Keywords

Tobacco industry, Public health, Bangladesh, Policy interference, Tobacco control, Revenue collection

Introduction

This report investigates the pervasive influence of the tobacco industry in Bangladesh, with a specific focus on how it undermines public health and interferes with policy implementation. Tobacco use remains a significant public health concern, with millions of Bangladeshis consuming smoking and smokeless tobacco products. Despite government efforts to control tobacco consumption, the industry’s manipulation of laws, policies, and public opinion continues to obstruct progress. The primary obstacle to effective tobacco control in Bangladesh is the strategic interference by tobacco companies, especially British American Tobacco Bangladesh (BATB), which employs various methods to maintain its market dominance and weaken public health initiatives.

This report will be published on the Bangladesh Network for Tobacco Tax Policy (BNTTP) website and other relevant platforms to ensure widespread access and to support ongoing efforts to strengthen tobacco control policies in Bangladesh.

Key Problem: Tobacco Industry Interference (TII)

Tobacco Industry Interference (TII) in Bangladesh is multifaceted and includes a range of tactics aimed at protecting corporate interests at the expense of public health. The industry exploits legal loopholes, influences tax policies, and provides misleading information to policymakers and the public to create an environment where tobacco use thrives. These actions directly undermine tobacco control laws, enforcement mechanisms, and revenue collection efforts, making it difficult for the government to implement effective tobacco control measures.

Key Findings: Evidence of Tobacco Industry Interference

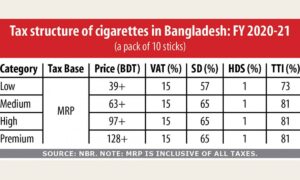

Lobbying and Legal Manipulation: Tobacco companies in Bangladesh actively lobby against the implementation of strict tobacco control laws. They have been known to challenge regulations, such as advertising bans and public smoking restrictions, through legal challenges and extensive lobbying efforts. By maintaining close relationships with key government officials and institutions, the industry has successfully delayed or weakened the enforcement of critical health policies. For example, BATB has frequently lobbied to maintain a complex, multi-tiered tax structure that benefits the company while complicating revenue collection.

Influence over Tax Policies: One of the most prominent examples of tobacco industry interference is in the shaping of tax policies. BATB has played a significant role in influencing the National Board of Revenue

(NBR) to create a convoluted tax system that favors the industry. This manipulation allows companies to minimize their tax burden and avoid price increases that could reduce tobacco consumption. For instance, the omission of the term “maximum” in government directives related to cigarette pricing has resulted in substantial revenue losses, as tobacco companies are able to sell their products at higher prices while reporting lower values for taxation purposes.

Corporate Social Responsibility (CSR) as a Smokescreen: BATB and other tobacco companies use CSR activities as a public relations tool to improve their image and gain favor with policymakers. These CSR initiatives often focus on education, environment, and public health, creating a false narrative that the companies are committed to societal well-being. In reality, these activities are used to distract from the harmful effects of tobacco use and to gain access to influential stakeholders. CSR programs are often launched strategically during periods of legislative reform, further illustrating how the industry manipulates public perception to influence policy outcomes.

Conflicts of Interest in Policy-making: Another key finding is the conflict of interest within the government, where senior officials serve on the board of BATB. This direct involvement in corporate governance compromises the government’s ability to enforce tobacco control laws effectively. The state also holds a financial stake in BATB, which creates tension between public health objectives and revenue generation from the tobacco industry. This financial entanglement and the presence of government officials on BATB’s board have allowed the company to shape tobacco policies in its favor, often at the expense of public health.

Policy Recommendations

To address the pervasive influence of the tobacco industry and protect public health, the following policy recommendations are proposed:

Strengthen Financial Transparency: Implement stricter financial reporting standards for tobacco companies, including detailed disclosures of lobbying activities, CSR spending, and financial transfers. This would limit the industry’s ability to manipulate revenue reporting and policy outcomes.

Simplify the Tobacco Tax Structure: Reform the existing multi-tiered tax system to a simplified, uniform structure that minimizes opportunities for tax evasion and enhances government revenue collection. A shift towards specific taxation could help stabilize prices and reduce tobacco affordability, thereby curbing consumption.

Regulate CSR Activities: Introduce regulations to limit the use of CSR by tobacco companies as a tool for policy influence. These initiatives should be carefully monitored, with clear guidelines ensuring that CSR activities do not undermine public health campaigns or tobacco control efforts.

Prevent Conflicts of Interest: Prohibit government officials from holding positions on the boards of tobacco companies. This would help eliminate conflicts of interest and ensure that public health priorities are not compromised by corporate affiliations.

Enforce Tobacco Control Laws: Strengthen the enforcement of existing tobacco control laws by allocating more resources to law enforcement agencies and ensuring that tobacco companies are held accountable for violations.

