Sushanta Kumar Singha[1]

Executive Summary

In Bangladesh, cigarette taxes were first imposed in 1992-93, and while the tax structure has fluctuated over time, a four-tier system has been in place since 2004-05. However, there are no clear guidelines for determining cigarette prices, which are set annually in the national budget, often influenced by cigarette companies. Tobacco control activists claim the National Board of Revenue (NBR) caters to the preferences of these companies, leading to issues like tax evasion and ineffective enforcement of retail prices.

Despite steps by the NBR, such as monitoring cigarette factories, the lack of transparency in tax policies and pricing methods complicates tobacco control and revenue collection. The absence of digital tax reforms and unclear guidelines has allowed tobacco companies to grow profits as consumer numbers rise. Addressing these concerns could improve both tobacco control efforts and revenue generation in Bangladesh.

Research Objectives

This study aims to investigate how cigarette companies in Bangladesh acquire stamps and bandroles, and the associated revenue collection, with a focus on disparities between cigarette and bidi tax systems. It will also explore how tobacco companies evade taxes and influence government policies, while examining the dominance of multinational companies in the market.

Specific Objectives

- Identify policies and disparities in the NBR’s cigarette stamp and bandrole system, and the challenges of manual verification at factories. Also, explore how the term `furthermore’ in budget proposals benefits cigarette companies.

- Analyze news reports on cigarette smuggling to detect tobacco company involvement.

- Investigate how BAT and JTI have monopolized the low-tier cigarette market, sidelining local companies.

Research Methodology

This research employed content analysis of publicly available documents, including Statutory Regulatory Orders (SROs), directives, and policies from the NBR regarding banderoles. Secondary data on revenue collection and production was gathered from NBR sources. To investigate myths propagated by tobacco companies, news articles related to tobacco tax, smuggling, and corporate interference from 20 national daily newspapers were analysed, covering the period from April 1 to May 31 across 2022, 2023, and 2024. Additionally, key informant interviews (KIIs) were conducted with 10 individuals, including current and former NBR officials, public health and tobacco control experts, and economists for deeper insights.

Research Findings

The National Board of Revenue (NBR) in Bangladesh oversees revenue collection from the cigarette and bidi industries through stamps and band rolls, but current methods for verifying authenticity are outdated and ineffective against counterfeits. Experts recommend adopting digital solutions like QR codes to modernize this process, enhance accountability, and reduce revenue losses.

Tobacco companies, particularly British American Tobacco Bangladesh (BATB), manipulate pricing and propagate myths linking tax increases to smuggling, resulting in significant government revenue losses. Despite a recent policy shift towards more structured pricing, where cigarette packs are now required to display maximum retail prices (MRP), about 94% of sales occur in single sticks that often violate these regulations.

The complex tax structure has disproportionately benefited BATB, whose profits have surged nearly nine-fold in 15 years, outpacing tax contributions. The introduction of the “Furthermore” clause in pricing regulations has allowed companies to manipulate prices, complicating compliance and facilitating tax evasion.

Media narratives often favor tobacco companies, undermining tobacco control efforts, while production has risen significantly, contrary to claims that higher taxes would hurt output. BATB has aggressively expanded its share in the low-tier market, threatening local manufacturers and raising concerns about fair competition.

Overall, there is a pressing need for comprehensive reforms in tax structure, regulatory practices, and enhanced enforcement to curb manipulation, protect local producers, and promote public health initiatives aimed at reducing tobacco consumption.

Conclusion

The analysis of the tobacco industry in Bangladesh reveals significant challenges in revenue collection and regulatory enforcement, primarily due to outdated identification methods for stamps and bandroles. Despite recent efforts by the NBR to implement a structured pricing system, the pervasive influence of tobacco companies, particularly BATB, continues to undermine these initiatives. The manipulation of pricing, facilitated by ambiguous terms such as “Furthermore,” has allowed companies to evade taxes and maintain excessive profit margins while promoting a narrative linking tax increases to smuggling.

The findings underscore the urgent need for comprehensive reforms in the tobacco tax structure and regulatory framework. Embracing digital identification solutions and removing loopholes that enable price manipulation are crucial steps toward enhancing revenue collection, protecting local manufacturers, and promoting public health objectives. Overall, a concerted effort involving collaboration among key ministries, clear policy directives, and improved enforcement mechanisms is essential for addressing the complexities of Bangladesh’s tobacco market.

[1] Sushanta Kumar Singha, Special Correspondent, Ekattor Television and Member, Bangladesh Network for Tobacco Tax Policy. Email- sinhasmp@yahoo.com

An Investigation of Bangladesh’s Industry-Friendly Cigarette Pricing and Way Forward

Sushanta Kumar Singha

Introduction

In Bangladesh, taxes on cigarettes were first imposed in 1992-93. Initially, there were four tax tiers, but over time; the structure fluctuated between five, six, and even three tiers. However, since the 2004-05 fiscal years, a four-tier tax structure has been imposed. Although the price of cigarettes is set annually in the national budget, but nobody knows on what basis the criteria is placed. In fact, there are no clear guidelines for determining cigarette prices in Bangladesh. The government increases the price each year by their internal choice. However, tobacco control activists in Bangladesh have long claimed that the National Board of Revenue (NBR) sets prices according to the preferences of cigarette companies. Various studies on cigarette pricing and tax evasion have already revealed this information.

This is due to the interference of tobacco companies in the process of verifying cigarette stamps and bandroles, 24-hour presence of government officials at cigarette factories, tax evasion, tax policy, and amendments to tobacco control laws. Despite various steps taken by the NBR, such as ensuring that cigarettes are sold at maximum retail prices, these measures are not effectively implemented for some unknown reason.

There is enough reason to question Bangladesh’s tobacco tax policy, cigarette market structure, tax collection, and pricing methods for tobacco products. These processes are neither conducive to tobacco control nor to increase revenue. It also appears to be no visible t initiative from government to introduce digital tax management or reform the tax proposal system. As a result, tobacco control in Bangladesh is becoming more complicated. At the same time, tobacco companies’ profit has multiplied significantly due to the increase in tobacco product consumers. Recognising these issues could positively impact both revenue growth and tobacco control.

Research Objectives

There is no clear perception about how cigarette companies in Bangladesh acquire stamps and bandroles and revenue is collected in return. There is a disparity between the stamps and bandroles used for cigarettes and bidis, with no progress in modernizing the tax system. Moreover, it is essential to highlight the strategy tobacco companies use to evade taxes and influence government policies. In addition to present information on how multinational companies dominate the cigarette market by sidelining the local companies and spreading misinformation through the media.

Specific Objectives

- Identify the policies and disparities in the National Board of Revenue’s (NBR) cigarette stamp and bandrole system. Highlight the challenges of manually verifying bandroles at cigarette factories 24 hours a day by NBR officials and the potential for revenue evasion. Also, explore how the term `furthermore’ in budget proposals benefits cigarette companies.

- Analyse news reports on cigarette smuggling before the national budget to identify tobacco companies’ involvement.

- Investigate how BAT (British American Tobacco) and JTI (Japan Tobacco International) have monopolized the market by sidelining local cigarette companies in lower-tier cigarette markets.

Research Methodology

This research was conducted using content analysis of publicly available documents. Various Statutory Regulatory Orders (SRO), directives, and policies of the NBR related to banderoles were reviewed. NBR data was collected as secondary data to analyse revenue collection and production information. To examine the myths created by tobacco companies, news articles on tobacco tax, smuggling, and tobacco company interference published in 20 national daily newspapers during 1st April to 31 May of 2022, 2023, and 2024 (a span of 6 months) were collected and analysed. Furthermore, for deeper insights, key informant interviews (KIIs) were conducted with 10 individuals, including current and former NBR officials, public health and tobacco control experts, and economists.

Research Findings

1.1 Issuing Stamp and bandrole

1.1.1 Bandrole Functions, Policies and Monitoring

National Board of Revenue (NBR) provides stamps and band rolls to collect revenue from cigarette and bidi industry in Bangladesh. There are different procedures for collecting stamps and band rolls for this. Band rolls are generally collected in two ways in the case of cigarettes. One is through the Large Taxpayer Unit (LTU) of the National Board of Revenue and the other through the local Customs, Excise and VAT Department. Under the Value Added Tax and Supplementary Duties Act, 2012, LTU collects tax from a total of 110 large taxpayers in various sectors as per sub-paragraph (3) of paragraph 4 of National Board of Revenue General Order No. 04/MUSC/2019. Among these 110 companies1, there are two tobacco companies. One is British American Tobacco Bangladesh (BATB) and the other is United Dhaka Tobacco Co. Ltd. (Japan Tobacco).

