Abstract:

Bangladesh is the world’s eighth largest cigarette market, with annual volumes exceeding 86 billion units and a growth rate of 2%.1 One of the most effective ways to increase government revenues while also decreasing tobacco consumption is through strong tax policy.2 In Bangladesh, a value added tax (VAT) on cigarettes was first introduced in the financial year (FY) 1992-93 with four tiers – premium, high, medium, and low.3

However, the tax structure for cigarettes has changed several times over the years, and eventually the number of tiers was fixed at four in the financial year (FY) 2004-05. The National Board of Revenue (NBR) sets taxes and prices on tobacco products on an ad hoc basis, having no tobacco tax policy or guidelines. Due to the complex multi-tiered tax structure, increasing the price of cigarettes every year without raising taxes has not been very effective in reducing the use of cigarettes. Because of multi-tier structure, when the price of cigarettes increases, consumers switch tiers and buy the lower-priced cigarettes. Consequently, because there was no noticeable price increase for consumers, consumption did not decline dramatically.

In Bangladesh, low-tire cigarettes account for 75% of sales. However, despite the large sales, the lower level’s revenue collection is not good enough. The reason for the low revenue is that the base price of low tier cigarettes is very minimal and the tax rate is lower than that of other tire cigarettes. But the profit of the tobacco producers in this tier is too lucrative. To reap this benefit, British American Tobacco Bangladesh (BATB) has become aggressive in capturing the low-tier cigarette market. Statistics show that BATB started producing low-tier cigarettes in FY 2006-07, which was their first appearance in the low-tier market.4

Initially, BATB could only capture 3% of this market, while the domestic cigarette manufacturers dominated the market with the rest of the 97% share. But in 2010-11, BATB’s share rose to 9%, and within 10 years the company owned 84% of the low-tier cigarettes market share in Bangladesh.5 Because domestic cigarette companies are far behind in financial strength to increase production capacity. They also migrate and diversify into non-tobacco industries such as hospitals and manufacturing sector. In contrast, BATB was already ahead in financial and production capacity in the high and premium tier cigarette market. In addition, BATB quickly captured the market by bringing down popular bands of cigarettes worldwide. BATB controls about 65% of the production and marketing of all tier-cigarettes in Bangladesh.

In the last 10 years, the price of cigarettes has increased less than the price of rice and eggs. 6 On the other hand, the current tobacco tax structure of raising the price allows cigarette manufacturers to make a boom in profit. Despite a 3% drop in cigarettes production, BATB’s net profit after tax/VAT has risen to 28%.7

Due to Ad velorum tax structure, it’s clear how BATB has been able to increase its profits so significantly while maintaining affordability of its products. BATB sends foreign currency abroad by buying equipments, service and technical fee and tobacco leaves etc, which is harmful to Bangladesh and tobacco growers. If BATB does not send such a huge amount of money to their mother company, this money would be added to the company’s profit. As a result, the government would get a 47% income tax and shareholder will get more dividend on that money. On the other hand, some several secretaries have been sitting in the BATB board for a long time. They play a proactive role in benefiting the tobacco companies at different times. They give financial benefits and policy support to the tobacco companies by harming the revenue of the government. The multinational cigarette company has been able to promote the myth that they have largest CSR portfolios and millions of people are being benefitted through its, very successfully to the public, NBR and government policymakers.

This paper analyses the financial reports and transactions of BATB between 2011-2020 to examine this anomaly, and to understand the reality and myths of public perception. The research identifies tobacco industry interferences in the taxation system and the ways in which BATB is manipulating the existing law and regulations in Bangladesh.

Specific Objectives:

- Analysis of financial anomalies in BATB’s annual reports from 2011 to 2020.

- Examination of BATB’s transfer of money to the mother company through under the name of royalties and technical fees, import of leaves and equipment etc.

- Analysis of BATB’s Corporate Social Responsibility (CSR) activities.