The report highlights the deep-rooted influence of the tobacco industry in Bangladesh and the urgent need for stronger regulatory measures to protect public health. By addressing these issues through comprehensive

policy reforms, Bangladesh can take significant strides toward reducing tobacco consumption and improving health outcomes for its population.

Methodology

This study employs a mixed-method research approach, combining both qualitative and quantitative methods to provide a comprehensive understanding of tobacco industry interference in Bangladesh. The mixed-method design allows for a holistic analysis, integrating numerical data with in-depth contextual insights to capture the multifaceted nature of the issue. Quantitative data will be gathered through surveys and analysis of financial and market data, while qualitative data will be collected through interviews and document analysis.

Findings

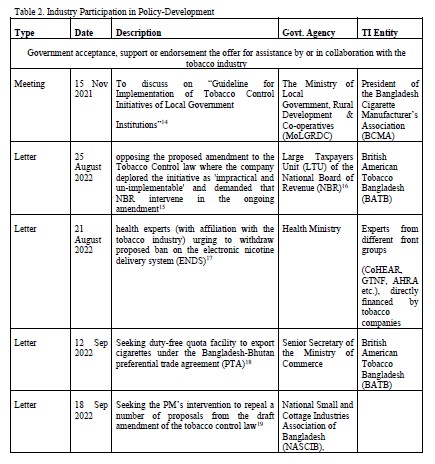

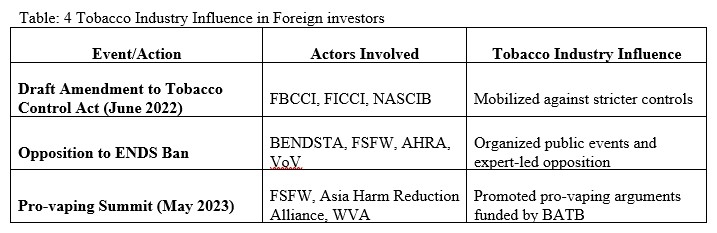

Most events in 2023 and 2024 involving tobacco industry interference aimed to undermine public health measures by obstructing the ongoing amendment initiative of the tobacco control law by the Ministry of Health and Family Welfare (MoHFW). The industry employed several well-known tactics, including using third-party or front groups to advocate on its behalf, misleading policymakers with industry-affiliated so-called experts, and directly approaching government bodies to advance its agenda.

The repetition of these tactics by tobacco companies indicates that the government has not updated its policies to safeguard public health measures despite public outcry. This persistent interference underscores the need for stronger regulatory frameworks and increased transparency to protect public health initiatives from being undermined by the tobacco industry.

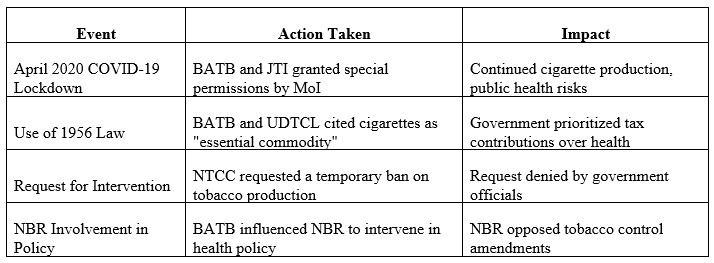

Lobbying and Political Influence: During the April 2020 COVID-19 lockdown, the Ministry of Industries (MoI) in Bangladesh granted special permissions to British American Tobacco Bangladesh (BATB) and Japan Tobacco International (JTI) to continue operations, despite public health risks.[1] The companies leveraged an outdated 1956 law, classifying cigarettes as an “essential commodity,” and emphasized their tax contributions. The swift decision by the MoI, following letters from the managing directors of BATB and United Dhaka Tobacco Company Limited (JTI’s subsidiary), sparked widespread criticism from tobacco control advocates. The National Tobacco Control Cell (NTCC) requested the cancellation of these permissions and called for a temporary ban on tobacco sales during the pandemic, but the government declined, citing the need for tax revenue.

Additionally, BATB continued its influence by prompting the National Board of Revenue (NBR) to interfere in the Health Ministry’s policy-making. BATB’s request led the NBR to write to the Health Services Division, opposing tobacco control amendments. This reflects a pattern of political interference, as BATB has previously influenced the NBR to act against tobacco control initiatives, including graphic health warnings and the National Tobacco Control Policy (NTCP). These actions highlight the industry’s deep-rooted influence over policy decisions in Bangladesh.

