Speakers at an Online Consultation Meeting Stated,

Heart Diseases Can Be Treated for Free by Imposing a Specific Tax on Tobacco

If the tobacco tax rate proposed by the anti-tobacco organizations is imposed to protect public health in the upcoming fiscal year, the government will earn a revenue of around BDT 39,600 crore. Which is BDT 9,200 crores more than the last financial year. If only 4.45% of this revenue is spent on cardiovascular healthcare, all heart disease patients in the country can be treated for free, said the public health experts of the country.

The public health experts said this at an online consultation meeting titled ‘Tax Management of Tobacco Products to Ensure Free Heart Treatment: Possibilities and Initiatives’ that was held today, 26 April 26, 2022; at 10:30 AM. Bureau of Economic Research (BER), University of Dhaka; Bangladesh Anti-Tobacco Alliance (BATA), and Bangladesh Network for Tobacco Tax Policy (BNTTP) jointly organized the online consultation meeting by using the online video conferencing software ‘Zoom’

The keynote address at the meeting was presented by Dr. Rumana Haque, Professor of the Department of Economics at the University of Dhaka and BER’s focal person. Professor Dr. Golam Mohiuddin Farooq, Project Director of the Bangladesh Cancer Society; Dr. Sohel Reza Chowdhury, Head of Department of Epidemiology and Research, National Heart Foundation Hospital and Research Institute; and Advocate Syed Mahbubul Alam, Technical Advisor of International Development Agency, The Union were present at the event as expert discussants. Besides, media personnel, public health experts, and representatives of various anti-tobacco organizations took part in the consultation meeting.

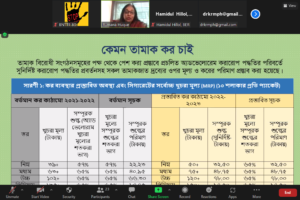

In her key speech, Dr. Rumana Haque presented the tobacco tax proposal for the upcoming fiscal year. The proposal suggests fixing the prices for a 10-stick pack of cigarettes of the low tier at BDT 50, medium-tier at BDT 75, high tier at BDT 120, and premium tier at BDT 150; and imposing a specific supplementary duty of BDT 32.50, BDT 48.75, BDT 78 and BDT 97.50 respectively for the four tiers.

Besides, in the case of unfiltered bidis, it has been proposed to keep only 25-stick bidi packs in the market by fixing the retail price of the 25-stick pack at BDT 25 and imposing a specific supplementary duty of BDT 11.25. On the other hand, in the case of filtered bidis, it has been proposed to fix the retail price of a 20-stick bidi pack at BDT 20, and impose a specific supplementary duty of BDT 9.

In the budget proposal, in the case of Zarda, it has been proposed that the retail price should be fixed at BDT 45 per 10 grams and a specific supplementary duty of BDT 27 will be imposed. And for Gul, it has been proposed that the retail price should be fixed at BDT 25 per 10 grams and a specific supplementary duty of BDT 15 should be imposed. Apart from that, it was also strongly urged to bring Sadapata under the government’s tax net as soon as possible. They also proposed to retain the 15% value-added tax (VAT) and 1% health development surcharge on the retail price of all tobacco products just as before.

Speakers at the online consultation meeting said that, in Bangladesh, additional revenue of almost BDT 9,200 crores can be generated if a specific tax is imposed on tobacco products according to this proposal, part of which the government can spend on the treatment of tobacco-related diseases. The experts remarked that of this additional revenue, only BDT 410 crores are enough to treat all patients suffering from heart-related diseases. At present, 67% of the medical expenses have to be borne by the citizens. Bangladesh is slowly moving towards becoming a welfare state. The state is taking up various responsibilities for the welfare of the citizens. A measure like this would be a unique initiative for public welfare.

The speakers also mentioned that patients have spent almost BDT 286.61 crores last year for three kinds of treatment procedures namely angiogram, stenting, and bypass surgery at Bangabandhu Sheikh Mujibur Rahman Medical University, National Heart Institute, and National Heart Foundation. This amount is only 3.12% of the expected additional revenue from the tobacco sector. If this number of patients is assumed as 70% of total patients in the country, it will cost BDT 410 crore to get similar treatment for all heart patients in the country which is only 4.45% of the additional revenue.

They further stated that tobacco companies are manipulating cigarette prices and evading approximately BDT 5,000 crores as tax revenue each year. By preventing this fraudulent activity and ensuring proper tax collection, this money can also be spent on health care.

It is necessary to impose a specific tax on all kinds of tobacco products as proposed in the meeting as well as prevent the price manipulation and other ill tactics of the tobacco companies, spending a portion of the additional revenue generated from tobacco products on the treatment of tobacco-related diseases and formulating a comprehensive national tobacco tax policy to make Bangladesh tobacco-free by 2040 according to the announcement of Honorable Prime Minister Sheikh Hasina.