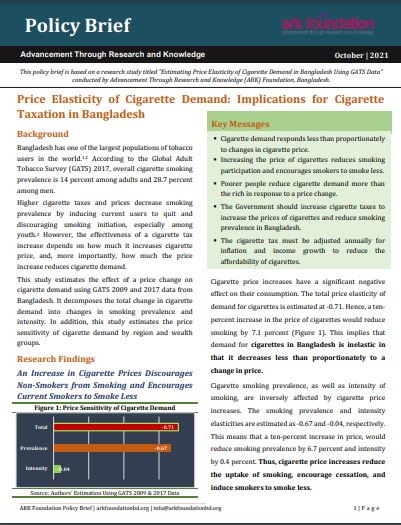

Price Elasticity of Cigarette Demand: Implications for Cigarette Taxation in Bangladesh

This Policy Brief was written by Advancement Through Research and Knowledge (ARK) Foundation in Bangladesh. The researchers estimate that the total price elasticity of demand for cigarettes is -0.71. A 10% increase in the price of cigarettes would reduce smoking by 7.1 percent, meaning that cigarette demand is inelastic. The elasticity of smoking prevalence and […]

Professor Dr. Rumana Huque, Mr. S M Abdullah, Mr. Md. Nazmul Hossain

Cigarette Demand Analysis: Bangladesh

This Report was written by Advancement Through Research and Knowledge (ARK) Foundation in Bangladesh. The researchers estimate that the total price elasticity of demand for cigarettes is -0.71. A 10% increase in the price of cigarettes would reduce smoking by 7.1 percent, meaning that cigarette demand is inelastic. The elasticity of smoking prevalence and intensity […]

Professor Dr. Rumana Huque, Mr. S M Abdullah, Mr. Md. Nazmul Hossain

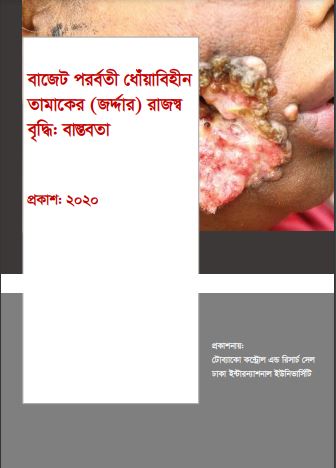

Increase in revenue from smokeless tobacco (Jarda) after budget: The Reality

Increase in revenue from smokeless tobacco after budget: The Reality. please see the document in Bengali below.

TCRC

A survey on Impact of the price change of tobacco products in the national budget 2020-21 at the retail market

Tobacco is the single most preventable cause of death and disabilities posing major threats to public health. According to a study by the Bangladesh Cancer Society & Dhaka University, in 2018 more than 126 thousand people died from tobacco-related diseases and Bangladesh lost BDT 30570 crore as a health cost to treat tobacco-related diseases. In […]

Bureau of Economic Research (BER), University of Dhaka

Markets of Smokeless Tobacco Products: Challenges and Way Forward

The philosopher and world famous traveler Ibn Battuta wrote his book “The Traveler of Ibn Battuta” regarding using batel leaf traditionally in the subcontinent. But he not indicates to use tobacco with the batel leaf on his book. However, once upon a time the use of Jorda, Gul, Sadapapat, Khaini, was as part of the […]