In order to collect band rolls, the first BATB and JTI apply to the Revenue Officer of the Large Taxpayer Unit of the National Board of Revenue stating their demand for band rolls. After that LTU sends a demand order letter to the General Manager of local purchase and sale branch of The Security Printing Corporation (Bangladesh) Ltd (SPCBL). SPCBL print and supply the band roll as per the demand mentioned in the application form of the company (this application form has the signature of both the LTU official and the company representative). Taking the DO into an account, the SPCB then prints band rolls within a specified period.

Figure 1: Illustration of procedure for collection of bandroles from LTU

Once the band roll gets printed, the application for getting the band roll is sent from LTU to the manager of SPCBL. Then SPCBL hand over the printed band roll to a designated representative of the company. It is to be noted that identity cards of the designated company representatives and all the applications for collecting bandroles must be signed by the concerned officer of LTU. Band roll will be provided (free of cost) by SPCBL only if the company representative provides the authorized application and LTU application form. When the band roll gets collected by the company representative the SPCBL informs the LTU. The LTU then collects revenue from that company considering the number of band rolls and cigarette production.

On the other hand, all tobacco companies who are not listed in LTU (from Dhaka and outside of Dhaka) apply to their local Revenue Officers/Divisional Officers of Customs, Excise and VAT Department for band rolls and stamps. The Revenue Officer/Divisional Officer of the local VAT Department then, issues a demand order letter to the General Manager/Deputy General Manager of the Local Purchase and Sales Branch of SPCB (Gazipur) to print and supply the band rolls as per the demand mentioned in the application of the company (the demand order contains the signatures with seals of the officer and the designated representative of the company). In view of that application SPCB prints the band roll within a specific time.

Once the band rolls are printed, an application is sent by the Revenue Officer/Divisional Officer of the local Customs, Excise and VAT Department to the Manager of SPCB in order to collect the band rolls. The application form should be accompanied by three sample signatures (if applicable) of the officer. At the same time, three sample signatures of the company’s designated representative (if applicable), identity card, passport size photo (sometimes environmental clearance copy is also required) and application form attached with the signature and seal of the concerned officer is needed for collecting the band rolls. After providing the documents with the application form, SPCB supplies the printed band roll without any cost to the designated representative of the company.

When the representative of the company collects the band roll, the SPCB informs the local customs, excise and VAT department about the delivery of the bandrole. Then the local Customs, Excise and VAT Department informed the NBR about supplying the company with the number of band rolls. NBR collects revenue from that company accordingly.

It is to be noted that at least one government official must present in cigarette manufacturing factories per roster for 24 hours to monitor and ensure the process of attaching stamps or band rolls on cigarette packets as per the provisions of rule2. At the same time the NBR assess the amount of customs duty tax on the basis of the nature of each band of cigarette pack, number of cigarettes, retail price, supplementary duty and rate of value added tax; plus the government official supervise the implementation of revenue collection activities and payment activities. Moreover, the officials observe all activities related to stamps/band rolls in the factory and submit the report with comments in the form provided by NBR.

However, the 24-hour monitoring provision is documented for BATB3 and JTI4 only, but there is not enough information on whether it is abided by other tobacco companies as well or not. In Key Informant Interviews (KII), current NBR officers said that “those officers assigned to tobacco company factories are there for special purposes. High-ranking NBR officials must be bribed to get the duty there. No one is appointed there except the selected officers. As a result, it is easy to understand from this process that it is profitable to perform duties in tobacco company factories. Because companies benefit them financially and take advantage accordingly”.

On the other hand, in case of bidi (traditional hand-rolled cigarettes), the company must first submit an application to the local Customs, Excise, and VAT department’s revenue officer/divisional officer, indicating the requirement for stamps. Considering the application the revenue officer/divisional officer issues a demand order letter to the General Manager/Deputy General Manager of the local purchase and sales branch of SPCBL (Security Printing Corporation (Bangladesh) Ltd. requesting the specific number of stamps. The demand order letter includes seals and signatures from both the official and the company representative. Upon receiving the letter, SPCBL prints the requested stamps and supplies them to the postal department. The tobacco company then collects the stamps from the postal department, after depositing the government determined VAT and supplementary duties into the government treasury.

Tobacco control and public health experts told KII, “Taxation is digital worldwide. But in Bangladesh it is an exception. Why should government officials stay in the factory for 24 hours to watch the machines produce thousands of cigarettes per second? NBR needs digitization of the tax system. Then NBR officials felt no need to stay in the tobacco factory. So, the government should digitize tax management quickly.”

Though, the cigarette companies can collect stamps and band rolls without paying for them upfront. The NBR (National Board of Revenue) only receives the revenue for stamps and band rolls after the cigarettes are distributed from factory for marketing purposes.

1.1.2 Stamp and Bandrole Identification Process in Bangladesh

There is no digital method available to distinguish between genuine and counterfeit stamps and banderoles for cigarettes or bidis. In the past, a traditional method was used, where a stamp or band roll was tested with water. When the water was lightly rubbed on the part of the stamp or band roll marked with the water lily symbol, the blue colour of the water lily would come off if it was genuine.5 In contrast the blue colour of the water lily on a counterfeit stamp or band roll would not come off when in contact with water. But the NBR has recently introduced a different method to identify fake band rolls, though it is also not digital. Currently, the NBR provides a special type of laser light at the field level. When this light is shone on the band roll, a special hidden mark would appear on the band roll.

In case of identifying used band rolls or stamps, the guidelines state that, when a band roll or stamp is removed from a packet, the blue colour of the water lily symbol spreads, making the symbol unrecognizable. Moreover, sometimes the band roll tears apart when being removed from a packet, and some people try to reattach it, which can be detected upon close inspection. Due to multiple uses, the band roll or stamp needs to be glued a second time, which increases its thickness and makes it feel stiffer.6

Recently, various media reports have revealed that the law enforcement agencies and NBR (National Board of Revenue) have seized some fake band roll consignments that look exactly like the genuine ones.7 These were illegally imported from China and that highlights the ineffectiveness of NBR’s existing stamp and band roll identification methods.

Through Key Informant Interviews (KII), efforts have been made to understand this issue in more detail. Tobacco control experts have stated that “NBR’s method does not align with the government’s proclaimed vision of a Digital Bangladesh. Currently, most activities in the country are conducted online. Globally, the methods for identifying genuine stamps and band rolls are much more advanced. The lack of an effective system in Bangladesh raises various questions. Despite longstanding demands for the modernization of stamps and band rolls, the lack of progress in this area benefits the tobacco companies”, said experts. They believe that a certain level of haziness has been maintained around the issue. The identification method for stamps and band rolls needs to be such that any consumer can easily verify their authenticity.

NBR officials believe that “although the method for identifying stamps and band rolls is traditional, it doesn’t cause any significant challenge for the verification process. They don’t see any reason for concern regarding revenue evasion”. Although one NBR official mentioned that “it is essential to modernize the identification process for stamps and band rolls. While it is possible to identify bandroles using traditional methods, the process is time-consuming and complicated, considering verifying all stamps and band rolls. As a result, in most cases, verification is not conducted unless there is a specific complaint or a suspicion from an official. Therefore, the identification process for stamps and band rolls needs to be digitized so that consumers can also verify them and report any counterfeit stamps or band rolls.”

1.1.3 Misuse of Stamps and Bandroles

The Cigarettes Containing Imported or Produced Tobacco (Stamp or Band roll Usage Procedure) Order, 2001 outlines the misuse of band rolls in detail under section 4, article 3. It states that “the number of damaged stamps or band rolls must not exceed 1% of the total number of used stamps or band rolls.” That means that in both the bidi and cigarette industries, a 1% band roll misuse is allowed. If stamps or band rolls are damaged due to reasons other than technical faults, the commissioner will investigate, and if necessary, send a report to the NBR (National Board of Revenue) indicating up to 2% damage. If the board approves, the company may receive a band roll misuse allowance of up to 2%.

NBR officials clarified the issue of stamp and band roll misuse issues. They explained that typically, when stamps and band rolls are damaged, cigarette companies gather a significant number of these damaged items over a few months and then notify the NBR. “After receiving information about damage to a significant number of banderoles or stamps from the cigarette company, representatives of the NBR and the Security Printing Corporation (Bangladesh) Limited (SPCBL) inspect and verify the damaged stamps The returned stamps and band rolls are incinerated, and SPCBL reprints new ones as replacements.,” NBR officials at KII stated in an interview. Band rolls are then given back.