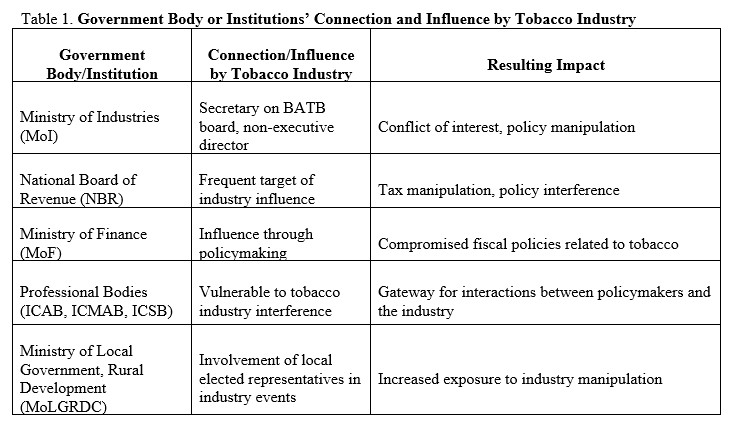

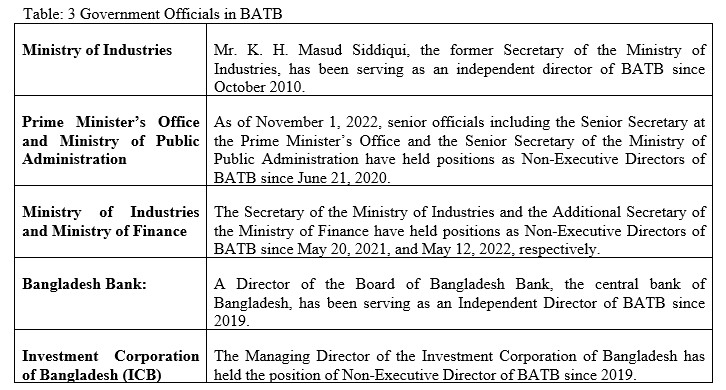

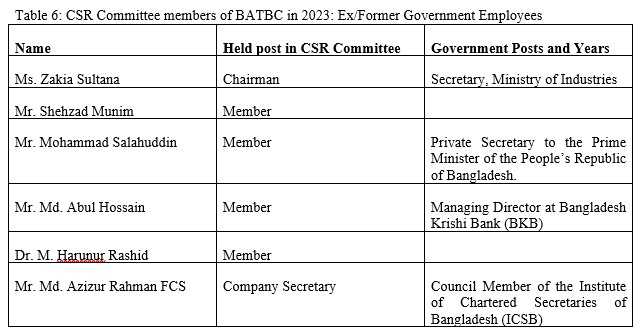

Government and Industry Connections: The deep connections between the tobacco industry and the government in Bangladesh are evident, with senior government officials, including the Secretary at the Ministry of Industries (MoI) and a Secretary at the Prime Minister’s Office, holding positions on British American Tobacco Bangladesh’s (BATB) board. This leads to conflicts of interest, as highlighted by a 2022 study. Government bodies like the National Board of Revenue (NBR), Ministry of Finance, and Ministry of Industries, alongside autonomous professional organizations, are particularly vulnerable to tobacco industry interference. Elected local government representatives’ frequent involvement in industry events further illustrates the industry’s widespread influence.

Policy Dialogue and Trade Associations: In July 2022, a “policy dialogue” event was held at a five-star hotel in Dhaka by the Intellectual Property Association of Bangladesh (IPAB), where speakers criticized a proposed amendment to Bangladesh’s main tobacco control law by the Ministry of Health and Family Welfare (MoHFW). The IPAB’s Executive Committee included government officials and senior BATB members. BATB was listed among its corporate members, acknowledging extensive support from the company. This event illustrates the tobacco industry’s influence on policy debates and its ability to mobilize opposition to tobacco control measures.

The government accommodates requests from the tobacco industry for a longer time frame for implementation or postponement of tobacco control law. A government order from July 4th, 2017, requiring graphic health warnings to cover the upper half of cigarette packs in Bangladesh has been delayed. The Bangladesh Cigarette Manufacturers’ Association challenged the order, and the High Court postponed its implementation. Currently, health warnings remain on the lower half of cigarette packs.

Conflict of Interest: Government Investment in BATB: The government of Bangladesh has continued its investment in British American Tobacco Bangladesh (BATB), holding a 9.4% share as of the latest reports. Despite the potential for conflicts of interest, there is no policy in place to prohibit contributions from the tobacco industry. However, under Section 44A of the Representation of the People Order, 1972, election candidates are generally required to disclose contributions received to cover election expenses when submitting their nomination papers.

The involvement of high-ranking government officials in BATB, coupled with the government’s substantial investment in the company, highlights significant conflicts of interest. These connections can potentially undermine public health policies and tobacco control efforts, as government officials may face divided loyalties between public health objectives and corporate interests. Addressing these conflicts requires stringent policies and greater transparency to ensure that public health priorities are not compromised by corporate affiliations.

Diplomatic Lobbying: There have also been instances of lobbying by foreign diplomats on behalf of the main transnational tobacco companies operating in Bangladesh. In 2017, the British High Commissioner in Bangladesh intervened on behalf of BATB in a tax dispute with the NBR. Similarly, in 2021, the Japanese Ambassador sent a letter to the Bangladeshi Finance Minister criticizing tax reforms that impacted JTI and restrictions on the marketing and sale of certain JTI products. These diplomatic interventions highlight the international dimension of tobacco industry lobbying in Bangladesh.