Markets of Smokeless Tobacco Products: Challenges and Way Forward

TCRC

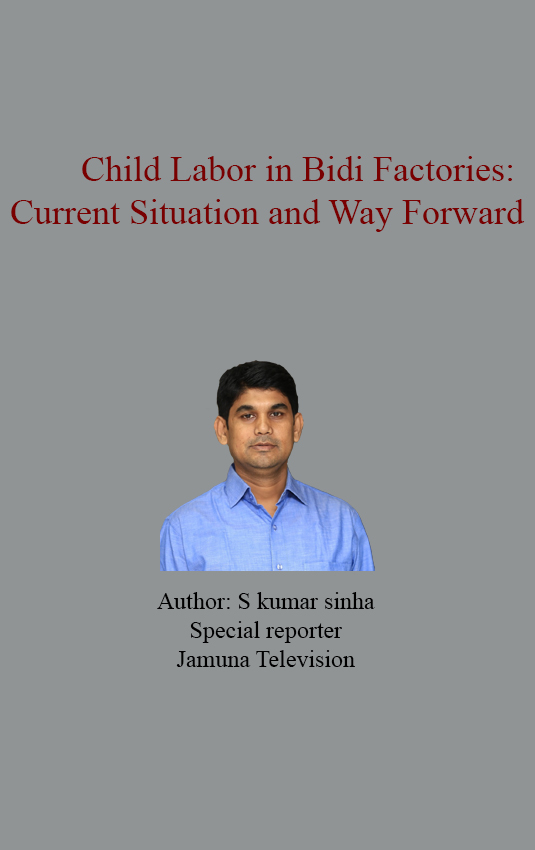

Child Labor in Bidi Factories: Current Situation and Way Forward

Background and challenges to implementation: Bidi is one of the major tobacco products consumed in Bangladesh with about 65,000 people directly employed in 117 bidi factories in the country. Along with their some associate labor, a significant proportion of these workers is children. In this context, it is important to explore the child labor situation in bidi factories to […]

S kumar singha

Environmental degradation due to tobacco cultivation in Bangladesh: A case study of Doulathpur, Kushtia

Tobacco plant is diseases prone and requires much chemical fertilizers, pesticides and enormous care. Yet, since the liberation tobacco cultivation has become an important part of agriculture in Bangladesh thanks to its promotion by the British American Tobacco Company. Kushtia is one of the major tobacco growing areas of Bangladesh. This paper aims to find […]

Md. Juel Rana Kutub and Nishat Falgunee

Tobacco cultivation in Bangladesh: Is it a threat to traditional agro-practice?

The impacts of tobacco cultivation on traditional agro-practices and knowledge, food security, agro-biodiversity and socio-economic conditions of a remote hilly tribal community of Bangladesh were investigated. Sixty per cent households were found practicing shifting cultivation compared with 10 yrs back changing local food availability. Local crop varieties were being lost due to low cultivation and […]

Mohammad Abdul Motaleb & Haseeb Md Irfanullah

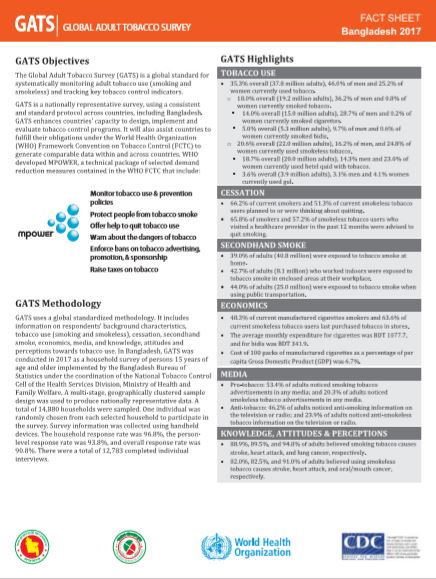

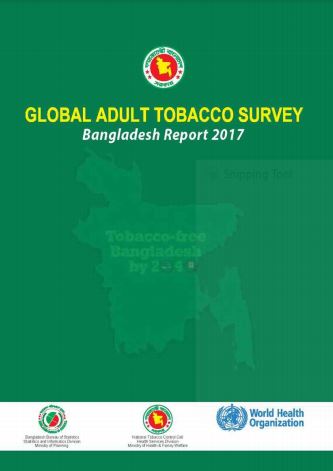

Global Adult Tobacco Survey 2017

The Global Adult Tobacco Survey (GATS) is a global standard for systematically monitoring adult tobacco use (smoking and smokeless) and tracking key tobacco control indicators. GATS is a nationally representative survey, using a consistent and standard protocol across countries, including Bangladesh. GATS enhances countries’ capacity to design, implement and evaluate tobacco control programs. It will […]

Global Adult Tobacco Survey 2017

UnveilingTobacco Industry Strategies to Combat Tobacco Epidemic in Bangladesh

Deaths caused by tobacco are not acceptable. In Bangladesh, 57 thousand people die and about 400 thousand become disabled due to tobacco every year. If the current trend of tobacco-related deaths continues, the annual death toll will reach 10 million by 2030, out of which seven (07) million will be in developing countries like Bangladesh, […]

