Speakers stated in a webinar

Tobacco tax policy not formulated even after 6 years of the PM’s announcement

In order to protect the public health of the country, the Honorable Prime Minister Sheikh Hasina has pledged to eliminate the use of tobacco in Bangladesh completely by the year 2040 at the South Asian Speakers’ Summit held in 2016. To achieve this goal, she announced to formulate a strong tobacco tax policy in the country. But even after 6 years of this announcement, there has not yet been any initiative to formulate it. At the same time, no effective steps are being taken to fulfill the promise of building a tobacco-free Bangladesh by 2040. Considering the risks to public health, it is essential to formulate a strong and integrated tobacco tax policy immediately to fulfill the Prime Minister’s promise and implement her directive.

This was stated by the speakers at a webinar titled ‘Strong Tobacco Tax Policy for Effective Tobacco Control’ at 10.30 am on Tuesday, May 18, 2022. The webinar was organized by Bureau of Economic Research (BER) of University of Dhaka, Bangladesh Anti-Tobacco Alliance (BATA) and the Bangladesh Network for Tobacco Tax Policy (BNTTP) on the online meeting software Zoom.

The keynote address was delivered at the webinar by Professor of Economics of University of Dhaka and the Convener of BNTTP, Dr. Rumana Huque. S M Abdullah, Associate Professor, Department of Economics, University of Dhaka; Sushanta Sinha, Special Correspondent, Ekattor Television; and Aminul Islam Bakul, Project Advisor of Development Activities of Society (DAS) were present as panelists on the occasion. Besides, more than 50 media personnel, public health experts and representatives of various anti-tobacco organizations participated in the webinar.

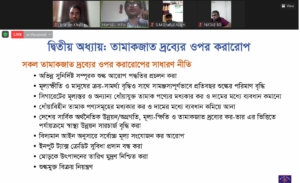

Speakers at the event said that the most impactful and cost-effective method of tobacco control is to reduce the availability of tobacco products by increasing their prices and taxes. To achieve this goal, imposing specific taxation on tobacco products is a preferred method worldwide. In order to make Bangladesh tobacco free by 2040, there is no alternative to imposing specific taxes on all types of tobacco products from the upcoming fiscal year and develop a strong national tobacco tax policy according to the Prime Minister’s announcement.

They further added that while announcing to make Bangladesh tobacco free, the Honorable Prime Minister has spoken of adopting a comprehensive tobacco tax policy to achieve this goal. Therefore, in order to fulfill the promise of our Prime Minister, a national tobacco tax policy has to be formulated as soon as possible. This will incorporate all the issues related to tobacco tax including specific taxation, tax collection methods, monitoring, tracking and tracing, tax evasion, import-export, and matters related to tobacco tax administration.

They also said that it is the responsibility of the government to abide by any announcement made by the Honorable Prime Minister. But even after 6 years of the Prime Minister’s announcement on the formulation of a tobacco tax policy, no progress has been made yet. The organizations and individuals responsible to carry out this directive cannot avoid their liability. They sought an intervention by the Prime Minister in the implementation of this issue. Concurrently, BER and BNTTP have jointly prepared a draft tobacco tax policy following a standard process. The concerned government department can prepare a strong tobacco tax policy based on this draft.

In addition to raising the price of tobacco products in the upcoming budget, it was also recommended to increase supplementary duties, impose specific taxes, ensure sale of tobacco products at the fixed maximum retail price, spend a portion of additional revenue collected from tobacco products on treatment of diseases caused by tobacco consumption and formulate a comprehensive national tobacco tax policy.