- Investigation into the government officials who sit on BATB’s board of directors and their influence to hamper the country’s tobacco control.

Methodology

The research has been conducted following qualitative and quantitative research methods. Financial reports of BATB over 10 years from 2011 to 2020 were collected from BATB’s website and analyzed. Relevant data was also collected from NBR, national and international media, the Bangladesh Network for Tobacco Tax Policy (BNTTP), the Union of Domestic Tobacco Companies, and other stakeholders. Apart from the financial reports, the misleading narratives and activities of BATB in Bangladesh have also been highlighted.

This report is financially supported by the International Union Against Tuberculosis and Lung Disease (The Union) on behalf of STOP, a global tobacco industry watchdog.

Key Findings and Discussions

Financial anomalies in BATB’s Annual Reports: One of the primary goals of this research was to determine whether BATB, as a multinational company, has any distortions in its financial reports. In Bangladesh, it is assumed that multinational companies do not engage in any kind of financial irregularity, but this study found evidence of several anomalies in BATB’s reports.

In the annual report of 2011, under the heading of operating expenses, trade marketing expenditure was BDT 132 crore. But in the annual report of 2012, the trade marketing expenditure in 2011 was shown as BDT 122 crore, which is BDT 10 crore less. The question is why need to change the previous year data without any note.

On the same way expenditure on CSR in the 2011 annual report was BDT 9 crore. However, the CSR expenditure for 2011 was shown BDT 6 crore in the 2012 report. So what was the real expenditure for CSR in 2011—BDT 9 crore or BDT 6 crore?

Similarly, Traveling and training expenses for the year 2011 were BDT 11.7 crore in the annual report of 2011. But reflected as BDT 14.8 crore for the same year in the 2012 report, without any note regarding the changes in figures in the financial statement (see Table No. 1).

Table No: 1

| Sector-wise expenditure in 2011 | Shown in 2011 annual report (,000 BDT) | Shown in 2012 annual report (,000 BDT) | Difference (,000 BDT) |

| Trade marketing expenditure | 1,320,940 | 1222,043 | 98897 |

| Corporate Social Responsibility | 90,574 | 60,679 | 29895 |

| Travelling and training | 117,652 | 148,223 | 30571 |

These three sectors together make a difference of about BDT 16 crore (160 million). Publicly Listed companies in the capital market do not have the right to change the financial figure of the previous year’s expenditure in the following year’s annual report without any note. This is basic principle of preparing financial reporting. Therefore, BATB has breached financial reporting regulations.

In 2015, BATB started manufacturing overhead and operating expenses separately. Previously, all the costs were combined under “manufacturing overhead”. The financial report of 2014 also showed two types of expenditure under the heading “cost of sales”. They showed an additional expenditure of BDT 46 crore, from BDT 1,933 crore to BDT 1,979 crore, in 2015.

Reporting difference between the 2014 report and 2015 report also occurred under “CSR”, “insurance fees”, and “security and safety” as well in other budget lines (see Table No. 2). These reporting differences are not in line with Financial Reporting Council Bangladesh (FRCB) guidelines. FRCB sets the standard procedure for financial reporting guidelines and states that a company may not change the previous year’s data without justification which must be noted in the annual report.8

Table No: 2

| Expenditure by sector in 2014 | Shown in 2014 annual report (,000 BDT) | Shown in 2015 annual report (.000 BDT) | Difference (,000 BDT) |

| Cost of sales | 19332215 | 19794030 | 461815 |

| CSR | 18672 | 11920 | 6752 |

| Insurance fee | 83470 | 92195 | 8725 |

| Information Technology | 395484 | 423739 | 28255 |

| Security and Safety | 111417 | 113208 | 1791 |

| Repairs and Maintenance | 965,297 | 979621 | 14,324 |

In 2019, there are discrepancies in the cost of some sectors. The annual report showed lower spending in some sectors and higher spending in others (see Table No. 3). In this way, they have kept the gross figure adjusted on the balance sheet. BATB adjusts the gross figures and makes changes inside the report so that auditors do not raise any major questions about the report.