Prevention of Tobacco Tax Evasion: “Law and Policy Review”

Work for better Bangladesh Trust published this publication on Prevention of Tobacco Tax Evasion: “Law and Policy Review”. Please read the full publication in Bengali. তামাকজাত দ্রব্যের কর ফাঁকি রোধ “আইন ও নীতি পর্যালোচনা” তামাকের কর বাড়ানোর বিষয়টি উত্থাপিত হলেই তামাক কোম্পানীগুলো চোরাচালান এবং কর ফাঁকির বিষয় সামনে এনে কর বৃদ্ধির বিরোধীতা করে। অথচ, […]

Methun Baidya and Syed Mahbubul Alam

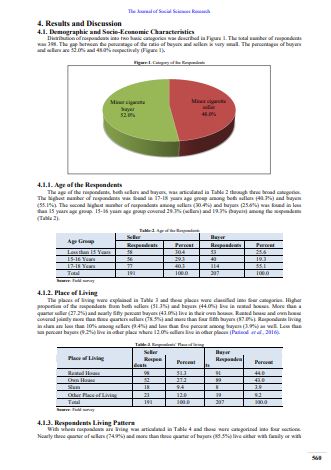

Cigarette Selling and Buying by the Minor and Adolescents in Bangladesh: Prevalence, Perceptions and Awareness

Abstract Though there is a tendency among teenagers to not care about the adverse effect of tobacco but long-term smoking causes a serious problem in health. The objective of this study is to explore the prevalence, perception and awareness of minors and adolescents on cigarette selling and buying in Bangladesh. In this study, a quantitative […]

The Journal of Social Sciences Research

Md Al Amin, Md Nazirul Islam Sarker, Md Altab Hossin, Most Nasrin and Nazmul Huda

Global Adult Tobacco Survey Bangladesh Report 2017

The second round of GATS (GATS 2017) aimed to systematically monitor adult tobacco use (smoking and smokeless) and track key tobacco control interventions since the first GATS survey in 2009 in Bangladesh. To read the full documents on the Global Adult Tobacco Survey Bangladesh Report 2017, please click the download button.

Bangladesh: Overveiw of Tobacco use, Tobacco control legislation, and taxation

Executive summary Bangladesh was one of the first countries both to sign and to ratify the WHO Framework Convention on Tobacco Control. Prime Minister Sheikh Hasina in 2016 pledged the commitment of her government to work towards full compliance with the WHO FCTC and stated that overhauling tobacco taxation was high on the agenda as […]

World Bank Group

Demand for tobacco products in Bangladesh

ABSTRACT Background Tobacco tax increase is considered as one of the most effective means to reduce tobacco consumption and its consequences. An increase in taxes, which results in an increase in the price of tobacco products, reduces consumption. Historically, a number of studies estimated the responsiveness of quantity demanded to a change in price—the price […]

Nasiruddin Ahmed , Tanvir Ahmed Mozumder, Md. Tariq Hassan and Rumana Huque

The economics of tobacco taxation in Bangladesh

The study details the present structure of tobacco taxes in Bangladesh estimates the own- and cross-price elasticities of demand for tobacco products, and simulates the impact of cigarette tax increases on government revenue and public health with the goal of recommending an effective tobacco tax policy for Bangladesh. To examine the tobacco tax structure, the […]

Nasiruddin Ahmed, Jahangir Hossain, Rumana Huque, Md. Tariq Hassan and Tanvir Ahmed Mozumder

A comprehensive economic assessment of the health effects of tobacco use and implications for tobacco control in Bangladesh

Introduction Tobacco is one of the greatest risk factors for noncommunicable diseases (NCDs) including cancers and cardiovascular and respiratory diseases. Globally smoking, chewing tobacco, and exposure to secondhand smoke together were responsible for the loss of 8.7 million lives and 230 million disability-adjusted life years in 2019. The global economic cost of smoking-attributable diseases from […]

Nigar Nargis, Golam Mohiuddin Faruque, Maruf Ahmed, Iftekharul Huq, Rehana Parven, Syed Naimul Wadood, AKM Ghulam Hussain and Jeffrey Drope