1.1.4 Evasion of revenue by selling old-priced cigarettes at new price

Months after the budget announcement in Bangladesh, cigarette companies like BATB and JTI are still selling old-priced cigarette packs at new prices.8 This practice has allowed them to take billions of extra taka from consumers over the years, violating the law.

On July 14, 2022, Ekattor Television broadcast a special report titled, “Old-priced cigarettes sold at new prices: Revenue evasion of BDT 100 crore per month by BATB after announcement of the national budget.”9 The report highlighted how cigarette packs with old prices were being sold at the new, higher prices announced in the budget. Despite these price hikes, the government does not receive any additional revenue from the increased price.

According to regulations, cigarette packs produced before the budget hike should be sold with a new price sticker or seal. However, cigarette companies have repeatedly failed to comply. Following my report, recently the NBR investigated and confirmed these findings.10

The NBR report reveals that this year, BAT stocks cigarettes in 14 of its own warehouses before the budget announcement. After the budget, these pre-budget cigarettes are sold at the new price but old packet. BAT and JTI are taking the extra profit but the government loses significant revenue. This time, the Large Taxpayer Unit (LTU) of NBR has issued notices demanding BATB pay BDT 210 crore and JTI BDT 13 crore for cigarettes stockpiled before the budget increase.11

1.1.5 Why Modernizing Band rolls is Necessary

The band rolls used on cigarettes and bidis has not undergone any modernization. These band rolls do not include QR codes, production dates, or information about the ingredients used in production. Modernizing band rolls would make the collection of revenue simpler and make it easier to hold companies accountable for any irregularities. Below are some key reasons why modernization is essential:

- In Bangladesh, after the announcement of the new fiscal year’s budget, tobacco companies often sell cigarettes at old prices for several months, resulting in substantial revenue loss for the government. Although regulations require that new price stamps be applied to old packets, tobacco companies frequently ignore this rule. If band rolls and stamps include QR codes, production dates, and ingredient information then relevant government agencies could take proper action during market inspections to address such issues.

- Manually identifying fake band rolls or stamps based on existing colour codes is extremely difficult. Band rolls with QR codes would make it easier to detect counterfeit items. This would also simplify revenue collection and enhance efficiency for NBR officials by relying on technology for verification.

- Currently, at cigarette factories, three NBR officials are assigned 24/7 to ensure cigarette production and the use of band rolls/stamps. Given that more than 1,000 packets are produced every minute, this process is extremely complex and outdated. Although the cigarette production process itself is modernized, but the marketing and distribution system is kept back outdated intentionally. Modernizing both the packaging and distribution methods from the factory to the market could significantly reduce revenue evasion.

2.1 Procedure to increase price through Budget

Tobacco companies spread the myth throughout the year that “raising taxes will increase cigarette smuggling, causing the government to lose revenue.” By using this myth, cigarette companies manage to secure various policy advantages from the government. An analysis of the revenue collected and the profits of tobacco companies over the past 10 years make this even clearer.12

Although the process of increasing cigarette prices is supposed to be under government control, but the profits of tobacco companies and the prevailing market prices tell a different story. This evidence show that the process of raising prices has been designed to favors tobacco companies.13 In other words, the entire system of market regulation and price increases for cigarettes is controlled by the tobacco companies.

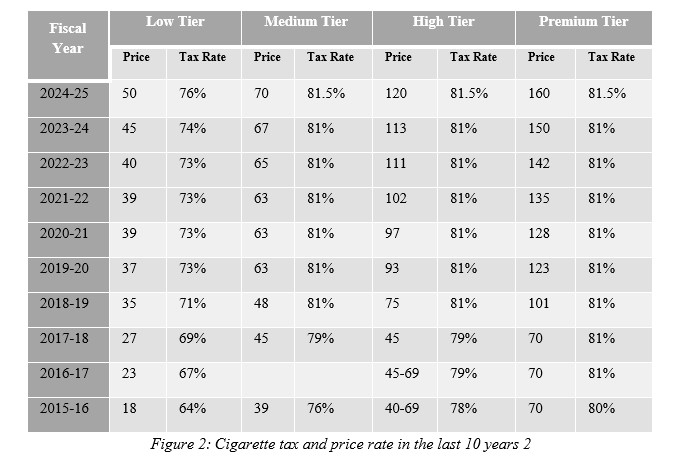

In Bangladesh, the price of a 10-stick pack of cigarettes was historically set at odd numbers. For example, in the 2020-21 fiscal years, the price for a 10-stick pack of low-tier cigarettes was set at 39 BDT, meaning each stick cost 3.90 BDT. Similarly, the price for a 10-stick pack in the mid-tier was set at 63 BDT, making each stick cost 6.30 BDT. For the high-tier, the price was set at 97 BDT, resulting in a cost of 9.70 BDT per stick. Since coins are no longer in circulation in Bangladesh, cigarettes priced at 3.90 BDT per stick are legally sold for 4 BDT, and those priced at 6.30 BDT are sold for 7 BDT. On average, 200 million cigarette sticks are sold daily in Bangladesh. As a result, if cigarette companies such as BATB and JTI collect an additional 0.50 BDT per stick, they could gather an extra 100 million BDT from the public each day.

For years, the National Board of Revenue (NBR) has maintained a price increase structure for cigarettes that aligns with the preferences of tobacco companies. In most fiscal years, prices for three out of four tires were set at odd numbers. Study findings14 and media reports15 highlighted this manipulation of retail prices by tobacco companies. Taking this into account, the Large Taxpayer Unit of NBR conducted an investigation16 and confirmed the truth behind the tax evasion scheme. As a result, to stop cigarette companies from collecting extra money from consumers under the guise of fractional prices, NBR has, for the first time in the 2024-25 fiscal year budgets, set the maximum retail prices in all four tiers as even numbers. Additionally, the tax rates for all four tiers have been raised, which is a first-time move.

In KII, a tobacco control activist and policy analyst told, “Year after year, tobacco companies have been defrauding the law and evading taxes to the tune of BDT. 5,000 crore annually. NBR has taken cognizance of the matter as it has come up in research and media, though of late.”

In the current fiscal year, the prices for a 10-stick pack of cigarettes have been set as follows: 50 BDT for the low tier (5 BDT per stick), 70 BDT for the medium tier (7 BDT per stick), 120 BDT for the high tier (12 BDT per stick), and 160 BDT for the premium tier (16 BDT per stick). In a Key Informant Interview (KII), an official from the National Board of Revenue (NBR) stated that “the shift from odd to even numbers in cigarette pricing represents a significant structural and qualitative change in the price-setting process for cigarettes in Bangladesh over the past 10 years. This decision was made as part of the government’s effort to increase revenue.”