Use of Third Parties: In June 2022, the Ministry of Health and Family Welfare (MoHFW) proposed amendments to the Smoking and Tobacco Products Usage (Control) Act, which were met with opposition from trade associations like the Federation of Bangladesh Chamber of Commerce and Industries (FBCCI) and Foreign Investors’ Chamber of Commerce and Industry (FICCI), both influenced by the tobacco industry. An investigation by PROGGA revealed that British American Tobacco Bangladesh (BATB) infiltrates business and trade organizations to resist stricter tobacco control measures. The tobacco industry also leveraged pro-vaping organizations to oppose the Ministry’s proposed ban on electronic nicotine delivery systems (ENDS).

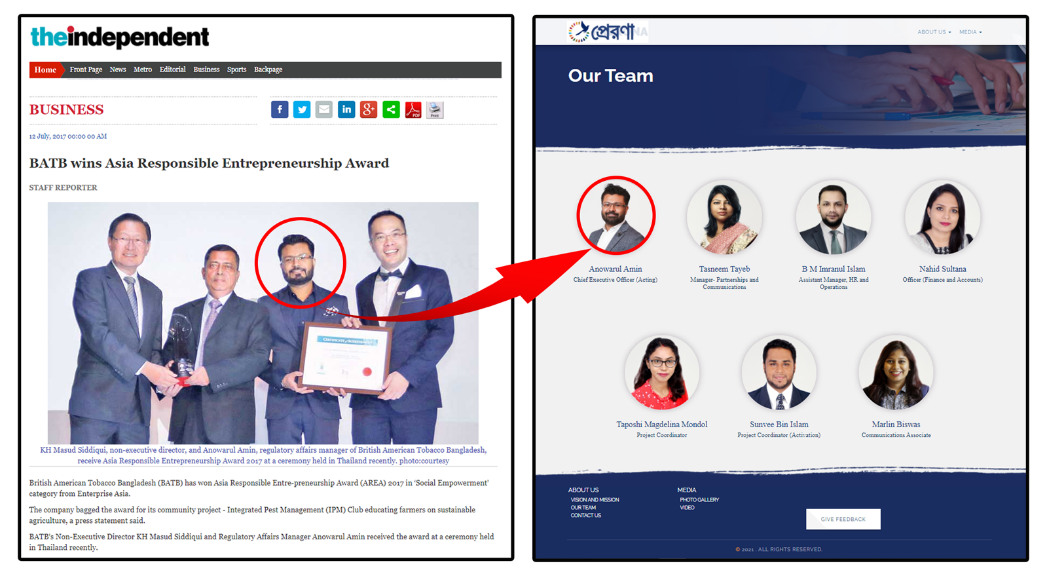

Case Study: Use of Third Parties – Prerona Foundation

Prerona Foundation, a British American Tobacco Bangladesh (BATB)-run organization, emerged as a key player in BATB’s Corporate Social Responsibility (CSR) initiatives during the COVID-19 pandemic. Though it claims independence, the foundation is controlled by BATB’s leadership, as revealed by Managing Director Shehzad Munim in 2020. Its Governing Body consists of top BATB officials, including Munim, the Head of Legal & External Affairs, and the Regulatory Affairs Manager.

Prerona Foundation’s activities include mask-making training for physically-challenged individuals and manufacturing hand sanitizers, produced in BATB facilities. During the pandemic, BATB distributed over 100,000 units of its “Shudhdho” hand sanitizer through the foundation, allowing company executives to build relationships with influential government figures, including the Mayor of Dhaka and senior law enforcement officials.

Despite its promotion as a contributor to Sustainable Development Goals (SDGs), tobacco production undermines many of these goals, such as poverty reduction (SDG-1), food security (SDG-2), quality education (SDG-4), gender equality (SDG-5), and climate action (SDG-13). Prerona Foundation serves as a strategic tool for BATB, helping the company strengthen ties with policymakers while presenting a false narrative of social responsibility, ultimately facilitating its influence over government and administrative levels in Bangladesh.