বাজেট পরর্বতী জর্দ্দার মূল্য বৃদ্ধি সংক্রান্ত গবেষণার ফলাফল

প্রারম্ভিক: জনস্বাস্থ্য রক্ষায় তামাক পণ্যের উপর কর বৃদ্ধি তামাক নিয়ন্ত্রণের অন্যতম প্রধান উপায় হিসেবে সারা বিশ্বে সুপরিচিত। তামাকপণ্যের কর বৃদ্ধি একই সাথে ব্যবহারকারীর সংখ্যা কমাতে যেমন কার্যকর, তেমনি দেশে রাজস্ব বৃদ্ধি করতে সহায়তা করে। গ্লোবাল এ্যাডাল্ট টোব্যাকো সার্ভে ২০১৭ এর তথ্যানুযায়ী, বাংলাদেশে মোট প্রায় ৩ কোটি ৭৮ লক্ষ (৩৫.৩%) মানুষ তামাক ব্যবহার করে। এর মধ্যে […]

বাজেট পরর্বতী জর্দ্দার মূল্য বৃদ্ধি সংক্রান্ত গবেষণার ফলাফল

BANGLADESH: Illicit Tobacco Trade

In step with the country’s notable recent tobacco taxation reforms, Bangladesh is taking action to fight the illicit tobacco trade. Bangladesh currently has a low estimated illicit cigarette trade incidence (2 percent), compared to estimated global rates of 10-12 percent. Annual revenue losses from illicit cigarette trade are about Taka 8 billion ($100 million), or […]

A GLOBAL REVIEW OF COUNTRY EXPERIENCES

Sadiq Ahmed, Zaidi Sattar, and Khurshid Alam

Tobacco industry pricing undermines tobacco tax policy: A tale from Bangladesh

The effectiveness of tax increase in reducing tobacco use depends on the extent to which the industry passes on the tax to consumers. Evidence suggests that tobacco industry may absorb or raise the price more than the tax increase depending on the price segment of tobacco products. In this paper, we examined the industry’s pricing […]

Tobacco industry pricing undermines tobacco tax policy: A tale from Bangladesh

Nigar Nargis, A.K.M. Ghulam Hussain, Mark Goodchild, Anne C.K. Quah, Geoffrey T. Fong

Tobacco companies exploit CSR programmes to interfere in tobacco-control activities: report

Tobacco companies have used their corporate social responsibility (CSR) programmes to get closer to policymakers, government officials and administration in order to exploit “connection to extract different benefits and to interfere in tobacco control activities”, anti-tobacco group Knowledge for Progress said citing a survey report. In addition, the companies have publicised their CSR activities as […]

The Tobacco Industry Uses Pricing to Undermine Tobacco Tax Policy: Evidence from Bangladesh

The effectiveness of a tax increase in reducing tobacco use depends on the extent to which the industry passes on the tax to consumers. Evidence suggests that the tobacco industry may absorb or raise the price more than the tax increase (over-shift) depending on the brand segment of tobacco products. Very little is known about […]

The tobacco industry uses pricing to undermine tobacco tax policy: Evidence from Bangladesh

Nigar Nargis, A.K.M. Ghulam Hussain, Mark Goodchild, Anne C.K. Quah and Geoffrey T. Fong

The Economic Cost of Tobacco Use in Bangladesh: A Health Cost Approach

This study followed the cost-of-illness approach to estimate the economic cost of the adverse health effects of tobacco use (Rice, Hodgson, Sinsheimer, Browner, & Kopstein, 1986). In this study, we estimated the economic cost for seven tobacco-related diseases, namely, ischemic heart disease, stroke, chronic obstructive pulmonary disease (COPD), pulmonary tuberculosis, lung cancer, laryngeal cancer, and […]

Nigar Nargis, Jeffrey Drope and Gregg Haifley

The Impact of Income and Taxation in a PriceTiered Cigarette Market – findings from the ITC Bangladesh Surveys

Background: Taxing tobacco is among the most effective measures of tobacco control. However, in a tiered market structure where multiple tiers of taxes coexist, the anticipated impact of tobacco taxes on consumption is complex. This paper investigates changing smoking behaviour in lieu of changing prices and changing income. The objective of the paper is to […]

The Impact of Income and Taxation in a PriceTiered Cigarette Market

Iftekharul Huq, Nigar Nargis, Damba Lkhagvasuren, AKM Ghulam Hussain & Geoffrey T Fong