Table No: 3

| Expenditure by sector in 2019 | Shown in 2019 annual report (,000 BDT) | Shown in 2020 annual report (,000 BDT) | Difference |

| Manufactured overhead (BDT) | 5356749 | 6033642 | 676893 |

| Distribution cost (BDT) | 530359 | 1207252 | 676893 |

| Operating Expenses: | |||

| Distribution cost | 212549 | 148284 | 64265 |

| Trade support expenditure | 1222448 | 1286714 | 64266 |

| Royalty (,000 USD) | $ 5260 | $ 4734 | $526 |

| Remittance of foreign (,000 USD) | $28556 | $28030 | $526 |

| Total export earnings | |||

| Export of Leaf (,000 USD) | $44544 | $44013 | $531 |

| Export of finished goods (,000 USD) | … | $784 | $784 |

Manufacturing overhead costs showed a difference of BDT 67.6 crore or 676 million, without any explanatory note. And they have adjusted this money by manipulating the distribution costs. It is not clear why there is such a sudden change in distribution expenditure in the previous year.

There is a large difference even in the amount of royalty given to their mother company – British American Tobacco headquarter. The annual report shows a difference of about BDT 4.5 crore in the royalty sector.

Not only that, in 2019, there was no export revenue from finished goods. But in the 2020 annual report, they showed an income of $784 thousand dollar in 2019, equivalent of BDT 7 crore ($1=90 taka) in that sector. Discrepancies have also been observed in tobacco leaf export income of BATB’s annual reports. This deviates from the standard for annual financial reporting.

Financial transactions between BATB and mother companies

Every year, BATB sends a large sum of money to its sister companies in different countries, including their mother companies, in the name of purchasing information technology, royalty fees, advisory fees, machinery and leaf purchases, and so on. There is no way to verify the veracity of the money they are sending to these sector wise expanse for their mother and sister companies.

BATB’s reports show equipment purchases from sister companies in BAT Pakistan, BAT Nigeria, BAT Chile, BAT Indonesia, and BAT Kenya etc. This raises questions, because these countries produce cigarettes like Bangladesh, which means there is no reason for them to buy new equipments and machineries.

By sending this money to other countries, foreign currency is going abroad from Bangladesh. Sending funds abroad reduces BATB’s overall profits, which reduces government revenue collected from revenue.

Table No: 4 (Figure ‘000)

| Year | Procurement of Information technology |

| 2020 | 1,225,440 |

| 2019 | 440,852 |

| 2018 | 288,751 |

| 2017 | 631,038 |

| 2016 | 578,922 |

| 2015 | 690,220 |

| 2014 | 869,589 |

| 2013 | 555,532 |

| 2012 | 510,222 |

| 2011 | 268,157 |

| Total = 605,87,23 | |

Analysis of the data published in the annual report of BATB from the year 2011 to 2020 (Table No. 4) shows that, according to the `Other Related Party Transactions’ in sectoral expenses.

In the last 10 years, BATB has sent a total of BDT 605 crore, or 6058 million, to the mother company under the subsector of procurement of information technology, products, and other services. In the year 2020, BDT 122 crore or $ 1225 million dollar was sent, which is 36% higher than in 2019. Again, in 2019, BDT 44 crore has been sent, which is more than 65% higher than the previous year. The question is for what basis they fixed the amount that should be public. So, government would get more revenue from BATB if they invested in business without sending this money abroad by on various pretexts.

Alongside the mother company, it is shown that the money against the purchase of procurement of information technology, products, and other services has been sent to different countries, including BAT Australia, BAT Germany, BAT Indonesia, BAT Korea, and BAT Japan.

But in Bangladesh, it is possible to find innumerable ways to keep this money if the relevant government authorities properly check the income and expenditure accounts of the company. The amount is, on average, more than BDT 60 crore per year. This huge sum of money has been reflected as an overseas expenditure.

