The existing ad valorem system for taxing tobacco products in Bangladesh is complex and flawed. As a result, even though each year tobacco companies are generating profits that are several times higher than their production, yet the government is losing millions of taka in revenue. At the same time, despite increases in the prices of tobacco products, the number of tobacco users is not declining at the expected rate due to this flawed taxation system. These issues were discussed by the speakers on Wednesday 23rd February 2022 at a webinar titled ‘Tobacco Tax System, Loss of Government to the Profit of Tobacco Company’ which took place in the online meeting platform Zoom. University of Dhaka’s Bureau of Economic Research and Bangladesh Network for Tobacco Tax Policy (BNTTP) jointly organized the webinar.

The former chairman of the National Board of Revenue, Dr. Nasiruddin Ahmed; a former member of the National Board of Revenue, Aminur Rahman; and Professor of Economics at the University of Dhaka, Rumana Haque were present in the webinar as expert discussants. The keynote address was delivered by SM Abdullah, Associate Professor of Economics in the University of Dhaka, and moderated by Hamidul Islam Hillol, Project Manager, BNTTP.

Speakers at the webinar said that the production of British American Tobacco Company Bangladesh has doubled in the past 10 years, whereas their profits have grown 5 times in this time. But the government’s revenue is not growing at such a significant rate. Therefore, there is no alternative to introducing a specific tax system, instead of the current ad valorem system for tobacco products from the next fiscal year 2022-23.

They further remarked that about 1 lakh 62 thousand people die every year due to tobacco-related diseases in the country which is 10 times more than the average annual death due to the COVID-19 pandemic. In the fiscal year 2017-18, the amount of economic loss (loss owning to medical expenses and productivity loss) due to tobacco-related diseases in the country was BDT 30,560 crore. Conversely, the earnings from tax revenue during the same time was only BDT 22,866 crore. Considering this revenue income along with illness, death, economic loss, it can be ascertained that only the tobacco companies benefit from tobacco use. On the contrary, all parties, including the public and the government, suffer terrible losses. This crisis is compounded by the faulty taxation system. In order to control tobacco effectively and increase revenue, a specific taxation system for tobacco products should be introduced.

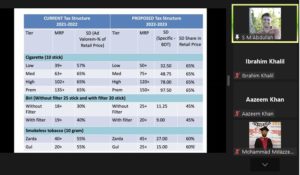

During the webinar, SM Abdullah presented the recommendations for the imposition of specific taxes along with concise proposals for pricing and tax rates of tobacco products for the fiscal year 2022-23 on behalf of the anti-tobacco organizations of the country. In the case of the low tier cigarettes, a retail price of BDT 50 with a fixed supplementary duty of BDT 32.50 per 10 sticks was proposed; for medium-tier cigarettes, a retail price of BDT 75 with a fixed supplementary duty of BDT 48.75 per 10 sticks was proposed; for high tier cigarettes, a retail price of BDT 120 with a fixed supplementary duty of BDT 78.00 for per 10 sticks was proposed; and for premium tier cigarettes, a retail price of BDT 150 with a fixed supplementary duty of BDT 97.50 for per 10 sticks was proposed.

Besides, in the case of unfiltered bidis, it has been proposed to keep only 25 stick bidi packs in the market and not 8 and 12 stick packs of bidi. However, they have urged to fix the retail price of a 25-stick pack at BDT 25 and impose a specific supplementary duty of BDT 11.25. On the other hand, in the case of filtered bidis, it has been proposed not to keep 10-stick bidi packs in the market, while fixing the retail price of 20-stick bidi packs at Tk 20 and imposing a specific supplementary duty of BDT 9.

In the case of smokeless tobacco products, the retail price of Zarda was suggested to be fixed at BDT 45 per 10 grams with imposing a specific supplementary duty of BDT 27; and the retail price of Gul was suggested to be fixed at BDT 25 per 10 grams with imposing a specific supplementary duty of BDT 15 in the proposal for the upcoming budget

They also mentioned that 15% value-added tax (VAT) and 1% health development surcharge should continue to be imposed on the retail price of all tobacco products as before.

The discussants mentioned that if the proposed increases in prices of tobacco products and taxation were implemented, 1.3 million adult smokers would quit smoking and about 9 million young people would be discouraged from initiating smoking. Additionally, the number of smokeless tobacco users will also be significantly reduced. This will save the lives of about 9 lakh tobacco users in the long run. At the same time, government revenue will increase by approximately BDT 9 thousand 200 crores.

The webinar was attended by about 50 representatives of various anti-tobacco organizations working in Bangladesh, including health experts and tobacco control experts from various organizations.