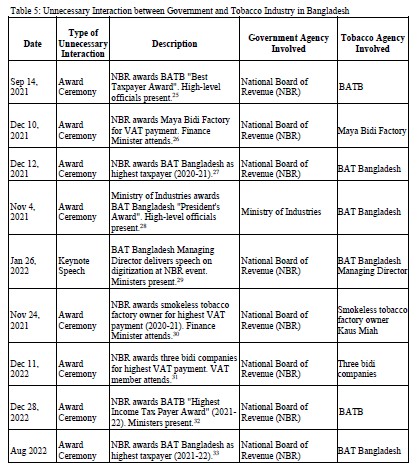

Unnecessary Interaction:

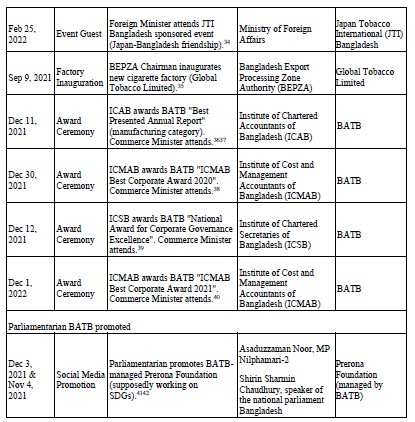

The ongoing recognition and collaboration between the government and tobacco companies in Bangladesh undermine public health efforts by normalizing the tobacco industry’s influence. In 2021 and 2022, British American Tobacco Bangladesh (BATB) received several awards, including the ‘Best Taxpayer Award’ from the National Board of Revenue (NBR), with high-ranking officials in attendance. BATB was also recognized by professional bodies like the Institute of Chartered Accountants of Bangladesh (ICAB) and the Institute of Cost and Management Accountants of Bangladesh (ICMAB), receiving awards for corporate governance and annual reports. These frequent interactions reflect a troubling normalization of the industry’s presence in government and professional spheres.

From 2021 to 2023, British American Tobacco Bangladesh (BATB) continued its partnership with the Department of Agriculture Extension (DAE) to support farmers, though no new government collaborations with the tobacco industry were established during this period. Concerns arose when the Ministry of Industries (MoInd) partnered with BATB on a project to develop a “sustainable model for sugarcane cultivation.” High-level officials, including the Secretary of MoInd and BSFIC representatives, attended a workshop organized by BATB. An agreement was signed on March 31, 2022, to develop improved sugarcane varieties, sparking criticism over potential conflicts of interest.

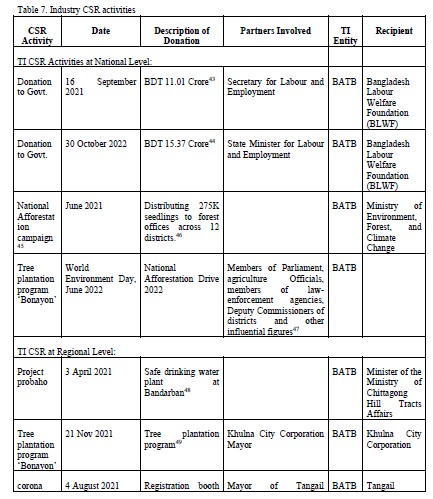

Corporate Social Responsibility (CSR) as a Strategy

Afforestation Program and Partnerships: British American Tobacco Bangladesh (BATB) has effectively utilized its Corporate Social Responsibility (CSR) activities as a strategic tool to enhance its public image and influence policymakers. One of the key initiatives under BATB’s CSR program is the afforestation program ‘Bonayon’. Launched in partnership with the Ministry of Environment, Forest, and Climate Change, Bonayon aims to promote national afforestation efforts. This program has been notable for involving influential figures, thereby amplifying its reach and impact.

In 2021, BATB’s national afforestation campaign under Bonayon was prominently supported by several high-profile officials, including the Minister of Chittagong Hill Tracts Affairs, the Mayor of Tangail Municipality, the Mayor of Khulna City Corporation, and the Mayor of Rajshahi City Corporation. The presence of these influential figures at CSR events not only lends credibility to BATB’s initiatives but also fosters favorable relationships between the company and key government stakeholders.

Financial Contributions to Labor Welfare: Beyond environmental initiatives, BATB has also made significant financial contributions to labor welfare. In both 2021 and 2022, BATB donated substantial sums of money to the Bangladesh Labor Welfare Foundation (BLWF). The ceremonial handover of cheques to the Secretary for Labor and Employment and the state Minister for Labor and Employment underscores the strategic use of CSR activities to strengthen ties with government officials. These contributions are framed as efforts to support labor welfare, which further enhances BATB’s public image as a socially responsible entity.

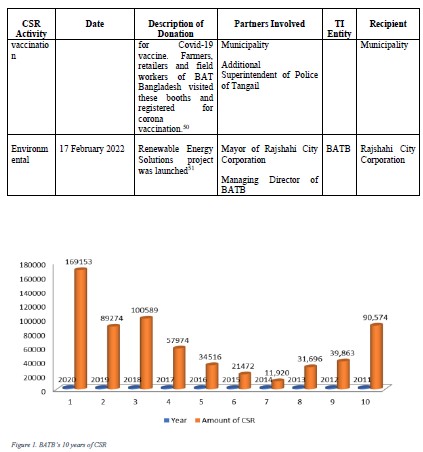

Impact and Continued Industry Interference: Despite a reported decrease in the number of CSR-related incidents in 2022 compared to previous years, the influence of BATB’s CSR activities remains significant. Bangladesh has consistently received the highest score (05) in the CSR category of the Tobacco Industry Interference Index since 2018, reflecting the persistent and concerning level of industry interference through CSR. This high score indicates that, although the number of CSR events might fluctuate, the overall mpact and strategic use of CSR by the tobacco industry to influence policy and public perception remain robust.