“According to recent media reports, Bangladesh lost $5.8 million in tax in 2016 owing to British American Tobacco’s Bangladesh operations shifting some of its profits to its associate company in the UK, where it paid almost no tax. Between 2014 and 2016, BAT Bangladesh declared $21 million a year in obligations owed to BAT’s UK subsidiaries in royalties, technical and advisory fees, and IT charges, which was equivalent to 15 percent of BAT’s pre-tax profits for the period. The payments allowed the BATB to avoid paying corporate tax on the sum, costing Bangladesh $5.8 million in lost tax in 2016, enough to cover the government’s per capita health expenditure for over 170,000 citizens for a year.” 9

Royalty fees: under the name of group company BAT Holdings Limited, BDT 463 crore (4630 million) has been sent as a royalty fees. On an average yearly, BDT 46 crore was transferred as a royalty fee to the group company. The criteria for determining royalty accounts should also be mentioned in the report, because it is public money.

Table No: 5 (Figure ‘000)

| Royalty Fee | Year | Technical & Advisory fee |

| 650,620 | 2020 | 1,133,313 |

| 762,204 | 2019 | 1,014,000 |

| 662,505 | 2018 | 918,754 |

| 534,917 | 2017 | 1,063,891 |

| 444,458 | 2016 | 836,274 |

| 457,408 | 2015 | 978,192 |

| 413,352 | 2014 | 892,964 |

| 391,433 | 2013 | 705,157 |

| 313,632 | 2012 | 780,415 |

| – | 2011 | 1,232,028 |

| Total- 463,0529 | 10 years | Total -955,49,88 |

Technical & Advisory Fee: BDT 955 crore (9554 million) sent to the mother company of BAT from 2011-2020. What type of technical and advisory service have they been taking from them that is not mentioned in BATB’s annual report. If the actual cost was less, then these money would be added to the company’s profit. As a result, the government would get a 47% income tax on that money as well as foreign currency, which would benefit Bangladesh.

Purchase of leaves and goods: BATB says that they are purchasing tobacco leaves from their registered 38,000 farmers around Bangladesh. From 2011 to 2020, they sent BDT 789 crore (7985 million) for the purchase of leaves and goods from BAT sister companies from different companies like BAT Japan, BAT Australia, BAT Singapore, BAT Nigeria, BAT Kenya, BAT Indonesia, PTCL, etc. This is how they are sending foreign currency abroad by buying tobacco leaves, which is harmful to Bangladesh and tobacco growers.

Table No: 6 (Figure ‘000)

| Purchase of equipment | Year | Purchase of leaf and goods |

| 5,714 | 2020 | 915,532 |

| 17,044 | 2019 | 348,449 |

| 579,136 | 2018 | 926,281 |

| 403,111 | 2017 | 1,356,574 |

| 365,548 | 2016 | 927,679 |

| 55,529 | 2015 | 487,212 |

| 470,032 | 2014 | 1,226,138 |

| 81,667 | 2013 | 789,314 |

| 120,721 | 2012 | 924,322 |

| – | 2011 | 84,347 |

| Total- 209,85,02 | 10 Years | Total-798,58,48 |

Purchase of equipment: In the last 10 years, BATB has spent BDT 209 crore on various equipment purchases. However, the companies from which this equipment has been purchased from their sister companies of BAT. At the same time, it is not known whether the equipment being brought from these countries is new or old. Price of new or secondhand machineries and equipment are not same. 10

In Bangladesh, BATB only produces cigarettes and does not produce any equipment. The picture should be the same for sister companies in other countries such as Pakistan, Singapore, Nigeria, South Africa, Indonesia, Romania, Mexico, Chili, Germany etc. This raises questions as to why equipment is procured from other countries from BAT’s sister companies. If they buy from their ‘sisters’ companies in these countries, there is no chance of the equipment being new. So, is BATB buying used equipment? And what is the actual cost of these products? It is not clear how the prices of these products are determined. It is important to check whether it is being done over invoicing or overbilling. As a result, it is important to verify the price mentioned to purchase of equipment from their sister companies of BATB.