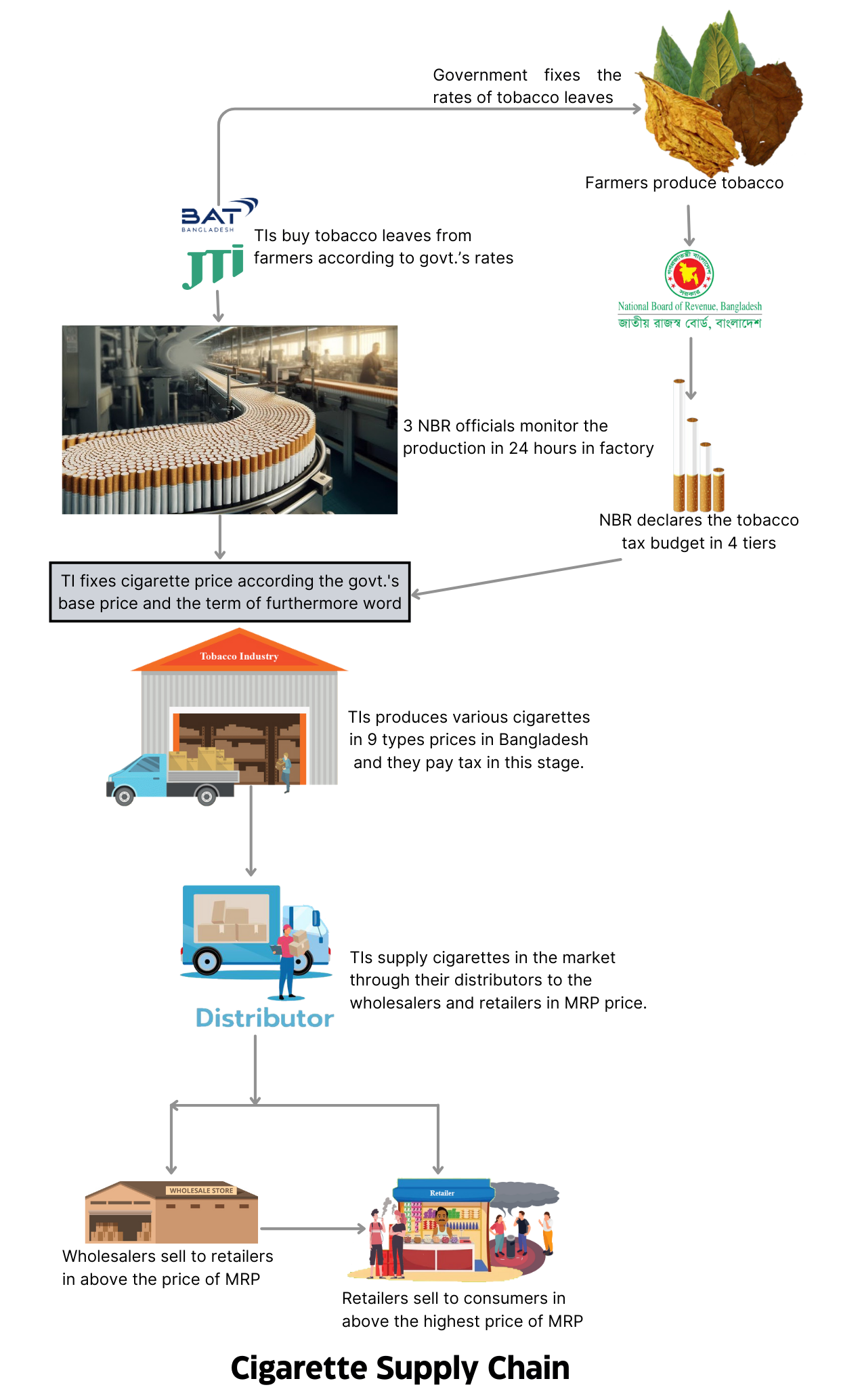

In the cigarette supply chain, the government first sets the price of tobacco leaves. Tobacco companies buy tobacco leaves from farmers at government-fixed prices. Then the cigarette companies take an advance band roles from the government and pay the revenue to the government when they market the cigarettes. Meanwhile, 3 officers of NBR monitor the cigarette factory for 24 hours. While the government had announced the price of cigarettes at 4 types during the budget announcement, cigarette companies are currently marketing cigarettes at 9 types, using the additional term used in the budget proposal. Although each product in Bangladesh is sold at the maximum retail price (MRP), cigarette companies sell to wholesalers and retailers at MRP through their distributors. As a result, consumers are forced to buy cigarettes at much higher prices than the MRP.

However, tobacco control experts have stated, “The decision to increase cigarette prices will have impact over consumers by making cigarettes more expensive, leading to a reduced number of smokers. Additionally, this will reduce the opportunities for tobacco companies to collect extra money from consumers and will increase the government’s revenue. We hope that the NBR will continue this timely measure of stopping the manipulation of fractional prices in the coming years, as it is crucial for protecting public health.”

In Bangladesh, one of the major obstacles to control tobacco consume, apart from the manipulation of fractional prices, is the widespread retail sale of single cigarette sticks. About 94% of cigarettes are sold as individual sticks in the country rather than full packs.17 Consumers often choose to buy single sticks instead of a whole pack. The more single sticks are sold, the greater the profit opportunity for cigarette companies, as these sticks are often sold at prices 1 to 3 BDT higher than the Maximum Retail Price (MRP) printed on the pack.18 Despite this higher price, the National Board of Revenue (NBR) does not receive any additional revenue from these over-the-counter sales above the MRP.

As a result, in addition to the decision to eliminate fractional pricing, the National Board of Revenue (NBR) introduced another significant structural change in the last fiscal year. For a long time, tobacco companies in Bangladesh had been misinterpreting the policy, labelling cigarette packs with just the “retail price” instead of the “Maximum Retail Price (MRP).” This method allowed tobacco companies to sell cigarettes at prices higher than the MRP. Consequently, they were able to extract an additional 7,000 crore BDT annually from consumers, leading to a revenue loss of approximately 5,000 crore BDT for the government. Besides, NBR’s investigation revealed that BAT and JTI evaded revenue of BDT 210 crore and BDT 13 crore by selling old cigarettes at new prices.19

This issue was brought to the attention of NBR policymakers through series of reports by Sushanta Sinha, a special correspondent at Ekattor Television and a tobacco control researcher, along with Rahmat Rahman, a senior reporter at the daily Share Biz newspaper, and research from the Bureau of Economic Research at the University of Dhaka.20 As a result, NBR made it mandatory for cigarette packs to display the Maximum Retail Price (MRP). Additionally, NBR issued a directive stating that cigarettes cannot be sold above the MRP at any level. This led to the implementation of the requirement to display MRP on every pack. Despite this regulation, tobacco companies continue to find ways to get round the law, selling cigarettes to consumers at prices higher than the stated MRP.

Tobacco control and public health experts believe that “to prevent tax evasion and ensure cigarettes are sold to consumers at the MRP, it is essential for NBR and the National Consumer Rights Protection Directorate, along with other relevant government agencies, to take proactive measures”. According to a tobacco control expert, “tobacco companies are evading thousands of crores of BDT of revenue every year by selling cigarettes at higher prices than the MRP. NBR officials also know this. But due to special reasons, NBR is not confirming the sale of cigarettes at MRP. They should act in the interest of the country and stop selling cigarettes at prices higher than MRP”.

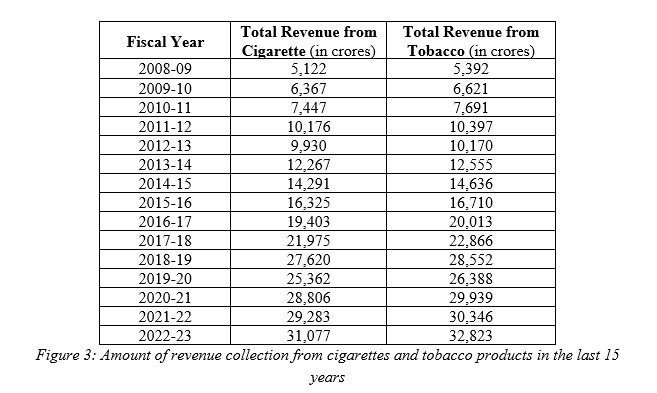

3.1 Despite a Weak Tobacco Tax System, Revenues Are Increasing

The complicated and weak tobacco tax system in Bangladesh benefits the tobacco industry. Because there is no policy on taxes and price hikes, the NBR generally fixes cigarette pricing and taxes on a ad hoc basis. Still, there has been a little increase in tax rates in recent years. It raised revenue as well. Cigarette companies have frequently claimed that raising taxes on cigarettes will result to a jump in smuggling and a decrease in revenue. This propaganda of the company is completely baseless. In KII, a former NBR high official said that “The tobacco firms not only lobbied in the media, but also via their numerous front groups, claiming that higher taxes would lead to an increase in the smuggling of cigarettes. Every year, particularly around April and May, they disseminate such confusion on a number of occasions. Their goal is for giving indirect pressure on the NBR.”

Since 2009, Bangladesh has been governed by the same political party, which made it easier to implement and simplify policy changes in tobacco control and public health. Despite the Prime Minister’s 2016 declaration of smoke-free Bangladesh, there were no institutional steps taken towards this goal. There were no joint initiatives from key ministries, including Health, Trade, Finance, Industry, and Agriculture. Additionally, no single ministry was given the exclusive responsibility to lead the efforts towards a smoke-free Bangladesh. Instead, the National Board of Revenue (NBR) focused on increasing revenue from the tobacco sector, which resulted in a substantial rise in revenue.