Strategic Objectives and Public Perception: The strategic objectives behind BATB’s CSR activities are clear: by aligning itself with social and environmental causes, BATB seeks to cultivate a positive public image and create a buffer against regulatory pressures. CSR activities, such as Bonayon and financial contributions to labor welfare, serve to distract from the harmful impacts of tobacco products while promoting BATB as a benefactor to society. The involvement of high-profile officials in these activities further underscores the extent of BATB’s influence and its ability to embed itself within critical networks of power and decision-making.

BATB’s strategic use of CSR activities, particularly through its afforestation program and financial contributions to labor welfare, illustrates the company’s adeptness at leveraging social responsibility initiatives to influence public perception and policy. The continued high scores in the Tobacco Industry Interference Index highlight the significant and ongoing challenge posed by tobacco industry interference through CSR in Bangladesh. Addressing this issue requires heightened awareness and stricter regulations to ensure that CSR activities do not undermine public health objectives and tobacco control efforts.

The British American Tobacco (BAT) company is accused of violating labor laws by not paying its workers’ wages. Despite record profits, BAT workers in Dhaka, Savar, and Kushtia are protesting against poor working conditions and unpaid wages. The company claims to contribute to a labor welfare fund but continues to exploit its workers. The article calls for the Labor Ministry and Factory Inspectorate to investigate these allegations and adhere to the World Health Organization’s Framework Convention on Tobacco Control (FCTC). It urges the public and media to be aware of BAT’s deceptive practices.

Workers in Dhaka and Savar factories are protesting against unpaid wages and poor working conditions. Similar protests occurred in Kushtia last year. Despite these issues, BAT reportedly made record profits (21,230 crore taka) from cigarette and tobacco sales in the first half of 2024.The article argues that BAT’s contributions to a government labor welfare fund are merely a public relations tactic. They claim BAT doesn’t fulfill its legal obligations to its own workers.

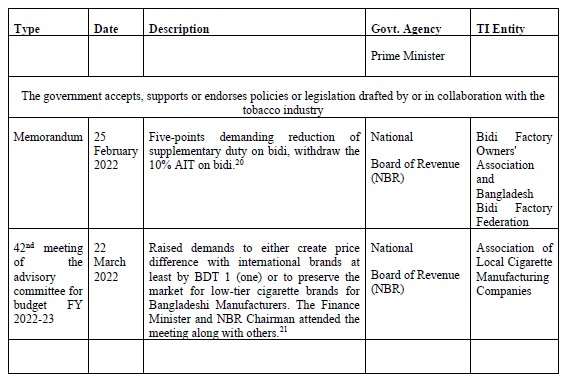

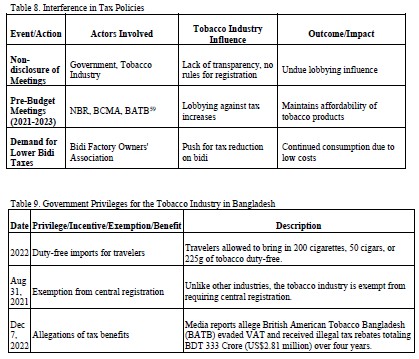

Interference in Tax Policies and Revenue Collection

Tobacco industry interference in Bangladesh’s tax policies and revenue collection remains a significant obstacle to effective tobacco control. The government maintains a policy of non-disclosure regarding meetings with the tobacco industry, allowing lobbying efforts to go unchecked. The National Board of Revenue (NBR) continues to hold pre-budget meetings with the Bangladesh Cigarette Manufacturers’ Association (BCMA), where industry representatives, including British American Tobacco Bangladesh (BATB), lobby against tax increases on tobacco products. This practice, along with calls for reduced bidi taxes by the Bangladesh Bidi Factory Owners’ Association, undermines efforts to reduce tobacco consumption.

Similarly, the NBR held meetings with the Bidi Industry Owners’ Association (BIOA), during which the President of BIOA demanded the withdrawal of the 10 percent advance income tax on bidis. However, as with other interactions, the details of these meetings were not disclosed, further illustrating the lack of transparency in how tax policies affecting the tobacco industry are discussed and potentially shaped.

British American Tobacco Company (BAT) evading taxes in Bangladesh. The company is accused of selling cigarettes at a higher price than what’s printed on the packets. This practice results in the government losing millions of dollars in tax revenue. The authorities have issued a notice to BAT. The article also mentions other multinational cigarette companies engaging in similar practices. BAT has evaded taxes worth 5 billion taka.