Recently, Bangladesh Financial Intelligence Unit (BFIU) claims that hundreds of crores worth of money are being laundered through the over invoicing of imported products and services, which is the largest threat to Bangladesh’s economy. In the annual report of BFIU chief said that some products have been imported by over-invoicing by 20 to 200 per cent. This means if a product is imported with a price of $100, it is shown as $200 in the receipt. It is not hard to assume how much money has been laundered. 11

Interference: Government Secretaries on BATB board of directors

From 2011 to 2020, a total of 8 secretaries from different ministries of Bangladesh were members of the Board of Directors of BATB, effectively helping to run the tobacco company. Three have served as additional secretaries in several ministries.

Surprisingly, each and every secretary of the Ministry of Industry has had their own board director nominated by BATB, the tobacco manufacturer. No secretary is appointed as a board member, other than the additional secretaries on the various boards, in contrast to the significant portion of shares held by the Bangladesh government in other foreign and multinational companies. 12

Investment Corporation of Bangladesh-ICB holds 6.11% share of BATB, Sadharan Bima Corportion -SBC holds 2.82% and Bangladesh Development Bank –BDBL holds 0.34% share, all of which are under the Ministry of Finance. His Excellency the President of Bangladesh has a name-only stake of only 0.64% in BATB, and for this government share, the ministry of finance nominated an additional secretary to the BATB board.

After serving on the BATB board for four years as senior secretary, Mosharraf Hossain Bhuiyan was then appointed to lead the National Board of Revenue-NBR . At a pre-budget meeting with the Bangladesh Cigarette Manufacturers Association-BCMA dated on April 21, 2019, he declared unique privileges for exporting cigarettes during his time as NBR chairman.13 As a result, NBR reduced tax and rebated hundreds of crore taka of revenue to the company each year. As a result of this policy shift, cigarette exports are increasing rapidly.

Members of the BATB board work to influence tobacco policy on the organization’s behalf. Different governmental organizations hold just 9.61 percent of BATB’s total shares. 73% of the shares are owned by the mother company of the global corporation. However, it is somewhat unexpected that five senior government officials, including the secretaries, make up their 10-person board of directors. It is uncommon for a multinational cigarette firm to have so many directors with so little ownership at the top level of policymaking.

Some of these secretaries, who have been on the BATB board for a long time, have played a proactive role in benefiting the tobacco companies at different times. They have given financial benefits to the tobacco companies by harming the revenue of the government. There are even instances of obstruction of the tobacco control movement.

In order to encourage tobacco production in the budget for the fiscal year 2019-20, the 10% duty imposed on unprocessed tobacco exports has been completely withdrawn. Because it was hazardous to public health, a 25% duty was imposed. The government is losing BDT 34 crore a year in revenue from tariffs on tobacco exports as they have been reduced from 25% to 10% and from 10% to 0% in three fiscal years. To put it bluntly, it has been reduced from 25% to 0%. As a result of this policy shift, cigarette exports are increasing rapidly. For example, in 2022, finished goods (cigarette) exports increased by 313% compared to 2019.14 BATB constructed a new factory in the Saver area of Dhaka for the purpose of exporting cigarettes.

Although the Ministry of Agriculture is not among the shareholders of BATB, the Secretary of the Ministry of Agriculture has been on the board year after year. The Ministry of Agriculture has been seen speaking in the language of tobacco companies in formulating tobacco cultivation policies. There is a committee under the Ministry of Agriculture to decide the price of tobacco leaves farmers will sell for. The tobacco company had no representative in the committee set up in 1977 under the initiative of the Department of Agriculture Marketing-DAM. But the Ministry of Agriculture in 2006 included 3 tobacco companies, including BATB, who purchased tobacco leaves from farmers. 15 As a result, tobacco farmers continue to grow tobacco year after year, while the poor remain extremely poor. The fair price of the crop is being robbed.