Here’s a summary of the revenue collected from cigarettes and tobacco products over the past 15 years, based on information from NBR:

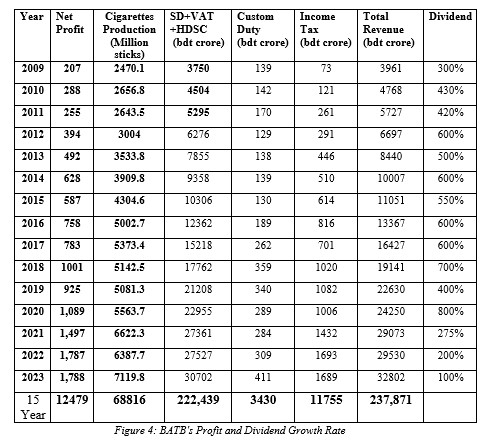

4.1 Evaluation of BATB’s Profit and Dividend Expansion

In 2009, the net profit of the multinational cigarette company British American Tobacco Bangladesh (BATB), after covering all expenses and taxes, was BDT 2.07 billion.21 Fifteen years later, in 2023, this net profit grew nearly nine-fold (8.63 times) to BDT 17.88 billion.22 Although the cigarette production in this period increased by nearly three times (2.88 times). This indicates that while cigarette production grew three-fold, BATB’s net profit increased nine-fold over the last 15 years, largely due to a faulty pricing process for cigarettes. Specifically, instead of reasonably increasing the tax rate, the price hikes contributed to both increased government revenue and a sharp rise in cigarette companies’ net profits.

The four-tier complex tax structure for cigarettes currently benefits cigarette companies. The lower tax on the most sold low-tier cigarettes has led to a significant increase in cigarette production and provided cigarette companies with uninterrupted profit-making opportunities. Over the years, BATB and other cigarette-producing companies have flourished around the faulty process of price hikes.

According to BATB’s financial reports from the last 15 years, the total revenue from supplementary duties, VAT, customs duties, and income tax has not increased as much as the company’s net profit. In 2009, BATB contributed BDT 39.61 billion in taxes across all categories, including income tax. By 2023, this figure had risen to BDT 307.02 billion—an 8.28-fold (828%) increase. In contrast, the company’s profit grew by 8.63 times (863%). This discrepancy shows the urgent need to reconsider Bangladesh’s cigarette tax structure.

As a result, even though it was delayed but enforcing the Maximum Retail Price (MRP) on cigarette sales is essential to limit the profits of cigarette companies. Currently, to make easy revenue collection, the NBR has imposed specific taxes on several products, such as mobile SIM cards, televisions, and bricks. Implementing a specific tax on cigarette packs would increase revenue while reducing cigarette company profits. Under a specific tax increasing system, the full increased price would be collected by the government as tax revenue. Currently 95% of the revenue from the cigarette sector comes from supplementary duties and VAT paid by consumers.23 The company’s taxes, mainly income tax, which is only 5% of the total revenue. So, by ensuring cigarettes are being sold at MRP and imposing a specific tax would help control tobacco consumption and will be good for public health.

As a multinational cigarette company, a significant portion of BATB’s profits is sent abroad to its parent or group companies. Currently 73% of BATB is owned by its group company.24 Every year, hundreds of crores of taka go away from Bangladesh in the form of royalty fees, technical fees, the purchase of machinery, and services, which are sent to group and sister companies in the UK and other countries. Additionally, a significant portion of profits is being sent to abroad as dividends, which are paid in foreign currency. Over the past 15 years, BATB has provided up to an 8% cash dividend. Therefore, it is essential to conduct a thorough audit of BATB’s income and expenditure reports by an independent auditor. There is evidence in several financial reports from previous years that the same expense category has been listed under two different headings. This raises the call for transparency in financial reporting to ensure accurate taxation and accountability.

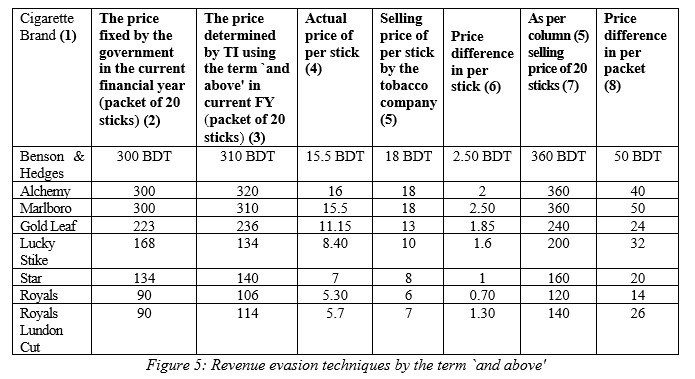

5.1 Complexities in the Use of the Term `and above’ in Budget

In Bangladesh, the term `and above’ is used annually in budget proposals for setting cigarette prices across four tiers. This term indicates that the price can be set from the declared base price up to the price of the next tier. Initially, in budget announcements, `Furthermore’ was used only for the premium tier of cigarettes with the base price, while other tiers had specific price ranges set. For example, in the 2011-12 fiscal year budget: The price for a 10-stick pack of low-tier cigarettes was set between 11 BDT and 11.30 BDT. The price for mid-tier cigarettes was set between 22.50 BDT and 23 BDT. The price for high-tier cigarettes was set between 32 BDT and 36 BDT. The price for premium-tier cigarettes was set at 60 BDT and above.

In KII, an NBR official said that “tobacco companies are evading more revenue by using the term `and above’ in the budget proposal. That’s why the complexity is increasing as revenue. So, the government should stop giving this opportunity to tobacco companies. Then the positive changes in tobacco control will come.”

In the 2016-17 fiscal year, the mid-tier level was abolished, but the term `and above’ was introduced for all tiers except the low tier. In the 2018-19 fiscal years, the budget once again set prices for four tiers of cigarettes, and `and above’ was included for all four tiers. Despite the use of `and above’ in these years, no new cigarettes were introduced to the market at prices above the base price using this term. In the 2019-20 fiscal years, BATB was the first to use `and above’ to introduce a new cigarette at a price above the base price under the name “Royals.” Since then, BATB and other tobacco companies have exploited the term `and above’ to introduce cigarettes at various prices which creates instability in the cigarette market. This practice is further delaying the government’s announcement of a tobacco free Bangladesh by 2040 and is resulting in significant revenue losses for the government.

5.2 The Term `and above’ is making Cigarette Pricing More Multi-Tiered:

Right now, the cigarette tax structure is based on four tiers (low, mid, high, and premium). Tobacco control experts and anti-tobacco coalitions have long been advocating for reducing this structure into two tiers. However, the budget proposal’s mention of “low tier 45 BDT and above” allows for the introduction of new cigarettes at various prices within each tier. As a result, there are now 2 to 3 different price points within each of the four tiers, complicating the already complex multi-tiered tax structure.

For the 2023-24 fiscal years, the government has set cigarette prices as Low tier: 45 BDT per 10 sticks and above, Mid-tier: 67 BDT per 10 sticks and above, High tier: 113 BDT per 10 sticks and above, last but not the least Premium tier: 150 BDT per 10 sticks and above. Due to the term `and above’, tobacco companies are legally able to market cigarettes at various prices within each tier. For example, within the low tier, brands are selling cigarettes at 45 BDT, 106 BDT, and 114 BDT per 10 sticks. Similarly, in the mid-tier, cigarettes are available at 67 BDT and 70 BDT per pack; in the high tier, at 118 BDT; and in the premium tier, at 155 BDT and 160 BDT. This pricing flexibility allows companies to increase their profits and evade large amounts of revenue. Moreover, by selling cigarettes above the highest retail price, companies have been evading around 5,000 crore BDT in revenue annually. The term `and above’ in pricing regulations enables these companies to manipulate prices within the same tier, thereby selling cigarettes at 2 to 3 different price points within the same tier, creating a highly complex and deceptive pricing structure.

So, without the term `and above’ the prices for cigarettes across the four tiers would have been BDT 4.5, BDT 6.7, BDT 11.3, and BDT 15, respectively. But due to the inclusion of `and above’ there are now eight different price points for cigarettes available in the market: BDT 5, BDT 6, BDT 7, BDT 8, BDT 10, BDT 13, BDT 18, and BDT 20. This has made cigarettes more accessible, and consumers can easily switch brands.

The term `and above’ is encouraging tobacco companies to violate the MRP law and sell cigarettes at random prices. In Bangladesh, nearly 90% of cigarettes are sold as individual sticks, which tobacco companies have exploited to sell cigarettes at prices higher than the MRP which leads evading more than 5,000 crore BDT in revenue annually.25 In response, the government amended the law this fiscal year to enforce MRP compliance though tobacco companies continue to violate the MRP law. The term `and above’ is playing a key role here. This term allows them to set prices at odds and in changes that are not available at money market. The tobacco companies deciding prices per stick of cigarette of their own, which are significantly higher than the printed MRP on the packs. In a consequence, consumers are forced to buy cigarettes at higher prices per stick.