The ongoing secretive interactions between the NBR and the tobacco industry, combined with lobbying efforts during pre-budget meetings, have a significant impact on tax policies and revenue collection. The tobacco industry’s demands to keep taxes low and remove advance income taxes undermine public health objectives by making tobacco products more affordable and accessible. This not only hinders efforts to reduce tobacco consumption but also affects the government’s ability to collect adequate revenue from the tobacco sector.

Figure 2Tax structure for FY 2021-22

The lack of stringent disclosure rules and the continued secretive nature of these interactions prevent public accountability and transparency, allowing the tobacco industry to exert undue influence on policy decisions. This influence results in tax policies that favor the industry, ultimately undermining public health goals and leading to inadequate revenue collection from the tobacco sector.

Supply Chain Control and Price Fixing

Incentivizing Tobacco Cultivation: British American Tobacco Bangladesh (BATB) exercises significant control over the supply chain of tobacco cultivation in Bangladesh, primarily through strategic incentives offered to farmers. To ensure a steady supply of tobacco leaf, BATB provides farmers with seeds, pesticides, and other agricultural inputs, often at subsidized rates or free of charge. Additionally, the company offers hard cash incentives and high-level training through programs like the Integrated Pest Management (IPM) Club. According to industry stakeholders, these incentives are designed to make tobacco cultivation financially appealing, even though it often leads to long-term dependency on the company’s support. One farmer remarked, “BATB’s offers are hard to resist because they ensure immediate cash flow and cover the cost of inputs, making tobacco seem like the most lucrative option available.”

Another article “Tobacco Farmers Protest BATB’s Unfair Practices” reports that Bangladeshi tobacco farmers are protesting against the British American Tobacco Bangladesh (BATB) company. They accuse BATB of unfair practices, including not purchasing tobacco at the promised rates and not paying them on time. The farmers are demanding that BATB address their grievances.

Price Control Mechanisms: BATB’s control over the supply chain extends to price fixing, particularly through its influence within the Agriculture Pricing Advisory Committee under the Ministry of Agriculture. As a member of this committee, BATB plays a significant role in determining the price of tobacco leaves each year, ensuring that the prices are favorable to the company’s interests. This price control mechanism enables BATB to maintain profitability while exerting pressure on farmers to continue tobacco cultivation. Market analysis indicates that by controlling the supply chain from seed distribution to final pricing, BATB can effectively suppress the bargaining power of farmers, locking them into a cycle of dependency. Retail sellers also report that the prices set by BATB at the farm level often dictate the retail prices, leaving little room for price variation in the market. This manipulation of the supply chain not only reinforces BATB’s dominance in the tobacco industry but also undermines efforts to diversify agricultural production in Bangladesh.

Unauthorized Energy Drinks of BATB: While British American Tobacco Bangladesh is not directly involved in the production or sale of these energy drinks, it is possible that the company may have indirectly benefited from the illegal sale of these drinks.The government has taken action against the companies selling these drinks. The drinks are being sold without the necessary approvals and may be harmful to consume. Some of these energy drinks contain harmful substances, including caffeine and taurine.[1]

Tobacco companies like BAT are evading taxes by selling old cigarettes at new prices. This practice deprives governments of revenue. Despite government awareness, there is little enforcement. Tobacco companies also provide inaccurate information in their reports. Stronger regulations are needed to combat this issue.[2]

Discussion

Interpretation of Findings:

The influence of the tobacco industry in Bangladesh, particularly by British American Tobacco Bangladesh (BATB), presents a significant challenge to public health and tobacco control efforts. The findings reveal that BATB has employed a multifaceted strategy to maintain its market dominance, including financial manipulation, strategic use of Corporate Social Responsibility (CSR) activities, and direct influence over government policies. These practices not only enable the company to maximize its profits but also undermine the effectiveness of tobacco control measures intended to reduce tobacco consumption and protect public health.

One of the most concerning aspects of BATB’s influence is its manipulation of the tax structure. By lobbying for a complex, multi-tiered tax system, BATB has effectively ensured that price increases on cigarettes do not translate into a significant reduction in consumption. The ability to shift consumers between different price tiers allows the company to maintain sales volumes while limiting the impact of tax hikes. Additionally, the strategic use of CSR activities, often timed to coincide with proposed regulatory changes, serves to build goodwill and obscure the harmful effects of the company’s products. This not only misleads the public but also positions BATB favorably with policymakers, further complicating efforts to implement stringent tobacco control measures.

The involvement of high-ranking government officials on BATB’s board of directors exacerbates the problem. This conflict of interest undermines the integrity of tobacco control policies and suggests that public health priorities may be compromised in favor of corporate interests. The government’s direct financial stake in BATB further complicates the situation, as it creates an inherent tension between the need for revenue and the goal of reducing tobacco consumption.