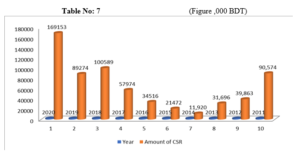

CSR: the tobacco industry’s tool to influence policy

It is well known that the BATB spends huge sums of money on CSR programs every year. The multinational cigarette company has been able to promote the myth that millions of people are benefiting through its CSR activities very successfully to the public, NBR and government policymakers.

But no one has ever asked this question: how much money does BATB actually spend on CSR in a year? They spend several times more on publicity campaigns to influence policy makers than they spend on CSR that actually benefits people. Yet they have received various government and private awards for its CSR activities.16

According to the Bangladesh Bank’s CSR policy, banks and financial institutions will compulsorily spend 2% of their profits on CSR. But since there is no CSR policy for tobacco companies, BATB spends money as they wish.

BATB’s 10 years of CSR

For example, according to the financial report of 2020, BATB spent 16 crore 91 lakh 53 thousand taka on CSR in 2020. In 2019, the expenditure here is 8 crore 92 lakh 74 thousand taka. In 2018, the expenditure on CSR was BDT 10 crore. However, in 2018, the expenditure on miscellaneous or other sectors was six times more, which is about BDT 60 crore.

BATB’s CSR spending over a decade: 65 or 61 crores?

The financial report states that BDT 95 million was spent on social responsibility by the BATB in 2011. The spending during 2011 has been changed to BDT 66 million in the financial report for 2012. The difference is BDT 30 million, or 33% of the difference, in a single year, which is extremely unusual. The financial report doesn’t explain or provide any information regarding why CSR spending varied from the prior year’s figure. What financial amount did the BATB CSR sector spend in 2011?

It’s also unknown how much CSR truly cost in 2014. BDT 18.6 million was spent in 2014, according to the study. The expenditure for 2014, however, was BDT 11.9 million, according to the “Excellence in Governance” report published in 2015. The difference is also greater than 36% in this case. Whether a cost differential of more than 36% over the course of a year is acceptable is a matter of contention. According to the general principles for the preparation of financial statements, the accounts from the previous year remain exactly same and were reflected in BATB’s financial report for the subsequent year.

CSR increases when the law reforms

The most striking observation is that BATB has raised its CSR spending anytime the government has taken action to alter tobacco control laws or other rules and regulations. By engaging in social activities, they want to win over the public and build goodwill. CSR also takes use of the chance to lobby lawmakers. They raised their CSR spending, for instance, in the years before the 2013 Tobacco Control Act Revision, the creation of regulations in 2015, the addition of graphic health warnings to tobacco product packaging in 2016, and the amendment of the current Tobacco Control Act in 2019. 17

Sector wise expenditure on major CSR projects such as BONAYAN (tree plantation), PROBAHO (drinking water supply) and DEEPTO (solar energy) is not disclosed in BATB’s annual financial report. From 2011-2020, BATB has spent BDT 64.7 on CSR. However, there is a difference in terms of CSR in their financial reports over the two years. According to BATB, the total amount of CSR for 10 years stands at BDT 62 crore 38 lakh. The difference is 2 crore 32 lakh taka. On the other hand, they made a net profit after tax of BDT 6 thousand 912 crore taka in 10 years. CSR accounted for only 0.94%- of their profit.

Banks in Bangladesh collectively spend over BDT 700 crore from their net profit annually on CSR18. However, BATB spent an average of only 6 crore 23 taka annually, and received various awards, including 5 state awards. The most interesting thing is that the chairman of BATB’s CSR committee is held responsible by the secretaries of the government year after year. Since most of the members of the committee are secretaries of the government, there is a conflict of interest to tobacco free Bangladesh by 2040.