For example, the 2023-24 fiscal years, except for a few brands in the low tier, tobacco companies took the advantage of the term `and above’ to set prices according to their benefit across other tiers. In the 2019-20 fiscal years, BATB was the first to exploit the term `and above’ to set prices above the base price set by the government for their “Royals” brand. After the success with this strategy, BATB has adopted the same approach for nearly all their cigarette brands in the 2023-24 fiscal years.

Last fiscal year, the price of Royals cigarettes was 104 BDT (now 108 BDT). This year, the company has introduced a new brand, called “Royals London Cut”. Although the 20-stick pack of Royals London Cut is priced at 114 BDT, the company has advertised it as 7 BDT per stick, resulting in a retail price of 140 BDT. Which means the government is not receiving the revenue over remaining 26 BDT.

5.3 Reluctance of Tobacco Companies to Increase Prices Due to the Term `and above’

Although the government aims to raise cigarette prices each year, tobacco companies employ various tactics to avoid price increases. This approach allows the government to slightly increase revenue, but it also gives tobacco companies the opportunity to inflate their profits. The multi-tiered pricing and the assurance of sales at specific prices enable tobacco companies to significantly boost their business. This manipulation is being possible by the deliberate use of the term `Furthermore’ in budgets.

NBR officials and tobacco control experts believe that “it is crucial to remove the term `and above’ from budget to determine cigarette prices and taxes. This change would help prevent manipulation, stop companies from selling cigarettes at multi-layer prices within the same tier, and close loopholes that allow for excessive profits and tax evasion”.

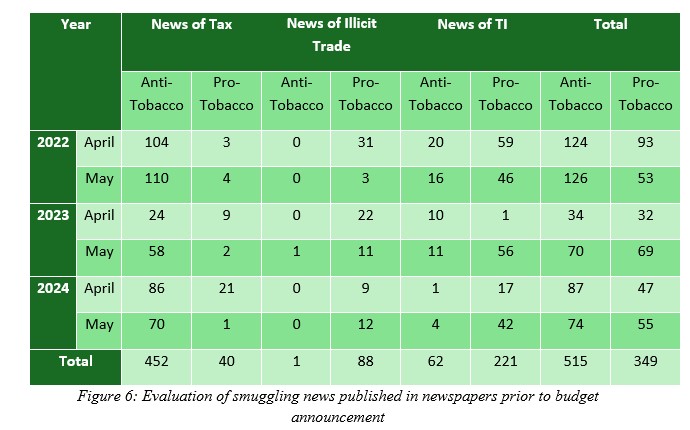

6.1 Analysis of Smuggling News and Myth Explored

Before the national budget announcement in April and May, various reports and opinions regarding smuggling often appear in media. Most of these smuggling-related news items are quite similar in nature.26 Typically, these reports lack information about the people behind the smuggling operations. Even there is no mention of anyone being detained for these smugglings. Mostly the ‘so-called smuggled cigarettes’ are found lying beside luggage at the airport.27

Secondly, the question of why smugglers would bring cigarettes purchased at a higher price from abroad and sell them at a lower price in Bangladesh remains unanswered. This is because, compared to developed countries as well as neighboring countries, the price of foreign cigarettes in Bangladesh is much lower. Therefore, it is not commercially or financially profitable to bring in more expensive cigarettes from abroad and sell them at a lower price. This raises questions about the true motives behind such cigarette smuggling activity.

Thirdly, among the top 10 smuggled items by the NBR cigarettes are not listed. Despite that media reports on smuggling are often presented in a way that suggests noteworthy revenue losses for the government. Press releases from law enforcement agencies about smuggled cigarettes often mention large quantities of cigarettes being seized. In reality, even if the number of smuggled cigarettes is small, the high percentage of 350% import duty makes the value appear large in economic terms.

Surprisingly these news reports are most seen in the months before the budget announcement (April and May). In reality, there is a different purpose behind this information. Through such news campaigns before the budget, tobacco companies negotiate with the NBR regarding cigarette price increases.28 They present these reports in such way that suggests if cigarette prices are increased, smuggling will rise in the country. However, the actual situation tells a completely different story, as demonstrated by production and revenue figures.

6.2 Evaluation of Smuggling News before the Budget

Globally, tobacco companies use falsehoods to sustain and expand their trade. They employ various campaigns to obscure the truth and create confusion. One common myth is that increasing cigarette taxes will increase smuggling which will cause significant revenue losses. Additionally, companies attempt to highlight news about smuggling and counterfeit cigarette factories in the media. Through these reports, they create fear among policymakers about potential revenue losses.

In 2018, a comparative analysis was conducted on tobacco tax and pro-tobacco company news from 20 national dailies over two years.29 In the months prior to budget in June, both tobacco companies and tobacco control organizations become more vocal. Therefore, this study analyzed 1,398 news articles from national dailies published in April and May of 2015, and May and June of 2016. Despite the high number of articles, content analysis revealed that the actual news addressing tobacco control objectives was quite limited. Among the tobacco tax-related news, only 58 articles focused on tobacco control efforts, including tax increases. In contrast, there were 110 reports on company interference and 290 articles were related to smuggling.

In other words, the number of news articles in favor of tobacco companies, including smuggling news, was 400, whereas the number of news supporting tobacco control were only 58. The purpose of analyzing the news of national dailies was to understand how tobacco companies influence and utilize journalists to their advantage. A tobacco control expert at KII said “before the budget, cigarette companies spend a lot of money on cigarette smuggling and illegal cigarette news in the media. They want to imply that increasing the price of cigarettes will harm the government. None of these things happen. It’s a tobacco company strategy. NBR also knows this strategy. But they offer many opportunities to tobacco companies. Tobacco companies must stop giving all kinds of concessions”.

6.3 Smuggling Out, Counterfeit Cigarettes In

Since the publication of this research in 2018, incidents and news of cigarette smuggling in Bangladesh have significantly decreased.30 However, tobacco companies have adapted by shifting focus from smuggling to highlighting counterfeit cigarette factories. Over the past 2-3 years, there has been a notable increase in media reports about the discovery of counterfeit cigarette factories in remote areas, villages, fields, and abandoned buildings across Bangladesh.31Law enforcement operations have showcased old, broken machinery, tobacco leaf powder, and a few cigarettes in these so-called counterfeit factories. Often, only a guard is found at these locations, and there are rarely any significant arrests. Additionally, the presentation of these counterfeit factories in jungle settings raises questions.

Based on years of experience in tobacco control advocacy, public health policy analysts have pointed out that the tobacco companies’ claims that increasing cigarette taxes would reduce revenue and increase smuggling have proven to be false. This has led to the promotion of new theories about counterfeit cigarettes being manufactured domestically.

Another myth faced in Bangladesh is that increasing taxes would reduce cigarette production. Research shows that BATB controls 70% of the cigarette market in Bangladesh. Their production has significantly increased over the years. For example, in 2009, they produced 24 billion cigarettes, while in 2023, production reached 71.2 billion cigarettes.32 Other cigarette companies have also increased their production. This data from the tobacco industry itself proves that over the past 15 years, smuggling or counterfeit cigarettes have not diminished the companies’ business. Despite some increase in cigarette taxes during this period, the industry’s operations have not been adversely affected.

In Bangladesh, achieving a net profit margin of 10% after paying VAT and taxes is quite challenging for any business. In 2017, BATB reported a profit of BDT 10.1 billion, which was more than a 28% increase from the previous year. This level of profit is only achievable due to the structured tax framework established by the tobacco industry.33

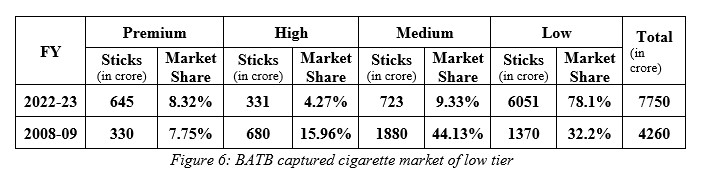

7.1 BAT and JTI Monopolize Low-Tier Cigarette Market

Since the fiscal year 2008-09, the production of cigarettes in Bangladesh has significantly increased from approximately 3,500 crore sticks to 7,750 crore sticks over the past 15 years. The production growth rate is 1.82% for the four tiers of Premium, High, Medium, and Low. According to data from the NBR, in the fiscal year 2008-09, the production of low-tier cigarettes was 1,370 crore sticks, which constituted 32.2% of the total cigarette production. By the fiscal year 2022-23, the production of low-tier cigarettes has raised to 6,051 crore sticks, which makes up 78.1% of the total cigarette production.