Declaration of Tobacco Free Bangladesh

SOUTH ASIAN SPEAKER’S SUMMIT ON ACHIEVING THE SUSTAINABLE DEVELOPMENT GOALS (SDGs) CLOSING SESSION Speech by Her Excellency Sheikh Hasina Honorable Prime Minister Government of the People’s Republic of Bangladesh Pan Pacific Sonargaon Hotel, Dhaka, Sunday, 18 Magh 1422, 31 January 2016 Bismillahir Rahmanir Rahim President of IPU and Chair of the Session Mr. Saber Hossain […]

A decade of cigarette taxation in Bangladesh: lessons learnt for tobacco control

Bangladesh has achieved a high share of tax in the price of cigarettes (greater than the 75% benchmark), but has not achieved the expected health benefits from reduction in cigarette consumption. In this paper we explore why cigarette taxation has not succeeded in reducing cigarette smoking in Bangladesh. Using government records over 2006–2017, we link […]

A decade of cigarette taxation in Bangladesh

Nigar Nargis, AKM Ghulam Hussain, Mark Goodchild, Anne CK Quahd & Geoffrey T Fong

Tobacco causes over 1 lakh deaths in Bangladesh every year: study

What is the extent of health hazard and economic loss caused by tobacco? Findings of a recent study are quite alarming. Tobacco users’ risk of developing three major types of cancer — lung, larynx and mouth — is 109 percent higher than non-users’, according to the study. Their risk of developing seven life-threating diseases — […]

Tobacco Taxes In Bangladesh

The Economics of Tobacco and Tobacco Taxation in Bangladesh by Abul Barkat, Ashraf Uddin Chowdhury, Nigar Nargis, Mashfiqur Rahman, Md. Shahnewaz Khan, Ananda Kumar Pk., Sharmina Bashir, and Frank J. Chaloupka. 2012.

Report on Assessment Study How to best change tobacco control policies in Bangladesh

The report consist of a political mapping was conducted by Management and resource development Initiative (MRDI) involving different stakeholders to develop a coordinated communication strategy to know how to best change tobacco control policy in Bangladesh. The assessment report was submitted to Campaign for Tobacco Free-Kids (CTFK)

Report on Assessment Study

Curbing the Epidemic

An overview of key issues that most societies and policymakers face when they contemplating tobacco control. WHO and World Bank jointly prepared this report from the 10th World conference in 1997 on Tobacco in Beijing, China, assesses the expected consequence of tobacco control for health, economies and for individuals.

Curbing the Epidemic

Tobacco Control-Why is Reducing Use of Tobacco a Priority?

Tobacco use is one of the single biggest causes of death worldwide. It kills more than 5 million people per year – more than TB, AIDS and malaria combined (source: WHO 2008), and deaths are rising. Many deaths and much disease could be prevented by reducing smoking prevalence.

Tobacco Control-Why is Reducing Use of Tobacco a Priority?

Bangladesh_tobacco_taxes_summary

One of a series of reports that illustrates, the summary of ‘The Economics of Tobacco Taxation in Bangladesh by Abul Barkat et al. an initiative by Bloomberg philanthropies and Bill and Melinda Gates Foundation with recommendations to reduce tobacco use.

ITC Final Bangladesh Price and Tax May 2014

This report presents key findings from the International Tobacco Control Policy Evaluation Project (the ITC Project) Bangladesh Waves 1-3 (2009-2012) Survey in relation to tobacco price and taxation issues.

ITC Final Bangladesh Price and Tax May 2014

the trend in affordability of tobacco product in bangladesh 2009-2015: Evidence form ICT Bangladesh Surveys

This publication is a trend analysis in affordability of tobacco products in Bangladesh from 2009 to 2015. The study uses nationally representative individual level cohort data from the international Tobacco Control (ITC) Bangladesh Survey.

ITCBD Affordability Apr 29 2016 ITC

The economics of tobacco and tobacco taxation in Bangladesh

This report illustrates economic engagement of tobacco in Bangladesh and how tobacco taxation can play a vital role in curbing the costs borne by tobacco consumption

Tobacco and Tobacco taxation in Bangladesh