The Value Added Tax and Supplementary Duty Act, 2012

[Act No. 47 of 2012]

WHEREAS it is expedient and necessary to expand the areas of imposing value added tax, supplementary duty and turnover tax; and to consolidate and simplify the provisions relating to collection procedures thereof; and to make other provisions ancillary thereto;

CHAPTER THREE

IMPOSITION OF VAT

15. Imposition of VAT.—(3) Unless otherwise provided in this Act, the rate of VAT, in relation to taxable import or taxable supply‚ shall be 15 (fifteen) percent.

CHAPTER SEVEN

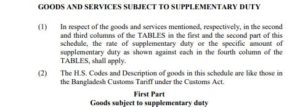

IMPOSITION AND COLLECTION OF SUPPLEMENTARY DUTY

58. Special schemes for tobacco and alcoholic goods.—(1) For the purposes of imposition and realisation of supplementary duty on the following goods manufactured in Bangladesh and subject to supplementary duty, the Board may, subject to the provisions of this Act or the rules made thereunder, make a special scheme to be complied with by the manufacturers of such goods, namely-

(a) tobacco products or any other similar product, including products blended with tobacco;

(b) alcoholic drinks, ingredients of alcoholic drinks or any other similar product.

(2) The Board may, by means of such special scheme, set a maximum retail price for the goods, which shall be treated as the value for imposition of VAT and supplementary duty.

(3) Such special scheme shall include the following matters, namely:—

(a) matters in relation to the stamps, banderols or special signs or marks of any particular size or design containing security features on the packages, bottles, pots or containers of such goods, or on the bodies

thereof, or any other similar matter; and

(b) matters in relation to the manufacture, acquisition, distribution, preservation, use supervision, observation, accounting, disposal, etc. of such stamps, banderols, or of the special signs or marks.

This is the documents of The Value Added Tax and Supplementary Duty Act, 2012. To read the full document in English please click the download button.