Conclusions

From the above investigation and analysis, why BATB includes 4/5 government officials on its board of directors, and why the government accepts this year after year, is clear. This intervention by the company and the flexibility of the government is completely at odds with the announcement of the Hon’ble Prime Minister Sheikh Hasina to make the country tobacco-free by 2040. Although financial anomalies are unacceptable to the government, BATB has been doing it for years, as shown by this analysis of its financial reports for the last 10 years.

In order to implement the declaration of the Hon’ble Prime Minister, the government’s shares in the tobacco company must be withdrawn. At the same time, government members of BATB’s board of directors should withdraw immediately to prevent the company’s interference in policy. To discourage the use of tobacco and decrease the abnormal profits of the tobacco company, and to prevent huge amounts of this profit from being sent abroad on various pretexts, the multi-tiered tax structure needs to be changed to levy specific taxes as opposed to ad-valorem. At the same time, the company should be punished for its financial irregularities.

Recommendations

- The government should withdraw its share from BATB, and no government official can be on the board of BATB. Until then, no one can be kept above the rank of Additional Secretary.

- BATB’s self-promotion through so-called CSR activities must be banned.

- A simple tobacco tax policy should be formulated and passed to achieve the Prime Minister’s declaration to build a tobacco-free Bangladesh by 2040.

- Any changes in BATB’s annual reports year on year should be explained with rationale, following government financial regulations.

- The NBR calculates the fiscal year from July 1 to June 30 of the following year. But BATB calculates its accounts from 1 January to 31 December, the calendar year. Due to this problem, there is a difference between the financial data of BATB and NBR. To solve this problem, the government also asked the big private companies to prepare and maintain their accounts for the financial year like the government instead of the calendar year. BSEC has to appoint a special auditor for BATB as a publicly listed company in the stock market.

- All the information about sending money to sister companies abroad should be presented in the annual report with a clear rationale.

Reference

- https://www.thedailystar.net/news/city/japan-tobacco-signs-agreement-with-bangladesh-akij-group-in-asian-business-1616758

- https://www.who.int/publications/i/item/9789241509121

- http://bnttp.net/resource/tobacco-taxation-in-bangladesh-administrative-and-political-constraints/

- Budget proposal of `Locally owned cigarette manufacturer malik samity’; 09.03.2022

- Budget proposal of `Locally owned cigarette manufacturer malik samity’; 09.03.2022 and

https://www.banglanews24.com/daily-chittagong/news/bd/919404.details

- https://bnttp.net/resource/tobacco-tax-myth-and-reality-by-sushanta-sinha/

- http://bnttp.net/affordability-of-cigarettes-vs-other-necessities-a-brief-study/

- https://frcbd.org/

- https://www.thedailystar.net/business/news/bangladesh-lost-58m-batbs-profit-shifting-1738924

- https://www.batbangladesh.com/group/sites/BAT_9T5FQ2.nsf/vwPagesWebLive/DOBZKBFU/$FILE/BATB_Annual_Report_2020.pdf?openelement

- https://en.prothomalo.com/opinion/editorial/xfk63wcxnb

- https://drive.google.com/drive/folders/1CKp1VWKfj-rZs6Vtg9qZlLsh7cyfUojA

- https://www.risingbd.com/economics/news/295447

- https://bnttp.net/tobacco-revenue-myths-company-ill-tactics/

- https://drive.google.com/drive/folders/1CKp1VWKfj-rZs6Vtg9qZlLsh7cyfUojA

- https://www.batbangladesh.com/group/sites/BAT_9T5FQ2.nsf/vwPagesWebLive/DO9T5K52

- https://www.observerbd.com/news.php?id=395577

Author: Sushanta K Singha, Public Health Researcher and Special Correspondent, Ekattor Television.

For contact : sinhasmp@yahoo.com

BNTTP

Sushanta kumar singha