The reduced tax burden, including supplementary duties, allows tobacco companies to earn more profits from the sale of low-tier cigarettes. This high profitability has driven BATB to capture the low-tier market by putting pressure on domestic cigarette companies. Until the fiscal year 2006-07, BAT focused on producing and marketing medium to premium tier cigarettes. However, starting from the fiscal year 2007-08, BAT began producing and selling low-tier cigarettes in Bangladesh under well-known international brands such as Gold Flake, Pilot, and Bristol. In the first year alone, BAT produced 3% of the total low-tier cigarettes, putting major stress on domestic low-tier cigarette producers.

On March 9, 2022, on behalf of the Domestic Cigarette Manufacturers Association, Nasiruddin Biswas presented this information in a written letter to the Chairman of the NBR. BAT began producing low-tier cigarettes, breaking promises made to domestic manufacturer and the government. When local cigarette companies protested, BAT verbally committed to producing and marketing a minimal amount of low-tier cigarettes and reduced production in the second year. In the fiscal year 2008-09, BATB produced only 1% of the total low-tier cigarettes. But due to lower tax burdens and the lower prices of foreign brands, these cigarettes quickly gained popularity among consumers. Consequently, BATB increased its production and marketing of low-tier cigarettes up to 7% in the following fiscal year. Due to BATB’s aggressive marketing, local cigarette companies rapidly lost market share. BATB eventually captured nearly 85% of the low-tier cigarette market. Conversely, local companies, which previously held 100% of the market share, now their share fall to below 10%.

That letter34 also states “In response to the alarming decrease in market share of local cigarette companies, the NBR halts the production and marketing of BATB’s “Gold Flake” cigarettes in the low-tier segment. Furthermore “Pilot” and “Bristol” cigarettes were upgraded to the mid-tier category, and a revenue collection notice was issued by the NBR’s Large Taxpayers Unit (LTU). Then BATB filed two writ petitions in the High Court against the LTU’s notice. Later, BATB introduces brands like “Derby”, “Hollywood” and “Royals” as low-tier cigarettes in Bangladesh.”

We can observe that, the total cigarette production was 4,260 crore sticks in the fiscal year 2008-09, with the mid-tier segment accounting for 1,880 crore sticks, or 44.13%. The high-tier segment held about 16% of the market. Fifteen years later, in the fiscal year 2022-23, the market share of high-tier cigarettes is 4% and dropped by 12%, while the mid-tier segment fell by 35% and now is 9% of the total cigarette production. Consequently, the increase in price and taxes for these two tiers, combined with the availability of internationally recognized brands at low prices in the low-tier segment, has led consumers from the high and mid-tier segments to switch to low-tier cigarettes.

BATB and JTI are determined to dominate Bangladesh’s cigarette market. Despite the competition between these two multinational tobacco companies, they are united in their efforts to make local cigarette companies out of the market. Local companies have been producing only low-tier cigarettes. The NBR confirmed that BAT and JTI sold low-tier cigarettes at a price of 3,500 Taka instead of the stated 3,900 Taka, meaning they were selling them 400 Taka cheaper per thousand sticks. The written complaint from local cigarette companies was found to be accurate.

The letter indicated that the production cost for a thousand sticks of low-tier cigarettes is 3,862 Taka, including the cost of basic raw materials, production, administrative, marketing, interest, and other expenses, plus 73% tax including supplementary duties, VAT, and health development surcharge. Although the market price is supposed to be 3,900 Taka, BATB and JTI were selling them at 3,500 Taka, which is 400 Taka less. Since multinational companies have substantial businesses in mid-tier, high-tier, and premium cigarettes, and are financially robust, they can afford to sell at a lower price to eliminate local companies from the market.

Apart from the strategy to push local companies out of the market, BATB has been accused of monopolistic practices by JTI. JTI has filed a case against BATB in the Competition Commission of Bangladesh.35 Allegations have that BATB’s board, which includes government secretaries, has influenced the Competition Commission, causing delays in the case’s hearing.

Recently, JTI sent a letter to the finance minister. The letter, (https://bnttp.net/wp-content/uploads/2024/11/Ambassador-of-Japans-Letter-for-JTI-.pdf) written by Japanese Ambassador Ito Naoki on behalf of Japan Tobacco, addresses two issues. It mentions that Japan Tobacco wants to introduce flavored versions of two mid-tier cigarettes, LD and More, but is not receiving cooperation from the NBR. Despite investing billions, they are not receiving a favorable business environment. The letter was sent to key policymakers including former Prime Minister’s advisor Salman F Rahman, Trade Minister Tipu Munshi, Cabinet Secretary Khandaker Anwarul Islam, and Principal Secretary to the Prime Minister Dr. Ahmed Kaykobad, Prime Minister’s Office Secretary Mohammad Toffazzal Hossain Mia, BIDA Executive Chairman Mohammad Sirajul Islam, and NBR Chairman Abu Hena Md. Rahmatul Munim. This indicates a long-term plan to take advantages from various ministries and policy makers. Previously, the then British Ambassador Alison Blake had also written to the NBR, advocating for the investigation into BATB’s revenue evasion.36

In the fiscal year 2017-18, the NBR Chairman was Mosharraf Hossain Bhuiyan. During his tenure as the Secretary of the Ministry of Industry, he served on the BATB board twice for nearly four years. For this reason, Japan Tobacco issued an SRO to prevent the marketing of flavored mid-tier cigarette brands. Interestingly, the SRO still states that flavored capsule cigarettes should not be supplied at the low-tier level due to the increased health risks to smokers.

On October 10, 2019, the NBR organized a meeting to ensure proper revenue collection from the cigarette sector. The meeting was chaired by the then NBR Chairman Mosharraf Hossain Bhuiyan, included representatives from BATB. The meeting minutes reveal that BATB’s Chairman Golam Mainuddin raised concerns about the draft “National Tobacco Control Policy, 2019”, by noting that the policy proposed increasing health warnings on cigarette packs from 50% to 90%, which could complicate the use of bandroles or stamps.37 He recommended discussing this with the Cigarette Manufacturing Association to avoid implementation issues and requested the NBR to finalize the policy after stakeholders input.

Conclusion

The analysis of the tobacco industry in Bangladesh reveals significant challenges in revenue collection and regulatory enforcement, primarily due to outdated identification methods for stamps and bandroles. Despite recent efforts by the NBR to implement a structured pricing system, the pervasive influence of tobacco companies, particularly BATB, continues to undermine these initiatives. The manipulation of pricing, facilitated by ambiguous terms such as “Furthermore,” has allowed companies to evade taxes and maintain excessive profit margins while promoting a narrative linking tax increases to smuggling.

The findings underscore the urgent need for comprehensive reforms in the tobacco tax structure and regulatory framework. Embracing digital identification solutions and removing loopholes that enable price manipulation are crucial steps toward enhancing revenue collection, protecting local manufacturers, and promoting public health objectives. Overall, a concerted effort involving collaboration among key ministries, clear policy directives, and improved enforcement mechanisms is essential for addressing the complexities of Bangladesh’s tobacco market.

Recommendations

- Introducing color-coded bandroles /stamps with QR codes and production dates to make it easier to detect counterfeit bandroles. This technology-based bandrole will also ease the process of revenue collection.

- Currently, three NBR officials manually inspect cigarette factories for 24/7. Switching to a more digital system would simplify preventing tax evasion.

- Replacing the ad-valorem taxation method with a specific tax system for tobacco products. Additionally, evaluating the raise of tax rate to increase prices.

- Ensuring that cigarettes are sold at the MRP only.

- Removing the term ‘Furthermore’ from national budget proposals to improve regulation and reduce tax evasion.

- The National Board of Revenue must ensure their effort to prevent multinational companies from creating monopolies in the market.