Comparison with Other Studies

The findings from Bangladesh are consistent with global patterns of tobacco industry interference, as documented in other studies. For example, the World Health Organization (WHO) Framework Convention on Tobacco Control (FCTC) highlights the pervasive influence of the tobacco industry in policy-making across various countries. Similar tactics have been observed in countries like the Philippines and Indonesia, where tobacco companies have successfully lobbied against tax increases and regulations aimed at curbing tobacco use. In these contexts, the use of CSR as a tool for influence, the strategic manipulation of tax structures, and the involvement of government officials in tobacco company operations are common strategies employed by the industry to protect its interests.

In comparison to other studies, the situation in Bangladesh is particularly troubling due to the level of government involvement in BATB. The fact that several senior government officials sit on BATB’s board is an anomaly that is not commonly observed in other countries. This unique situation creates a more direct pathway for the tobacco industry to influence policy and regulatory decisions, making it more challenging to implement effective tobacco control measures.

Policy Recommendations

To mitigate the influence of the tobacco industry and strengthen public health efforts in Bangladesh, several policy recommendations emerge from the findings:

Strengthen Financial Transparency and Accountability: The government should enforce stricter financial reporting standards for multinational companies like BATB. All financial transactions, particularly those involving overseas transfers for royalties, technical fees, and equipment purchases, should be thoroughly audited to prevent profit shifting and tax evasion. Any discrepancies in financial reports should be transparently explained and publicly disclosed.

Regulate and Monitor CSR Activities: CSR initiatives by tobacco companies should be regulated to prevent them from being used as tools for policy influence. The government should establish clear guidelines for CSR reporting and ensure that these activities are genuinely beneficial to public health rather than serving as a smokescreen for corporate interests.

Address Conflicts of Interest: The government should reconsider the involvement of its officials on the boards of tobacco companies. To avoid conflicts of interest, public officials should be prohibited from holding positions within tobacco companies. Additionally, the government should divest its financial stake in BATB to align its actions with its public health objectives.

Enhance Policy-making Independence: To safeguard the integrity of tobacco control policies, the government should implement strict measures to prevent tobacco industry interference in policy-making. This includes adhering to Article 5.3 of the WHO FCTC, which calls for transparency in interactions between government officials and the tobacco industry, and limiting such interactions to those strictly necessary for regulation.

Promote Public Awareness and Advocacy: Public health campaigns should be intensified to raise awareness about the detrimental effects of tobacco use and the tactics employed by the tobacco industry to undermine public health. Strengthening civil society advocacy can also play a crucial role in holding both the government and the industry accountable.

The findings underscore the profound impact of tobacco industry interference on public health in Bangladesh. Through financial manipulation, strategic influence over policy-making, and the exploitation of CSR activities, BATB has managed to maintain its dominance in the market while undermining efforts to reduce tobacco consumption. Addressing these challenges requires a coordinated effort by policymakers, civil society, and international organizations to implement robust tobacco control measures, enhance transparency, and protect public health from the detrimental influence of the tobacco industry. By adopting these policy recommendations, Bangladesh can take significant steps toward reducing tobacco use, improving public health outcomes, and achieving its goal of becoming a tobacco-free nation by 2040.

Conclusion

The comprehensive analysis of tobacco industry interference in Bangladesh reveals a troubling pattern of corporate influence that undermines public health and weakens tobacco control efforts. Key findings from the study indicate that British American Tobacco Bangladesh (BATB) has employed a range of strategies, including financial manipulation, strategic use of Corporate Social Responsibility (CSR) activities, and direct involvement in policy-making, to maintain its market dominance. The company’s manipulation of the multi-tiered tax structure, coupled with the involvement of government officials on its board, highlights significant conflicts of interest that compromise the effectiveness of tobacco control measures. Furthermore, BATB’s influence extends to shaping public perceptions through CSR, which is often timed to coincide with regulatory changes, thereby obscuring the harmful effects of tobacco consumption.

The implications of these findings for public health in Bangladesh are profound. The pervasive influence of the tobacco industry poses a significant barrier to reducing tobacco use, which is a major contributor to non-communicable diseases and preventable deaths in the country. By manipulating tax policies and leveraging CSR, BATB not only increases its profits but also undermines public health initiatives designed to protect the population from the harms of tobacco. This interference weakens the government’s ability to implement effective tobacco control measures, ultimately hindering progress towards a tobacco-free Bangladesh.

Given the critical nature of these findings, future research should focus on several key areas. First, there is a need for more in-depth studies on the financial practices of tobacco companies in Bangladesh, particularly regarding profit shifting and tax evasion. Additionally, research should explore the long-term effects of CSR activities on public perceptions and policy-making, with a view to developing strategies that counteract industry influence. Finally, further investigation into the role of government officials in the tobacco industry and the impact of their involvement on public health policies is essential to ensure transparency and accountability in policy-making. By addressing these areas, future research can provide valuable insights that contribute to more effective tobacco control measures and improved public health outcomes in Bangladesh.

Author: Md. Masum Billah, Joint Editor, Daily Share Biz Kortcha. Email-masumbillah22ag@gmail.com

STOP

Md. Masum Billah