References

- https://www.ltuvat.gov.bd/files/citizen_info_content/15661623131411.pdf; retrieved on 04/04/2024

- https://www.dpp.gov.bd/upload_file/gazettes/247-Law-2001.pdf; retrieved on 10/04/2024

- https://www.ltuvat.gov.bd/files/notice_content/BATB.pdf; retrieved on 12/04/2024

- https://www.ltuvat.gov.bd/files/notice_content/JTI.pdf; retrieved on 12/04/2024

- https://nbr.gov.bd/uploads/publications/13a.pdf; retrieved on 08/04/2024

- https://nbr.gov.bd/uploads/publications/13a.pdf; retrieved on 08/04/2024

- https://www.youtube.com/watch?v=rulg76BmecU; retrieved on 06/11/2024

- https://sharebiz.net/%E0%A6%AC%E0%A6%BF%E0%A6%8F%E0%A6%9F%E0%A6%BF%E0%A6%B0-%E0%A6%B0%E0%A6%BE%E0%A6%9C%E0%A6%B8%E0%A7%8D%E0%A6%AC-%E0%A6%AB%E0%A6%BE%E0%A6%81%E0%A6%95%E0%A6%BF-%E0%A7%A8%E0%A7%A7%E0%A7%A6-%E0%A7%AE/?fbclid=IwY2xjawGqaNdleHRuA2FlbQIxMAABHS-eU2gyH0-YKuqnpggU0AQ562Ebfv9QxN5T9Fq2BAYkaBiwRFVIgINkFw_aem_NQ6iiNhCu0OXmWXG2WooLQ; retrieved on 23/11/2024

- https://www.jugantor.com/tp-lastpage/859275; retrieved on 28/10/2024

- https://sharebiz.net/%E0%A6%AC%E0%A6%BF%E0%A6%8F%E0%A6%9F%E0%A6%BF%E0%A6%B0-%E0%A6%B0%E0%A6%BE%E0%A6%9C%E0%A6%B8%E0%A7%8D%E0%A6%AC-%E0%A6%AB%E0%A6%BE%E0%A6%81%E0%A6%95%E0%A6%BF-%E0%A7%A8%E0%A7%A7%E0%A7%A6-%E0%A7%AE/?fbclid=IwY2xjawGqaNdleHRuA2FlbQIxMAABHS-eU2gyH0-YKuqnpggU0AQ562Ebfv9QxN5T9Fq2BAYkaBiwRFVIgINkFw_aem_NQ6iiNhCu0OXmWXG2WooLQ; retrieved on 23/11/2024

- https://www.prothomalo.com/bangladesh/district/ih0w57skt4; retrieved on 24/09/2024; retrieved on 08/06/2024

- https://scholar.google.com/citations?view_op=view_citation&hl=en&user=LTiZ_m8AAAAJ&citation_for_view=LTiZ_m8AAAAJ:2osOgNQ5qMEC; retrieved on 23/11/2024

- https://mail.bangladeshpost.net/posts/govt-loses-due-to-complex-tobacco-tax-structure-45485; retrieved on 23/11/2024

- https://www.iphrc.org/ngo-service/%e0%a6%95%e0%a7%87%e0%a6%a8%e0%a7%8b-%e0%a6%96%e0%a7%81%e0%a6%9a%e0%a6%b0%e0%a6%be-%e0%a6%b6%e0%a6%b2%e0%a6%be%e0%a6%95%e0%a6%be%e0%a7%9f-%e0%a6%b8%e0%a6%bf%e0%a6%97%e0%a6%be%e0%a6%b0%e0%a7%87/; retrieved on 10/05/2024

- https://sharebiz.net/%E0%A6%96%E0%A7%81%E0%A6%9A%E0%A6%B0%E0%A6%BE-%E0%A6%AC%E0%A6%BF%E0%A6%95%E0%A7%8D%E0%A6%B0%E0%A7%87%E0%A6%A4%E0%A6%BE%E0%A6%B0-%E0%A6%B2%E0%A6%BE%E0%A6%AD-%E0%A6%AC%E0%A6%BF/; retrieved on 01/06/2024

- https://www.youtube.com/watch?v=UQvL3BMQH8Y&t=3s; retrieved on 03/04/2024

- https://www.jagonews24.com/national/news/839303; retrieved on 23/11/2024

- Ibrahim Khalil. Impact of Price and Tax Changes in the National Budget on the Wholesale and Retail Prices of Tobacco Products (Cigarette and Bidi): A cross sectional survey [Internet]. 2022 [cited 2022 February 14]. Available from: https://bnttp.net/resource/impact-of-price-and-tax-changes-in-the-national-budget-on-the-wholesale-and-retail-prices-of-tobacco-products-cigarette-and-bidi-a-cross-sectional-survey/

- https://sharebiz.net/%E0%A6%AC%E0%A6%BF%E0%A6%8F%E0%A6%9F%E0%A6%BF%E0%A6%B0-%E0%A6%B0%E0%A6%BE%E0%A6%9C%E0%A6%B8%E0%A7%8D%E0%A6%AC-%E0%A6%AB%E0%A6%BE%E0%A6%81%E0%A6%95%E0%A6%BF-%E0%A7%A8%E0%A7%A7%E0%A7%A6-%E0%A7%AE/?fbclid=IwY2xjawGQQLFleHRuA2FlbQIxMAABHapvrChg5e6RAd4is5QItnQjJZVV58vE0O6G9Dy-hBJbg5q1or84YZ33mA_aem_SkZDMgaDSlxt5BFnTiBMlQ; retrieved on 27/10/2024

- ( Ibrahim Khalil. Impact of Price and Tax Changes in the National Budget on the Wholesale and Retail Prices of Tobacco Products (Cigarette and Bidi): A cross sectional survey [Internet]. 2022 [cited 2022 February 14]. Available from: https://bnttp.net/resource/impact-of-price-and-tax-changes-in-the-national-budget-on-the-wholesale-and-retail-prices-of-tobacco-products-cigarette-and-bidi-a-cross-sectional-survey/)

- https://www.batbangladesh.com/attachments/2010_Annual_Report.pdf; retrieved on 23/11/2024

- https://www.batbangladesh.com/attachments/BATB_Annual_Report_2023-v3.pdf; retrieved on 23/11/2024

- https://bnttp.net/tobacco-revenue-myths-company-ill-tactics/; retrieved on 23/11/2024

- https://www.batbangladesh.com/attachments/BATB_Annual_Report-2022.pdf; retrieved on 23/11/2024

- Ibrahim Khalil. Impact of Price and Tax Changes in the National Budget on the Wholesale and Retail Prices of Tobacco Products (Cigarette and Bidi): A cross sectional survey [Internet]. 2022 [cited 2022 February 14]. Available from: https://bnttp.net/resource/impact-of-price-and-tax-changes-in-the-national-budget-on-the-wholesale-and-retail-prices-of-tobacco-products-cigarette-and-bidi-a-cross-sectional-survey/

- https://www.tobaccoinduceddiseases.org/Analysis-of-media-reports-to-understand-tobacco-industry-tactics-in-undermining-tobacco,83821,0,2.html; retrieved on 08/05/2024

- https://www.daily-sun.com/post/747098; retrieved on 08/06/2024

- https://bnttp.net/tobacco-revenue-myths-company-ill-tactics/; retrieved on 23/11/2024

- https://www.tobaccoinduceddiseases.org/Analysis-of-media-reports-to-understand-tobacco-industry-tactics-in-undermining-tobacco,83821,0,2.html; retrieved on 31/10/2024

- https://bnttp.net/tobacco-revenue-myths-company-ill-tactics/; retrieved on 01/05/2024

- https://bnttp.net/tobacco-revenue-myths-company-ill-tactics/; retrieved on 23/11/2024

- https://www.batbangladesh.com/attachments/BATB_Annual_Report_2023-v3.pdf; retrieved on 23/11/2024

- https://bnttp.net/news/%e0%a6%ac%e0%a6%bf%e0%a6%8f%e0%a6%9f%e0%a6%bf%e0%a6%b0-%e0%a6%89%e0%a7%8e%e0%a6%aa%e0%a6%be%e0%a6%a6%e0%a6%a8-%e0%a6%a6%e0%a7%8d%e0%a6%ac%e0%a6%bf%e0%a6%97%e0%a7%81%e0%a6%a3-%e0%a6%b9/; retrieved on 08/04/2024

- https://bnttp.net/wp-content/uploads/2024/11/Ambassador-of-Japans-Letter-for-JTI-.pdf; retrieved on 23/11/2024

- https://www.thedailystar.net/business/organisation-news/news/japan-tobacco-accuses-batb-anti-competitive-practices-2945906; retrieved on 23/11/2024

- https://www.thedailystar.net/business/united-kingdom-envoy-alison-blake-lobbied-vat-waiver-british-american-tobacco-bat-report-guardian-1460530; retrieved on 23/11/2024

- https://nbr.gov.bd/uploads/public-notice/mergepdf04112019.pdf; retrieved on 23/11/2024

# Sushanta k singha, Public Health Researcher and Special Correspondent of Ekattor Television. sinhaspb@gmail.com, contact: +8801712657540

Sushanta Kumar Singha